Ethereum

Why is the price of Ethereum (ETH) falling today? — TradingView News

On May 14, the price of Ether (ETH) fell approximately 2.5% to a two-week low of $2,871. Ether’s decline mirrored similar downward moves in the broader crypto market, with its net capitalization falling about 2.34% to $2.25 trillion.Cointelegraph

The decline in Ether’s price appears to be influenced by several factors, including dwindling hopes for approval of an Ethereum spot exchange-traded fund (ETF) in the United States, reduced demand for Ether products. Ethereum investment and the decrease in network activity.

Let’s take a closer look at why the price of Ether is falling today.

Traders fear the SEC will declare ETH a security and deny applications for spot ETFs.

Once the U.S. Securities and Exchange Commission (SEC) approved Bitcoin spot ETFs on January 10, Ethereum spot ETFs were expected to follow soon after.

The regulator’s recent release of a Wells notice to Ethereum-based protocol Uniswap on April 10 suggests that the SEC may consider Ether as a security, reducing the chances of an Ethereum spot ETF being approved in the United States. United.

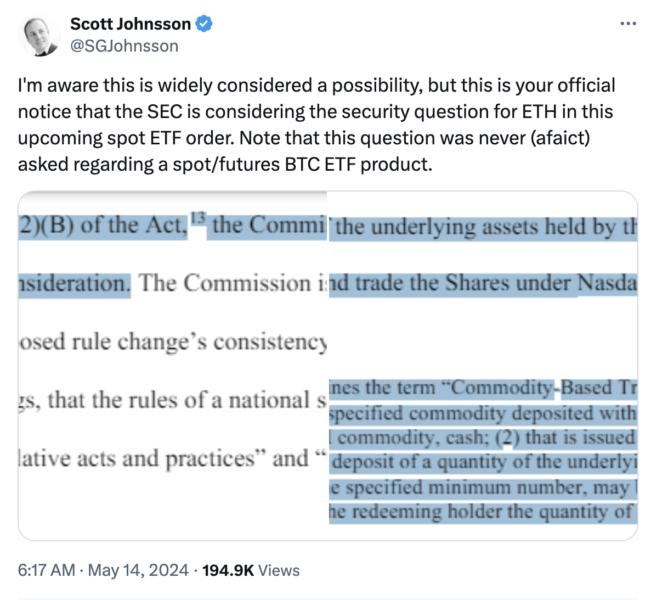

Financial attorney Scott Johnson shared excerpts from official documents in a May 14 article on Johnson noted that this “question was never asked” during the Bitcoin ETF’s one-time approval process.

Bloomberg ETF senior analyst James Seyffart weighed in on the matter, saying:

“Looks like chances have increased that the SEC will deny Ethereum ETFs by claiming #Ethereum is a security.”

Seyffart also believes that the SEC may not classify Ethereum as a security in future decisions, “but I think that almost guarantees that the SEC will at least consider it.”

The possibility of an approval of the US Ethereum ETF was dimmed after the SEC postponed its decision on the proposal from Invesco and Galaxy Digital on May 6, extending the deadline until July 2024. Additionally, the refusal by US SEC Chairman Gary Gensler to clarify whether Ethereum could be considered a security during his appearance on CNBC’s Squawk Box on May 7, further eroded investor confidence in the ETF’s prospects. Gensler’s appearance follows six crypto-related lawsuits in 2024.

Another Bloomberg ETF analyst, Eric Balchunas, says he wouldn’t be surprised if we don’t see approvals until 2025. Balchunas, who was previously optimistic about Ethereum ETF spot approvals, now says that “the chances of approval are “slim to none”. .

The SEC is expected to issue a decision on VanEck’s request, which is due May 23, and the deadlines for ARK 21Shares and Hashdex are May 24 and May 30, respectively.

A refusal is expected to have a negative impact on the trajectory of the Ether price in the medium term.

Ethereum investment funds saw $14.4 million in outflows last week

Last week saw the first inflows into crypto investment products in five weeks, with investors pouring in $130 million, according to a May 14 report from CoinShares.

However, Ethereum investors were “hesitant” last week as Ether saw outflows of $14 million.

CoinShares analyst James Butterfill said:

“US regulators’ weak interaction with ETF issuer requests for a spot Ethereum ETF has increased speculation that ETF approval is not imminent; This was reflected in capital outflows, which totaled $14 million last week.

This increase in Ethereum investment product releases speaks to reduced investor confidence in the token.

Related: Hong Kong Bitcoin and Ether ETFs Wipe 2 Weeks of Inflows in a Single Day

Ethereum Price Falls Due to Low Network Activity

Ethereum on-chain analysis has been unfavorable in recent weeks. According to data from CryptoQuant, active addresses on the Ethereum network have reached their lowest level in over a month.

The chart above reveals that active addresses on the blockchain increased from 460,474 on March 20 to 350,454 on April 24. This measure returned to 398,320 on April 29 before falling to the current level of 359,432.

Further data from DappRadar reveals that although the Ethereum network remains a powerhouse among layer 1 blockchains, handling a high number of transactions, it has declined by 14.88% over the past seven days.

The reduction in active addresses is also reinforced by a decline in total unique active wallets (UAW), which, according to the chart below, fell 32% over the past week.

The decline in Ethereum’s on-chain activity has impacted demand for ETH, thus weighing on its price.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research before making a decision.