Altcoin

On-chain data confirms whales are preparing for altcoin surge with increased buy orders

Ki Young Ju, CEO of analytics platform CryptoQuant, believes that whales are preparing for an impending altcoin rally.

In a recent revelation about X, Ju underlined that the limit buy order volume for altcoins excluding Bitcoin and Ethereum is increasing. This pattern suggests the formation of large buy walls, highlighting significant buying pressure from large-scale investors.

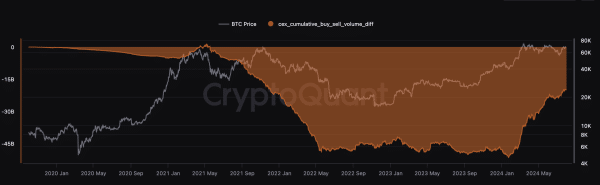

Ju’s chart identifies two main phases in altcoin limit order volume: the limit sell phase and the limit buy phase. The limit sell phase has seen a significant increase in cumulative sell orders in 2022, demonstrating strong selling pressure from whales and other market participants. This phase has coincided with a period of altcoin price collapse due to unfavorable market conditions.

Then, the Limit Buy phase began, characterized by a significant increase in cumulative buy orders. This indicates a period of strategic accumulation where whales establish substantial buy walls.

According to Ju, the increasing buying volume suggests confidence in the future market conditions for altcoins. This buying pressure creates strong support levels, indicating that whales are preparing for a positive market shift.

Buying pressure on specific altcoins

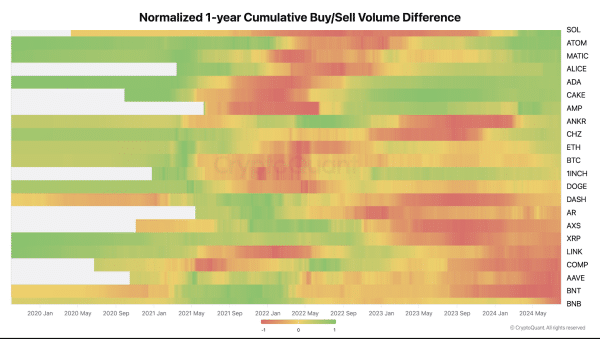

Ju also provided a heat map of the normalized cumulative buy/sell volume difference over a year for various altcoins, showing buying and selling pressure over time. Solana (SOL) has shown alternating buying and selling phases, with recent activity showing increased buying interest. Cosmos (ATOM) and Polygon (MATIC) have also shown elevated buying pressure despite contrasting activity trends.

Cardano (ADA) and PancakeSwap (CAKE) have been showing balanced buying and selling phases, with recent trends showing increased buying pressure. Coins like AMP and ANKR have also shown increased buying activity. The heat map reveals that most altcoins are seeing increased buying pressure as whales and significant investors accumulate altcoins in anticipation of a rally.

Meanwhile, coins experiencing selling pressure, as indicated by the predominantly red areas on the heat map, include DOGE, DASH, AXS, XRP, COMP, and AAVE, BNT.

Even Bitcoin Whales Are Buying

It is important to note that while whales are accumulating altcoins, Bitcoin whales are also active. The Crypto Basic noticed a surge in buyer activity on Binance, which aligns with an increase in the Taker Buy-Sell Ratio and whale movements. Analyst Ali Martinez highlighted fluctuations in the ratio from below 0.8 to above 1.7 between July 27 and 31. Ratios above 1.0 indicate aggressive buying, which often precedes price increases.

During July 27-28, the ratio mostly remained above 1.0, corresponding to the Bitcoin price rising from around $66.5K to over $67K. A spike to around 1.5 led to a sharp price increase to nearly $68.5K. However, on July 30-31, the ratio repeatedly dropped below 1.0, correlating with a price drop to around $66K, before a final spike to 1.7 signaled another slight price increase.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the personal views of the author and do not reflect the views of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Announcement-