Altcoin

Stablecoins exceed $846 billion in on-chain trading volume

Recent data from IntoTheBlock revealed that the stablecoin’s on-chain trading volume now exceeds $846 billion. This market still remains very active, despite a 30% drop in monthly trading and at the same time $20 billion below its highest peak.

This recent use of stablecoins in international remittances could be leveraged to reduce the large fees associated with traditional cross-border transactions.

Monthly stablecoin on-chain trading volume by In the block

Furthermore, a recent studies conducted by Coinbase showed that Americans spend nearly $12 billion annually on overseas transfer fees alone due to a lack of cheaper options.

PayPal’s PyUSD, a major stablecoin, plays a key role in this. Over the past four weeks, PyUSD has become not only one of the fastest-growing stablecoins, but also the tenth most capitalized stablecoin, up more than 21% since April. Also, PayPal recently announced its expansion onto Ethereum’s Solana blockchain, strengthening its position in this particular market.

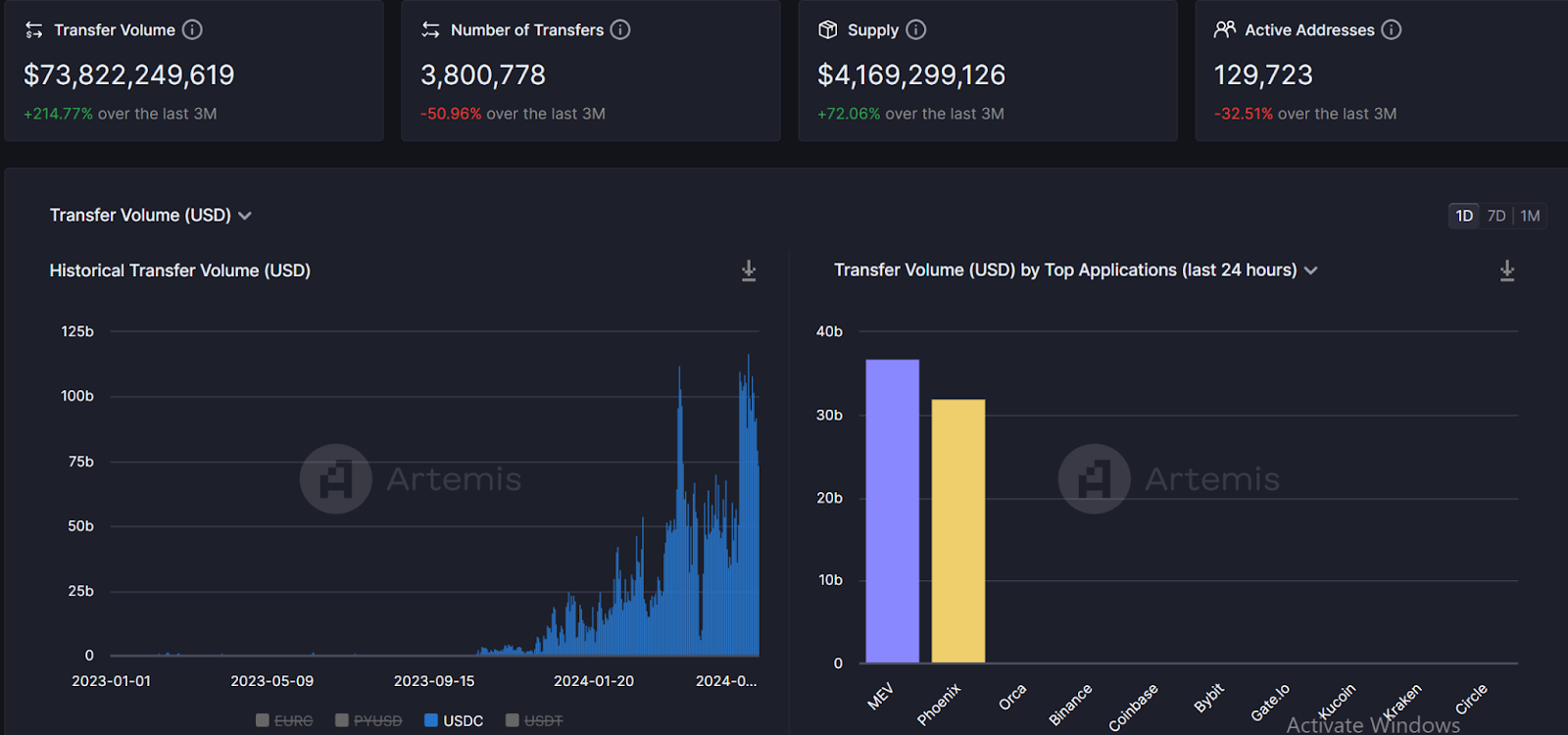

To date, the Solana ecosystem itself boasts a stablecoin market capitalization of over $4 billion, with USD Coin (USDC) currently dominating over 72% of market share according to Artemis data.

This development also follows that of PayPal announcement last month that Xoom, its money transfer service, would allow U.S. customers to send stablecoins to about 160 countries without incurring any fees.

The increase in stablecoin usage can be further indicated by the fact that stablecoin on-chain trading volume surpassed $1.3 trillion last month, surpassing the average monthly volume elaborate from Visa last year which recorded $32 billion. Tether USD (USDT), DAI, and USD Coin (USDC) have collectively processed over $1.3 trillion in transactions over the past 30 days.