Ethereum

Solana: Approval of Spot Ether ETF paves way for SOL ETFs

Approval of the Ether spot (ETH-USD) ETFs in the United States gave the crypto The market is a major boost and could be a big step forward in crypto regulation. Analysts at brokerage firm Bernstein believe Solana (SOL-USD) ETFs could be next.

Regulatory overhaul

Bernstein analysts Gautam Chhugani and Mahika Sapra view the potential approval as a sign of a looser regulatory stance, possibly influenced by the upcoming November election. They suggest that if Donald Trump is elected, “crypto could benefit from significant legislative and institutional support” with new SEC leadership.

Approval of a spot Ether ETF would be groundbreaking, marking the first time a non-Bitcoin blockchain asset has been classified as a commodity. This could pave the way for similar treatment towards Ethereum’s rivals, particularly Solana.

Market buzz

CNBC “Fast Money” trader Brian Kelly predicts a Solana spot ETF could follow, saying Bitcoin (BTC-USD), Ethereum and Solana “are probably the big three in this cycle.” He added that Robinhood (NASDAQ:HOOD) and Coinbase (NASDAQ:COIN) now have “some clarity on what a security is and what a security is not,” suggesting that these two companies are the biggest beneficiaries of regulatory clarity.

Bernstein predicts an Ether price rise similar to the 75% increase seen after the approval of spot Bitcoin ETFs. Earlier this week, the price of ETH jumped over 20% as optimism towards these funds grew.

The report highlights Ether’s attractive supply dynamics, with nearly 40% locked in staking and DeFi protocols, and a significant portion inactive for over a year. On-chain data shows that the number of small investors in ETH has reached a new all-time high, while large investors are lagging behind.

Is Solana a Buy?

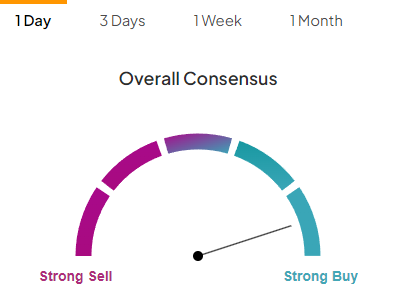

According to TipRanks Summary of technical indicatorsSolana is a buy.

Don’t let crypto give you a hard time for your money. Track part prices here.