Ethereum

Slow Ethereum Q2: Will ETF Approval and Low Supply Drive Prices Up?

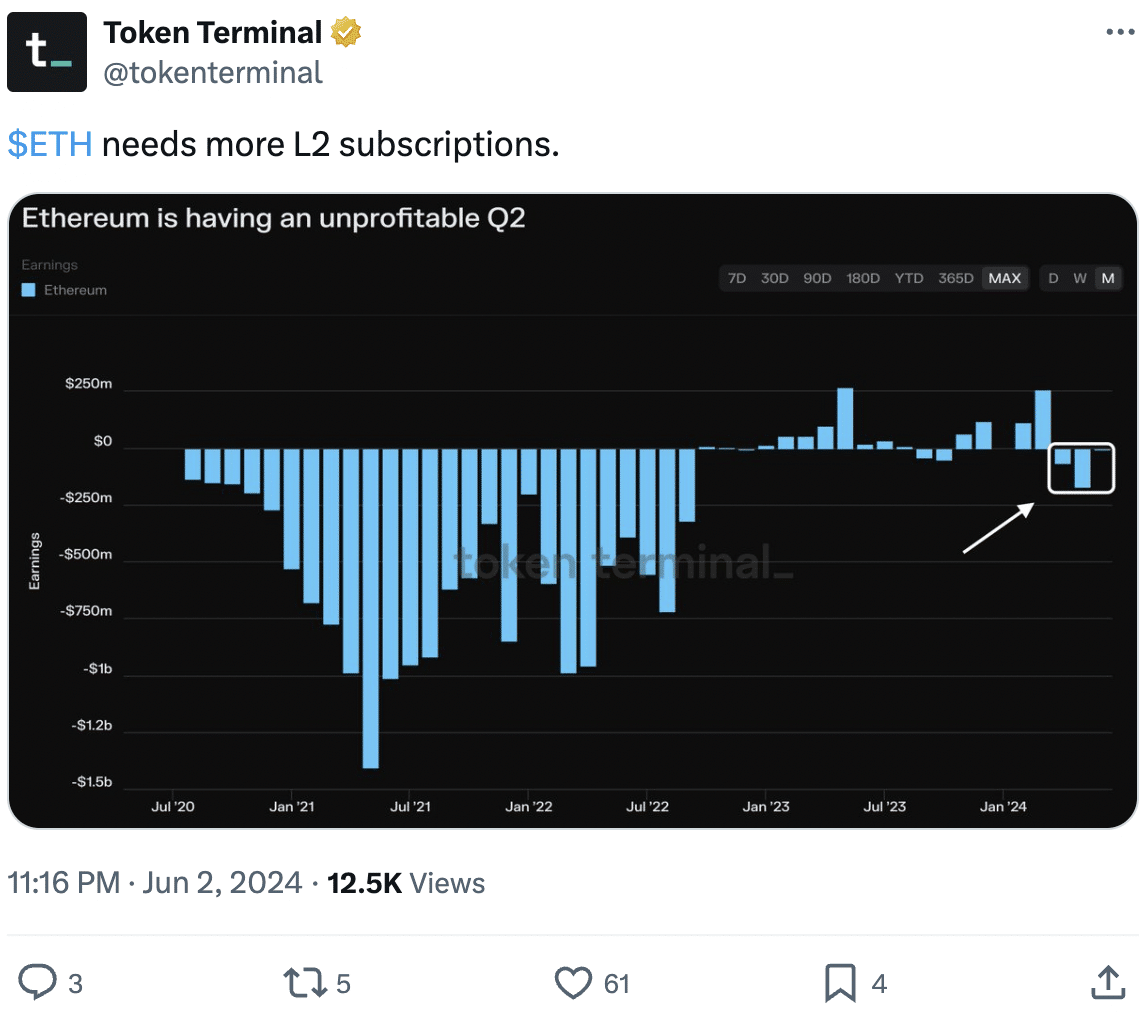

- Ethereum’s second quarter performance was unprofitable, indicating a difficult quarter.

- Whales and retail investors took some profits as prices soared.

Ethereum [ETH] has seen a surge in price and popularity over the past few days following the announcement of Ethereum ETFs.

A disappointing quarter

Despite this, the ecosystem was not doing very well. Data from Token Terminal indicated that Ethereum was experiencing an unprofitable second quarter.

If Ethereum continues to have difficulty generating revenue, it will be much more difficult for the network to sell its holdings.

Source:

However, interest in ETH has remained relatively high.

Following the May 23 approval of Ethereum spot exchange-traded fund ETFs in the United States, more than $3 billion worth of Ethereum was withdrawn from centralized crypto exchanges, indicating a possible price squeeze. ‘offer.

Data showed that the amount of Ethereum on exchanges decreased by approximately 797,000, or $3.02 billion, between May 23 and June 2.

Source: CryptoQuant

This reduction in foreign exchange reserves means that less ETH is available for sale as investors place their assets in personal custody for purposes other than immediate sale.

Ethereum supply on exchanges was now at its lowest level in years, at just 10.6%. This reduction in supply, coupled with an increase in investor demand after numerous ETF approvals, could further increase the price of ETH and push it towards its all-time high (ATH).

Still, concerns remain that Grayscale’s Ethereum Trust (ETHE), which manages $11 billion in funds, could impact Ethereum’s price action. This is based on the example of the Grayscale Bitcoin Trust (GBTC), which saw outflows of $6.5 billion in the first month after its approval.

How is ETH doing?

At press time, ETH was trading at $3,833.59 and its price increased by 1.19% in the last 24 hours. Surprisingly, whale interest and retail interest have declined slightly over the past few days.

AMBCrypto’s review of Santiment data found that cohorts holding between 0.01 ETH and 10 ETH experienced a decline in the overall ETH they held.

Additionally, addresses holding more than this amount also gave up some of their ETH.

Is your wallet green? Check the Ethereum Profit Calculator

This behavior exhibited by both whales and retail investors indicates that many holders were engaging in some level of profit-taking as prices soared.

However, the selloffs were not large enough to have a negative impact on prices.

Source: Santiment