Altcoin

Rendering against Theta; Which DePIN Altcoin to buy in May

In the world of cryptocurrency investing, it’s common for change to happen instantly, as the search for the next big opportunity continues. Investors have recently been attracted to the decentralized infrastructure projects grouped below Decentralized physical infrastructure network (DePIN). These initiatives seek to use blockchain technology to transform traditional physical infrastructure services, offering improvements in security, scalability and efficiency. This article delves into two such projects that have attracted high levels of attention: Render Token (RNDR) and Theta Network (THETA).

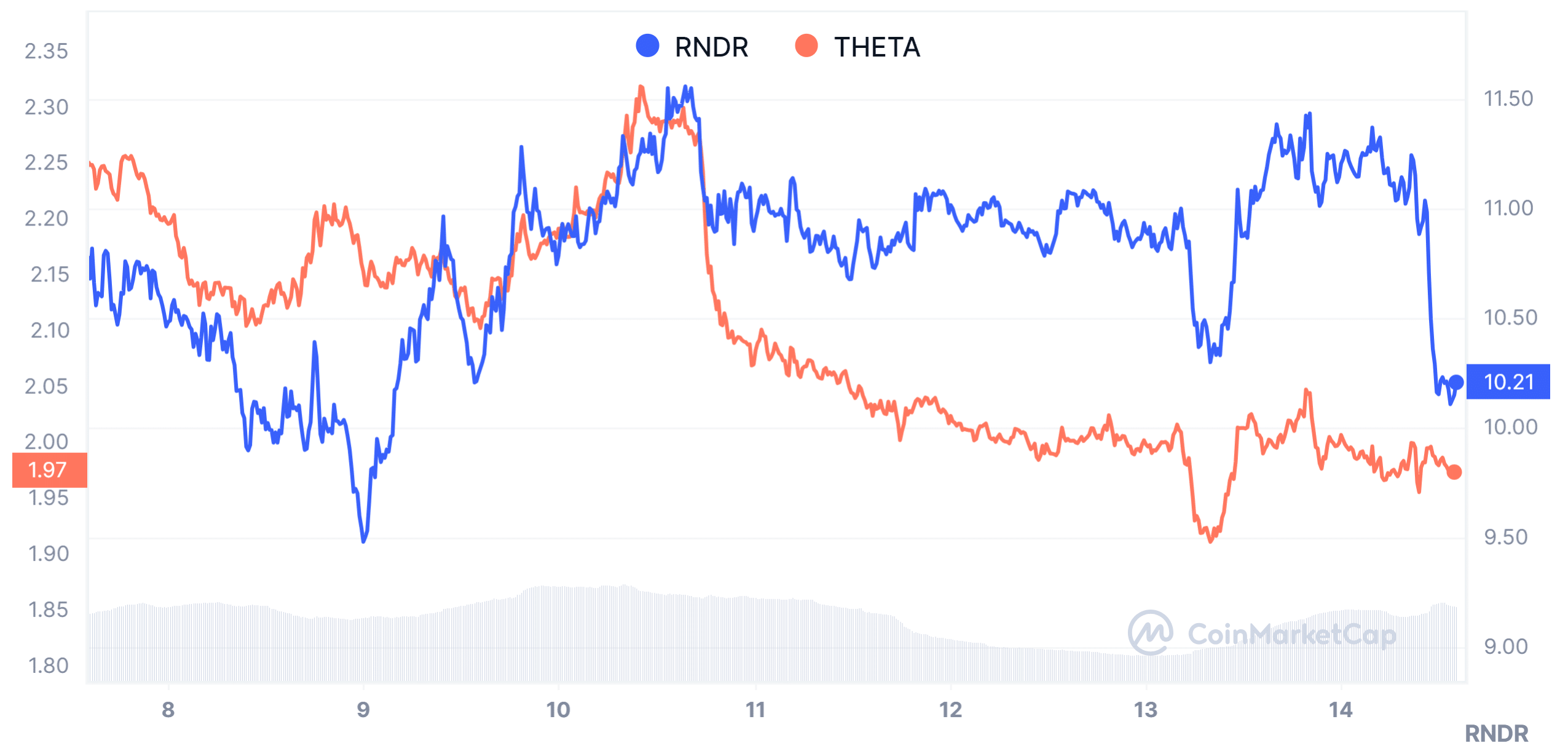

Render vs Theta: Market Performance

Render Network is a computational network protocol that uses vendors’ GPU capability for 3D rendering and artificial intelligence tasks. Users trade GPU power for RNDR tokens on their marketplace. Originally on Polygon, they switched to Solana in late 2023 for its efficiency and capacity.

RNDR, the Render Network token, is currently trading at $10.22, reflecting a decline of 8.08% over the past day. However, zooming out reveals a bigger picture: Over the past month, RNDR price increased by 30.79% and its annual performance is higher with a growth of 457.37%.

With a market capitalization of approximately $3.97 billion, RNDR maintains its position firmly at 25th place in the cryptocurrency market hierarchy, according to CoinMarketCap. Trading volume for RNDR in the last 24 hours stands at $467.93 million.

On the other hand, Theta Network is a Web3 blockchain infrastructure for video, AI, and entertainment that enables a decentralized peer-to-peer video distribution system. Contributors earn THETA tokens by sharing computing resources, potentially revolutionizing online streaming by eliminating the need for centralized content distribution networks and transforming the industry.

THETA, representing the Theta network, is priced at $1.97 per token, registering a slight decline of 1.46% on the day. Over the past week, THETA has seen a decline of 12.30%, while its monthly performance shows a decline of 4.37%. However, its annual growth remains impressive at 119.11%.

With a market capitalization with 1.97 billion dollars, THETA occupies the 50th position in the market ranking. Despite a 24-hour trading volume decline of 14.38%, THETA still sees a volume-to-market-cap ratio of 1.39%, suggesting decent liquidity.

While RNDR and THETA may differ in price movements and market positions, both projects show resilience and potential within the dynamic cryptocurrency ecosystem.

Theta network token is trading at $1.97, demonstrating a 1.46% drop in its value, over the past day. Over the past week and past month, THETA price has fallen by 12.30% and 4.37% respectively. Nonetheless, its value has grown by 119.11% since the beginning of the year.

THETA holds the 50th place in the market ranking with a market capitalization of $1.97 billion. Even with a trading volume decline of 14.38% over 24 hours, THETA maintains a volume to market cap ratio of 1.39%, indicating good liquidity.

Although RNDR and THETA show differences in price fluctuations and market positions, both projects demonstrate strength and promise in the ever-evolving cryptocurrency ecosystem.

Render vs Theta: technical analysis

Technical analysis sheds light on the current state of the RNDR, revealing a mix of signals across various indicators. While some moving averages signal a sell, indicating potential downside pressure, others trend towards a buy signal, suggesting upward momentum. This dichotomy highlights the complexity of RNDR’s current market sentiment.

While Relative strength index (RSI) is hovering around the neutral zone, indicating a balanced market sentiment, the Moving Average Convergence and Divergence (MACD) suggests a buying opportunity with its positive value.

Pivot levels serve as crucial reference points for traders, helping them evaluate potential entry and exit points in the market. Support levels for Render are at $5.5426 and $3.7462, with resistance levels at $9.9116, $12.4842 and $16.8532. Similar to RNDR, THETA moving averages show a mix of signals, albeit with a different emphasis. While some moving averages signal a sell, others align with a neutral or buy signal, reflecting the ongoing tug-of-war between bulls and bears in the market.

The RSI, while neutral, suggests a potential change in market sentiment, while the MACD and momentum indicators suggest prevailing selling pressure.

Support levels for THETA are $1.4504, $0.8825 and resistance levels are $2.8593, $3.7002 and $5.1090.

Conclusion

Both RNDR and THETA show potential in the decentralized infrastructure landscape, but investors should carefully consider the factors before investing. RNDR focuses on the computational network protocol for 3D rendering and AI tasks, while THETA is a Web3 blockchain infrastructure for video, AI, and entertainment. Both have seen growth, with RNDR up 457.37% and THETA up 119.11% year to date. Technical analysis suggests mixed signals for both, highlighting the importance of research and analysis before investing.