Ethereum

Predicting How ETH Will React IF SEC Approves Ethereum ETFs

- Coinbase analyst estimates there is a 30-40% chance of approval for Ethereum ETFs.

- Ethereum dominance and performance are at an all-time low, suggesting the need for positive development soon.

It is generally accepted that the US SEC will not approve any application for the spot. Ethereum [ETH] ETF due to several factors indicating that the agency’s new crypto enemy is Ethereum.

But no real confirmation has yet been obtained from the agency itself on what it is planning. So there is still a chance, however slim it may be, that the SEC will approve these ETFs.

However, if this is the case, is the market ready to deal with this impact? How would the price of Ethereum react?

Approval Ratings for Ethereum ETFs

David Han, institutional research analyst at Coinbase, suggests there could be a surprising upside.

Inside Coinbase Monthly Outlook report published on May 15, Han mentioned that the chances of approval are between 30 and 40 percent.

Bloomberg ETF analyst Eric Balchunas also together his chances of approval are 35%. Meanwhile, the crypto community has taken a investigation from Polymarket and the general estimate is a 7% chance of approval.

Larry Fink, CEO of BlackRock, echoed this somewhat optimistic sentiment during an appearance on CNBC, saying the SEC could approve spot ETH ETFs even though it considers Ethereum a security.

What does the data tell us?

If the SEC approves an Ethereum ETF, the market could see an unexpected rise. However, Ethereum’s recent dominance and performance is trending toward its lowest level ever.

Its status as an SEC-proclaimed security has had a negative impact on investment sentiment.

No one expects approval, so Ether prices could likely see very little movement in the near future.

Bitcoin [BTC] the price barely reacted to its ETF approvals earlier this year. And the community was looking forward to it.

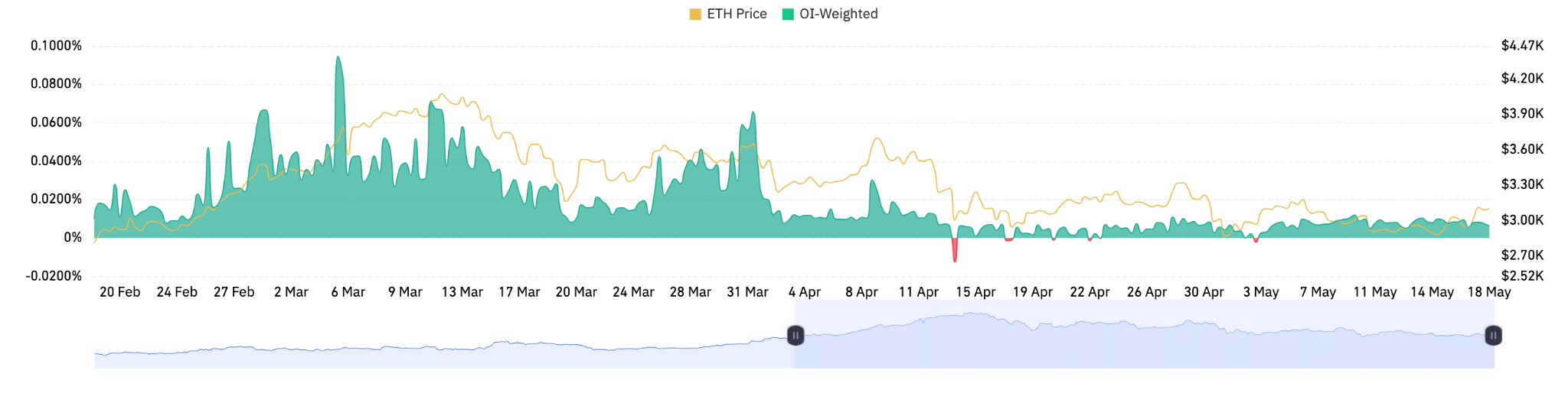

Recently, the Funding rate has been relatively weak or negative, which could imply a cooling of bullish momentum or increased caution on the part of traders, especially during price declines as occurred in mid-April.

Source: Coinglass

Additionally, the increase in open interest despite falling trading volumes suggests that traders could be preparing for significant price movements as positions build.

But trading Ethereum chart shows a consistent uptrend over a two-day period. The high price just above $3,160 could serve as a resistance level in the near term.

Read Ethereum [ETH] Price prediction 2024-25

Observing the price reaction when retesting this level could be essential for short-term investment strategies.

Source: TradingView

Given the strong bullish momentum and successful price recovery after the pullback, if the market maintains its bullish sentiment, Ethereum could potentially break through the current resistance level.