Ethereum

Ethereum: Why 298,000 ETH tokens were purchased in just 24 hours

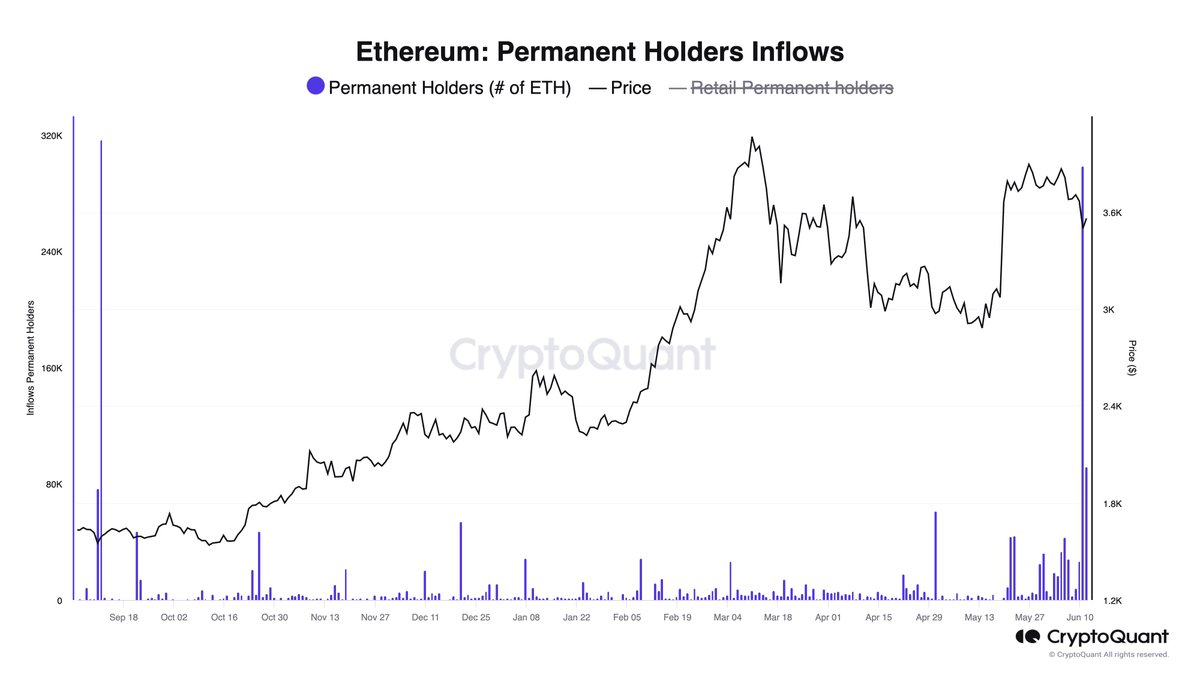

- Ethereum is seeing its second biggest buying day, with long-term holders accumulating significantly.

- Market indicators are showing mixed signals, with open positions shrinking and foreign exchange reserves hitting an eight-year low.

Ethereum [ETH]the second largest cryptocurrency by market capitalization, has been exhibiting some interesting market movements recently.

Despite an 8% decline over the past week, Ethereum saw a slight rise of 0.3% over the past 24 hours, bringing its current price to $3,519.

This slight increase comes during a period of general uncertainty in the market, particularly following the approval of spot Ethereum ETFs by the United States Securities and Exchange Commission in May.

Long-term holders profit from market declines

Amid these price adjustments, Ethereum has experimented a significant increase in long-term holder accumulation. According to Julio Moreno, Head of Research at CryptoQuant, Ethereum just had its second largest day of buying by long-term holders.

On June 12, approximately 298,000 Ethereum tokens, worth approximately $1.34 billion, were purchased by these loyal investors, taking advantage of a slight price decline of 2% during the same period of 24 hours.

Source: CryptoQuant

This remarkable accumulation is not far from the record set on September 11, 2023, when 317,000 Ether tokens were acquired as prices fell below $1,600.

This pattern of strategic buying during price drops highlights long-term investor confidence in the value of Ethereum.

Additionally, this trend corresponds to an increase in large transactions above $100,000, as shown in IntoTheBlock. datawhere these transactions increased from less than 4,000 at the start of the week to more than 6,000

This indicates active accumulation by whales regardless of market conditions.

Source: In the block

Market caution and technical outlook

However, in contrast to this bullish accumulation activity, Ethereum market indicators such as open interest and trading volume present a more moderate outlook.

Open interest on Ethereum declined by almost 2% to $15.41 billion, while trading volume saw a significant decline of 25.77%, now standing at $24.19 billion. These indicators suggest a cautious stance from some market participants, potentially anticipating further price adjustments.

Source: Coinglass

On the technical side, Ethereum’s inability to surpass its March highs activated a sell-off pattern on its daily chart, hinting at possible continued downward pressure.

However, a shorter-term perspective on the 4-hour chart suggests that there could be a temporary rise to around $3,800, potentially providing liquidity for a continued downtrend.

Source: TradingView

Read Ethereum [ETH] Price prediction 2024-25

In another key aspect of market dynamics, the amount of Ethereum held on exchanges has reached an eight-year low as rated by AMBCrypto.

This reduction in Ethereum held on exchanges, coupled with the launch of spot ETFs, could lead to a significant supply shock, which could, in turn, trigger a sharp increase in prices.