Ethereum

Ethereum Resurgence and Layer 2 Boom Define Crypto Q2: IntoTheBlock

Key takeaways

- Bitcoin price fell after its fourth halving, despite reduced issuance.

- Ethereum price rose following SEC approval of spot ETH ETFs.

Share this article

Crypto Q2 saw Bitcoin (BTC) and Ethereum (ETH) trending lower, with BTC miners selling off their reserves at a rapid pace and layer 2 blockchain activity surging four times, according to IntoTheBlock’s “On-chain Insights” newsletter.

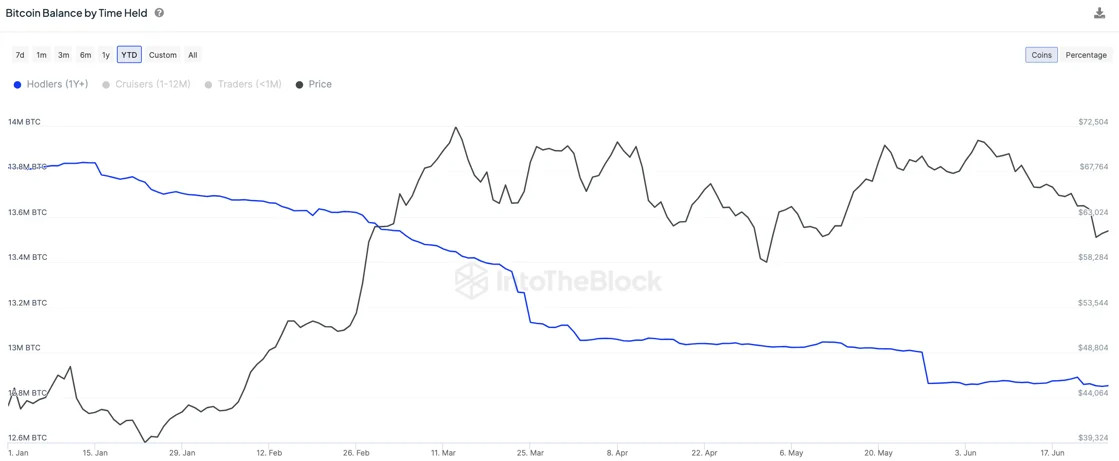

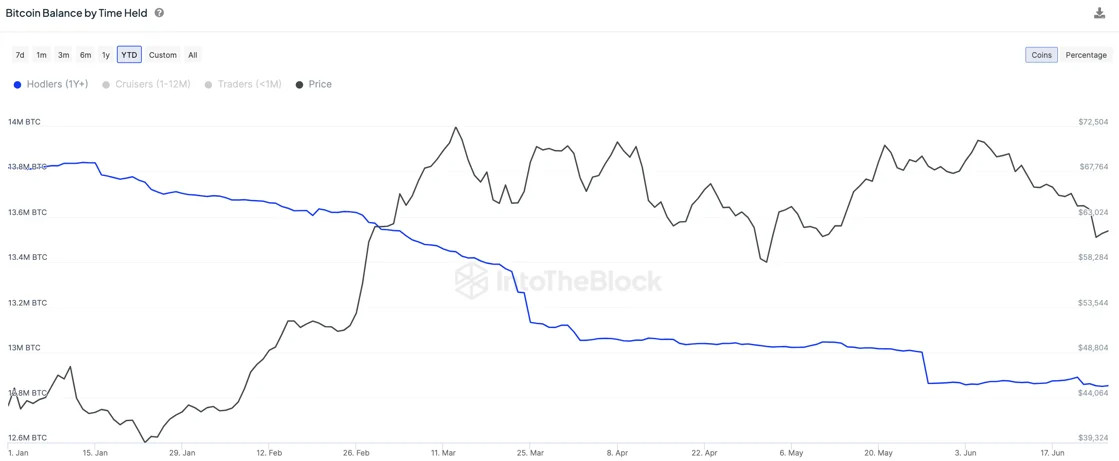

Bitcoin’s price fell 12.8% after its fourth halving on April 20, and the expected price rise caused by a supply shock failed to materialize. Analysts at IntoTheBlock said this was likely due to long-term holder profits in 2024.

Additionally, miners sold over 30,000 BTC in June alone, representing almost $2 billion. Again, the halving could be linked to this move, as profit margins for miners have declined since then.

Ethereum, on the other hand, saw a slight decline of 3.1%, a feat made possible by the approval of ETH spot exchange-traded funds in the United States, analysts noted. This event pushed Ethereum’s price up by more than 10%, as these investment products are expected to attract substantial investments, similar to the inflows seen with Bitcoin ETFs.

Additionally, the Ethereum landscape was noticeably different, with an increase in transactions on Layer 2 blockchains like Arbitrum, Base, and Optimism, following the integration of EIP-4844.

This development introduced “blobs,” which significantly reduced transaction fees for Layer 2 blockchains and encouraged greater on-chain activity. As a result, this potentially set the stage for long-term benefits for the network despite a short-term decrease in fee revenue.

Share this article