Altcoin

Ethereum Open Interest Gains $1 Billion: Impact on ETH?

- While Open Interest increased, the financing rate stalled.

- In the short term, the price of the altcoin could continue to fluctuate between $3,400 and $3,600.

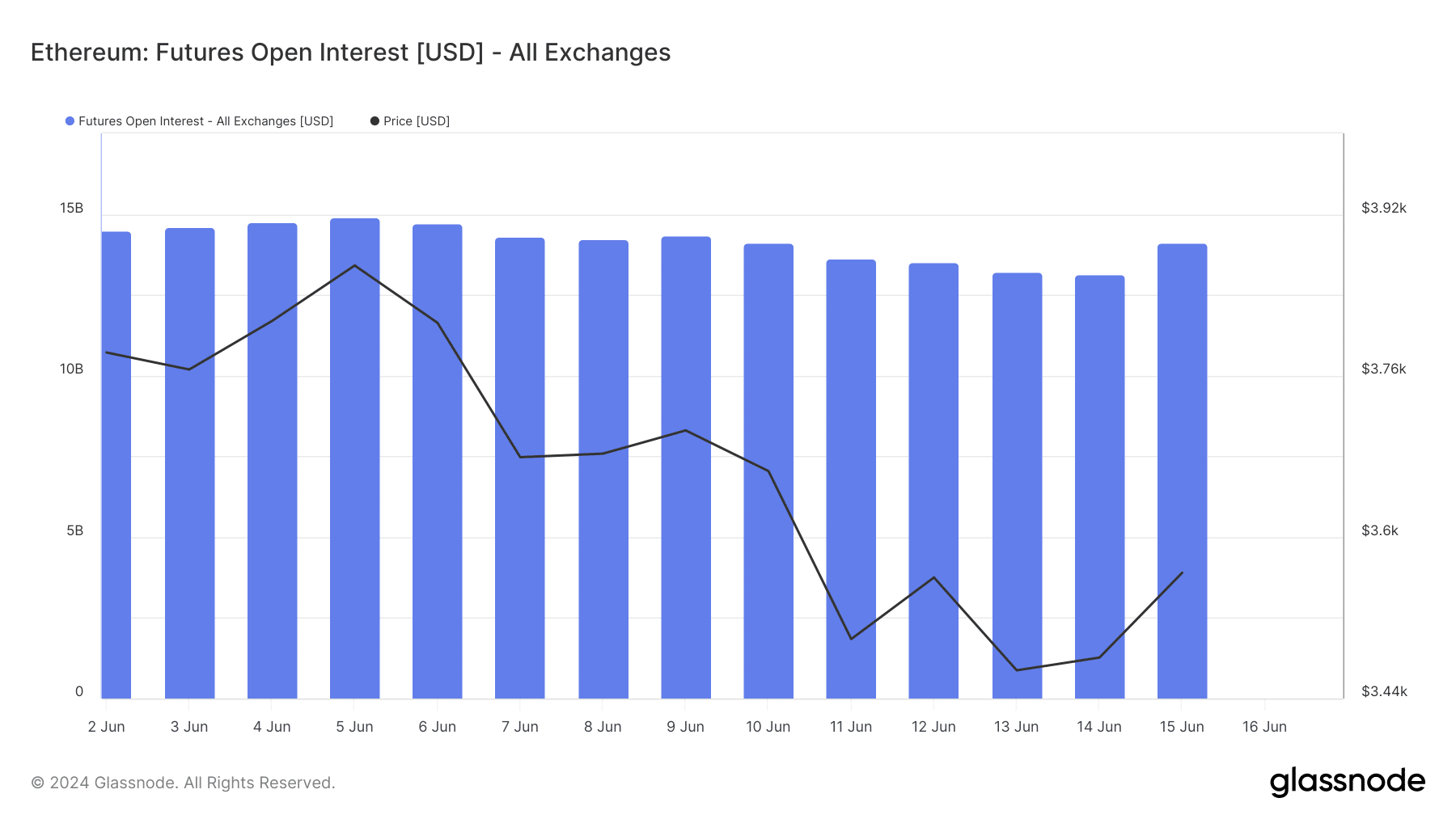

One day later That of Ethereum [ETH] Open interest fell to $13.14 billion, adding another billion to its value. At the time of writing, Open Interest (OI) stood at $14.10 billion, according to Glassnode data.

OI is the value of futures contracts outstanding on the market. Whenever it decreases, it means that traders are closing positions related to the cryptocurrency. However, an increase suggests otherwise.

Speculation is a ticket to a new high

Thus indicates the increase in Ethereum contracts increase in speculative activity regarding the altcoin. In many cases, an increase in OI provides strength to the price direction.

For ETH, it may be no different. As of this writing, ETH changed hands at $3,563, up a slight 1.10% in the past hour.

As it turns out, this could be the start of a significant uptrend for the cryptocurrency.

Source: Glassnode

However, the trading volume decreased by 35.36% in the last 24 hours. The decline in trading volume is a sign that activity involving ETH has been lower in the spot market.

If spot market activity continues to decline while trading in the derivatives market increases, ETH price could stall around the $3,500 to $3,600 region.

But if buying pressure in the spot market were to increase, the altcoin could do so jump in the direction of $3,800.

Skepticism persists

Despite the outlook, Ethereum’s funding rate has remained stagnant since June 8th. The funding rate is the cost of holding an open position in the derivatives market.

If the financing is positive, it means that the contract price is trading at a premium to the spot price. In a situation like this, longs pay shorts to keep their positions open.

On the other hand, negative funding implies that short positions are paying off long positions. Furthermore, the contract value of the cryptocurrency is discounted.

For ETH, the low funding rate and high price it means that spot volume could soon start to rise.

If so, the reasonable deduction could be a bullish move for Ethereum. However, the price of the cryptocurrency may fail to reach $4,000 in the next week.

Source: Santimento

Additionally, AMBCrypto examined the Taker Sell Ratio. To get this ratio, we need to divide the sales volume by the total perpetual swaps.

When the ratio is below 0.5, it means that selling pressure has decreased. However, a value above 0.5 indicates the selling is dominant in the market.

Realistic or not, that’s it ETH market capitalization in terms of BTC

At the time of writing, Ethereum’s Taker Sell Ratio was 0.50, according to data from CryptoQuant. If conditions remain the same, ETH price may struggle to close around $4,000, as mentioned above.

In the next week, the value of the cryptocurrency could trade between $3,400 and $3,600, as in previous weeks.

Next: Solana beats Bitcoin, Ethereum on THIS front: will SOL also grow?