Altcoin

BNB’s Next Move: Will It Break Above $600 or Should You Prepare for a Crash?

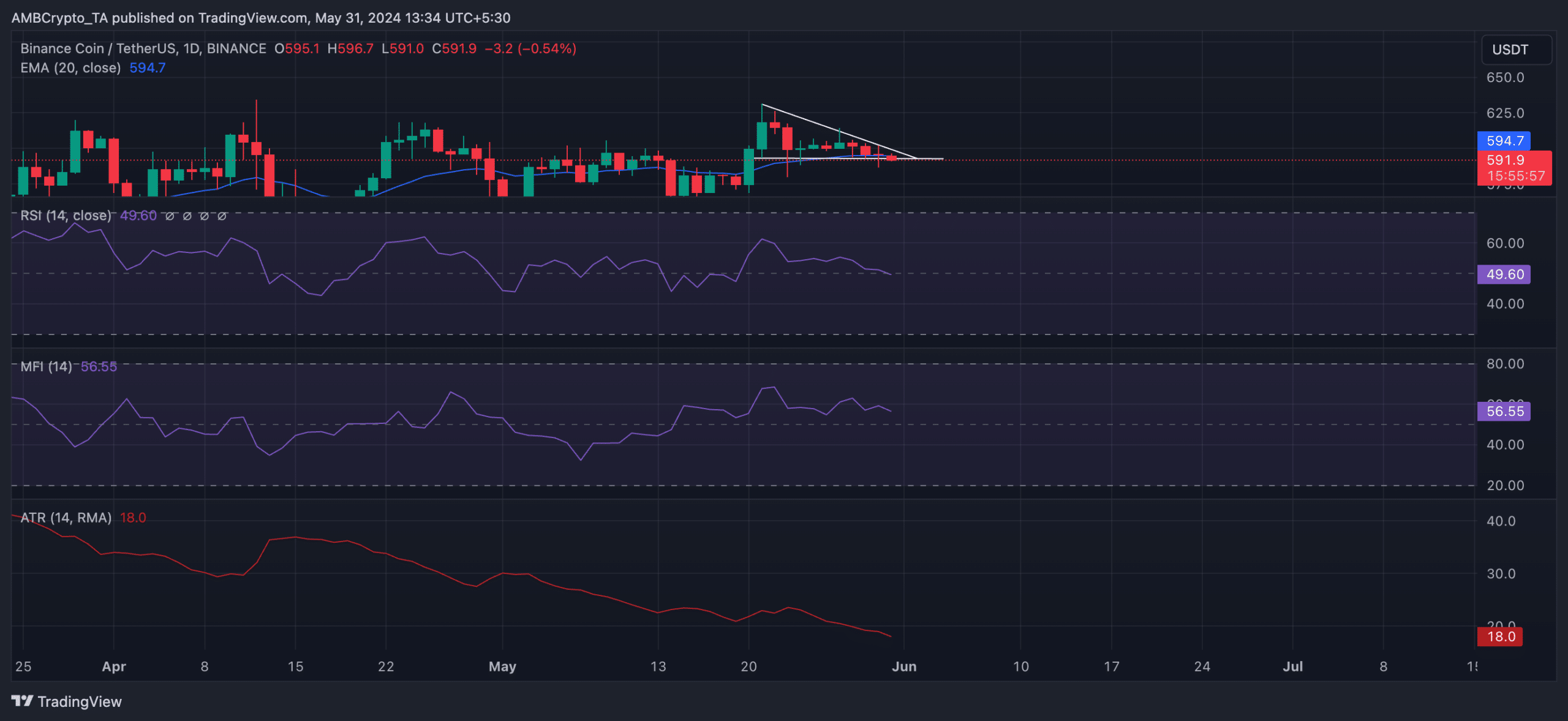

- BNB price is currently trending inside a descending triangle.

- Demand for the altcoin must increase for it to break above the top line of this triangle.

Binance coin [BNB] has been trending downward since its price peaked at $612 on May 27, forming a descending triangle. At the time of writing, the altcoin was trading at $593.11, recording a 3% price decline over the past three days.

BNB at a crossroads

At its current price, Binance Coin is trading slightly below the lower line of the descending triangle, which is support.

In order for a rally towards the upper line of this triangle (resistance level) to materialize, there must be an increase in buying pressure.

In the current market, readings of key BNB momentum indicators showed that neither buyers nor sellers were exerting enough pressure to steer the trend in their direction.

BNB’s Relative Strength Index (RSI) was 49.50, while its Money Flow Index (MFI) was 56.60. A combined reading of the values of these indicators showed that the price movement is balanced between gains and losses, with neither bears nor bulls having clear dominance.

This consolidation was confirmed by BNB’s Average True Range (ATR), whose value has fallen by 23% since May 23.

This indicator measures market volatility by calculating the average range between high and low prices over a specific number of periods.

Source: BNB/USDT, TradingView

When it declines like this, it suggests that the price of an asset is becoming less volatile and that the market is entering a consolidation phase.

BNB bulls have a chance

While there is an apparent balance between supply and demand in the BNB market, AMBCrypto’s valuation has revealed some indicators that confirm the bullish trend for the altcoin.

For example, at the time of writing, BNB’s Chaikin Money Flow (CMF) was above the zero line. This indicator measures how money enters and exits the BNB market. At 0.05, BNB’s CMF suggested there was still demand for the altcoin.

BNB Parabolic SAR readings confirmed this trend. At the time of writing, the points that make up this indicator are located below the price of BNB, suggesting the possibility of a short-term price increase.

Light Binance [BNB] Price forecast 2023-2024

Finally, at the current price, BNB is trading slightly above its 20-day exponential moving average. This means that its current price is higher than the average price of the last 20 days, albeit with a small difference.

Source: BNB/USDT, TradingView

This bullish signal suggests that traders may be slowly accumulating the altcoin.