Altcoin

BNB would like to break above $600, but why could the altcoin drop to $550 instead?

- A bullish invalidation could drop BNB to $561.

- Funding rate and sentiment were negative, suggesting a bearish bias.

Binance [BNB] may try to break out according to the 4-hour chart. But AMBCrypto’s analysis revealed that this effort may be in vain.

One of the reasons for this prediction is the Exponential Moving Average (EMA). This indicator measures the direction of the trend over a certain period of time.

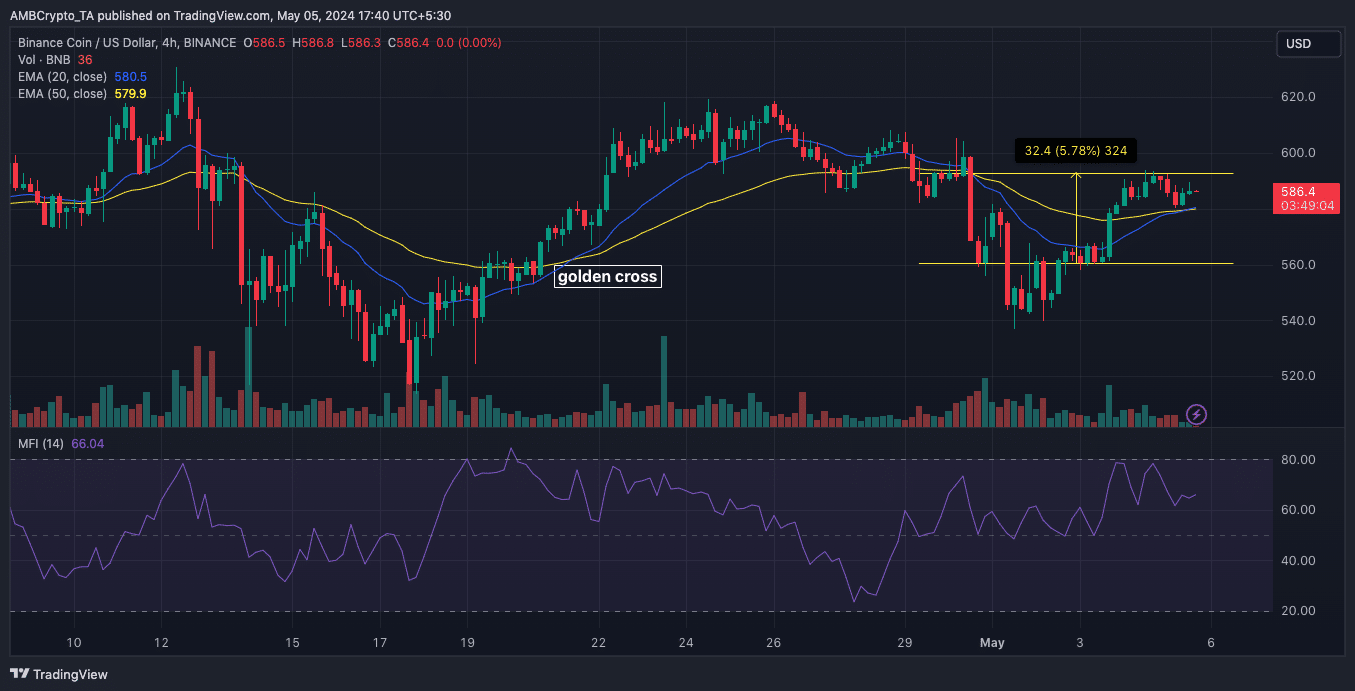

As of this writing, BNB changed hands at $586. But the 20 EMA (blue) and the 50 EMA (yellow) were at the same point. EMA positions indicate hesitation on the part of bulls and bears in directing price action.

Therefore, BNB could trade within a tight range unless a crossover occurs.

The missing golden cross: the next cross of death?

If the 20 EMA rises above the 50 EMA, the price could extend towards $593. But this seemed unlikely as the next target for BNB could be $561, where the latest golden cross occurred.

For those who are unfamiliar, the golden cross is the terminology used to describe a situation where the 20 EMA rises above the 50 EMA. If the 50 exponential moving average exceeds this value, it is called a scarcity cross.

Source: TradingView

In addition to the indicator above, another one that suggested a decline it was the Money Flow Index (MFI).

This indicator uses price and volume data to show whether a cryptocurrency is experiencing buying pressure or not.

At the time of writing, the MFI had fallen to 66.04, indicating that BNB buying volume had decreased. If the reading continues to decline, the bearish thesis could be validated.

However, this AMBCrypto analysis was not the only one to share this view. A look at on-chain data revealed that much of the market expects the price of BNB to decline.

Brings the bet double

This was evident from the thoughtful sentiment, which it was negative at the time of printing. This negative value shows that most comments about BNB on social platforms were bearish.

As long as this remains the same, it may be difficult for the price to rise. On the other hand, if observations on BNB start to turn optimistic, the trend could change.

Furthermore, a look at the financing rate showed that it was on the extreme side of the negative area. The funding rate has caused more traders to turn to short positions.

Source: Santimento

If the funding had been positive, this would have implied that the traders were positive bullish on the coin. Furthermore, financing also has an impact on the price. At press time, BNB price fell while funding was negative.

Is your portfolio green? Check the BNB Profit Calculator

The reasonable inference here is that criminal sellers are aggressive and receive rewards for their positions.

In a case like this, BNB could fade a bullish move, and a possible decline could be next unless spot buyers save the day.