Altcoin

What future for LTC as bulls hold $80 support

Litecoin price has remained stable around the $80 mark since early May 2024, despite the positive sentiment surrounding the broader altcoin markets, what lies ahead for LTC?

Litecoin price stagnates at $80 amid cryptocurrency market rally

The cryptocurrency market made an extraordinary start in May 2024 amid positive macroeconomic indices relationships in the United States. But curiously, Litecoin’s price action has decoupled from broader market trends, failing to capture double-digit gains like most mega-cap assets in the cryptocurrency market rankings.

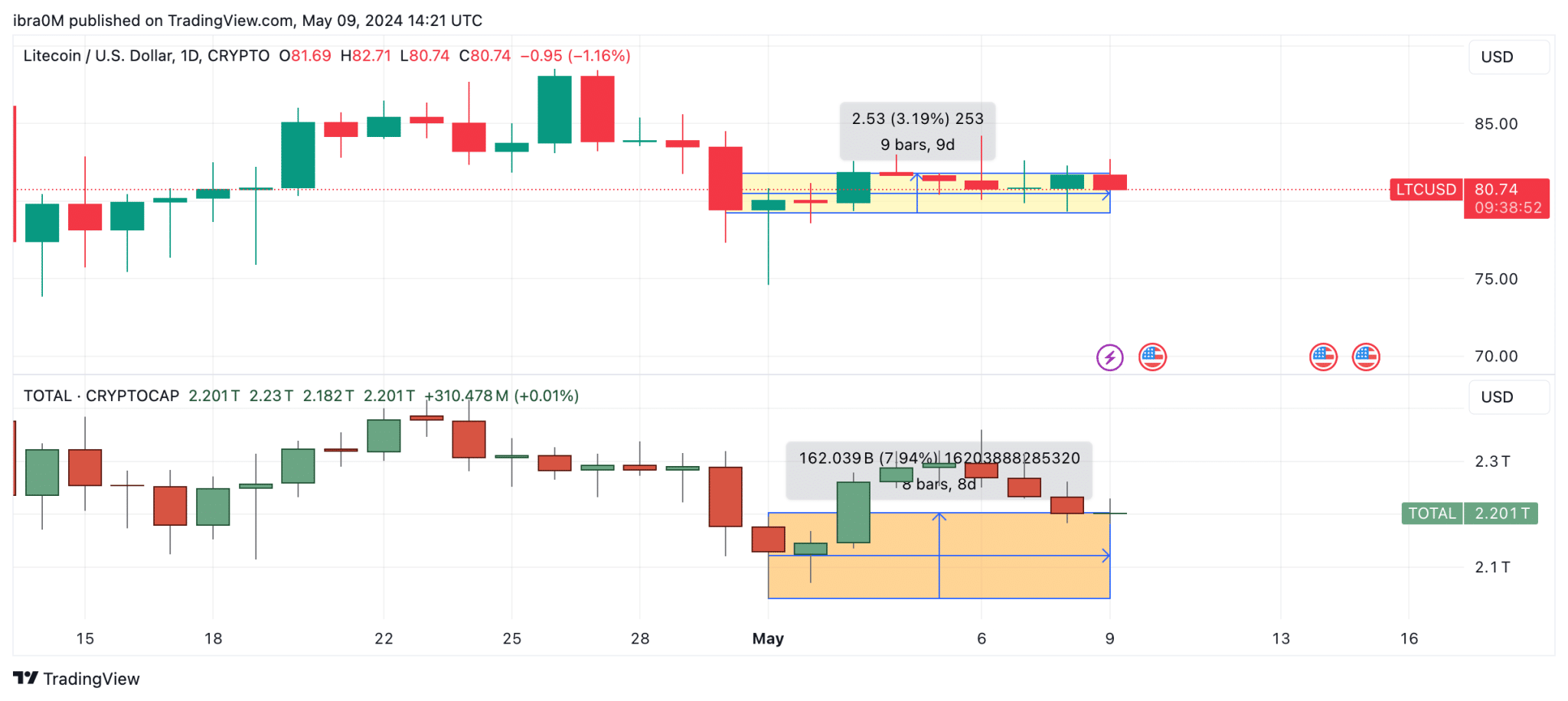

Litecoin price opened trading at $79.5 on May 1. But since then, LTC has moved up only 3.2%, settling in $80.7 territory at the time of writing on May 9.

But in comparison, TOTAL Crypto’s market cap saw growth of $162 billion, which represents a 7.9% rebound over the same time frame, more than double LTC’s gains.

This implies that Litecoin has underperformed the market average, so far in May 2024. And as expected, some strategic cryptocurrency traders have taken note, placing bullish bets to anticipate an imminent price breakout.

Litecoin bulls raise funding rates anticipating a major breakout

After 10 days of stagnation and consolidation around the $80 territory, vital market indicators suggest that LTC bulls are making strategic moves to trigger a breakout in Litecoin price.

The Coinglass Funding Rate monitors real-time changes in commissions paid between LONG contract holders and SHORT traders.

– Announcement –

The LTC financing rate was trending at 0.0008% on May 7. This figure has since increased considerably to reach 0.0121% on May 9th. Meanwhile, the price of LTC fell 2% during that period.

Spikes in the funding rate are a key indication that Litecoin bulls are getting bullish, so they are now paying higher fees (funding rate) on leveraged positions to SHORT contract holders, in hopes of getting amplified profits when the spot price increases.

The fact that bullish Litecoin traders have used considerably higher leverage in the derivatives markets over the past 48 hours signals an overwhelming expectation of an imminent recovery in spot prices.

LTC price forecast: imminent breakout above $100?

The price of Litecoin has remained stuck at $80 since the beginning of May 2024, despite growth of over 162 billion in the global cryptocurrency markets. But, after 10 days of stagnation, the price of LTC looks set to rise above $100, taking cues from the increased leverage used by bullish speculative traders this week.

However, in the event of a breakout in Litecoin price, the IntoTheBlock chart below shows that the bulls could face a major hurdle at the $88 level.

As seen above, 1.4 million active Litecoin addresses acquired 10.9 million LTC at the average price of $87.89. If they choose to take profits early, the price of LTC may struggle to break above $100 as expected.

On the other hand, in the event of a bearish reversal, the $75 buy-wall could offer significant short-term support. But given the rising funding rates seen this week, LTC is more likely to advance towards $100 than succumb to a reversal below $70.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Announcement-