Altcoin

Is it time to invest in altcoins? Link analysis shows…

- Altcoins with market caps under $10 billion are showing signs of imminent buying opportunities.

- Chainlink (LINK) may be poised for recovery, indicated by increased large transaction activity.

The altcoin market has suffered a downturn in recent months. After reaching a peak market capitalization of $1.27 trillion in March, this segment of the cryptocurrency market has since declined by more than 8%, now valued at $1.061 trillion as of this writing .

This decline has been quite evident in every aspect of the altcoin market.

Small-cap crypto assets have significantly underperformed since then, according to Jamie Coutts, chief crypto analyst at RealVision Bitcoin [BTC] reached new heights earlier this year

In a detailed analysis shared on social platform

Jamie Coutts suggests that the recent dip could be a typical mid-cycle correction within the broader cryptocurrency market cycle, which historically opens up buying opportunities.

As the market begins to stabilize, these small- and mid-cap cryptocurrencies could represent valuable entry points for discerning investors. This outlook is vital as it sheds light on potential recovery trajectories, suggesting a silver lining after the market storm.

Analytical breakdown: sector trends and forecasts

Jamie Coutts, sharing data from crypto tracking service Bitformance indicates a stark contrast in performance between various crypto sectors.

Over the past three months, while the top 200 equal weight index – which assigns equal weight to cryptocurrencies regardless of market capitalization – has fallen by more than 30%, the market capitalization index has seen a smaller decline, highlighting the resilience of larger cryptocurrencies such as Bitcoin and Bitcoin. Ethereum.

Source: Jamie Coutts

In particular, Bitcoin and Ethereum [ETH] they showed declines of 11% and 5% respectively, demonstrating their stability relative to the broader market. Among sectors, Metaverse-related tokens and infrastructure projects were hit the hardest, with declines close to 44%.

This significant decline across various sectors highlights the vulnerability of specific altcoins in times of market stress, but also highlights the potential for recovery in a stabilizing market.

Coutts’ analysis delves further into the specifics of these sectors, providing a clear picture of the market situation and what the future may hold. He observed:

“If we are experiencing a regular mid-cycle correction, which I think is likely, then expect there to be some opportunities in mid- and small-caps once the market stabilizes.”

Case Study: Chainlink Market Position

To assess whether smaller altcoins, especially those with market capitalizations under $10 billion, are poised for a rally, it is helpful to look at a specific example from this category.

Chainlink The LINK token, with a market capitalization of just over $9 billion, serves as an ideal case study to explore the potential of an uptrend.

Chainlink is currently trading at $15.31, reflecting a 1.4% decline over the past 24 hours and a more substantial 12.4% decline over the past week.

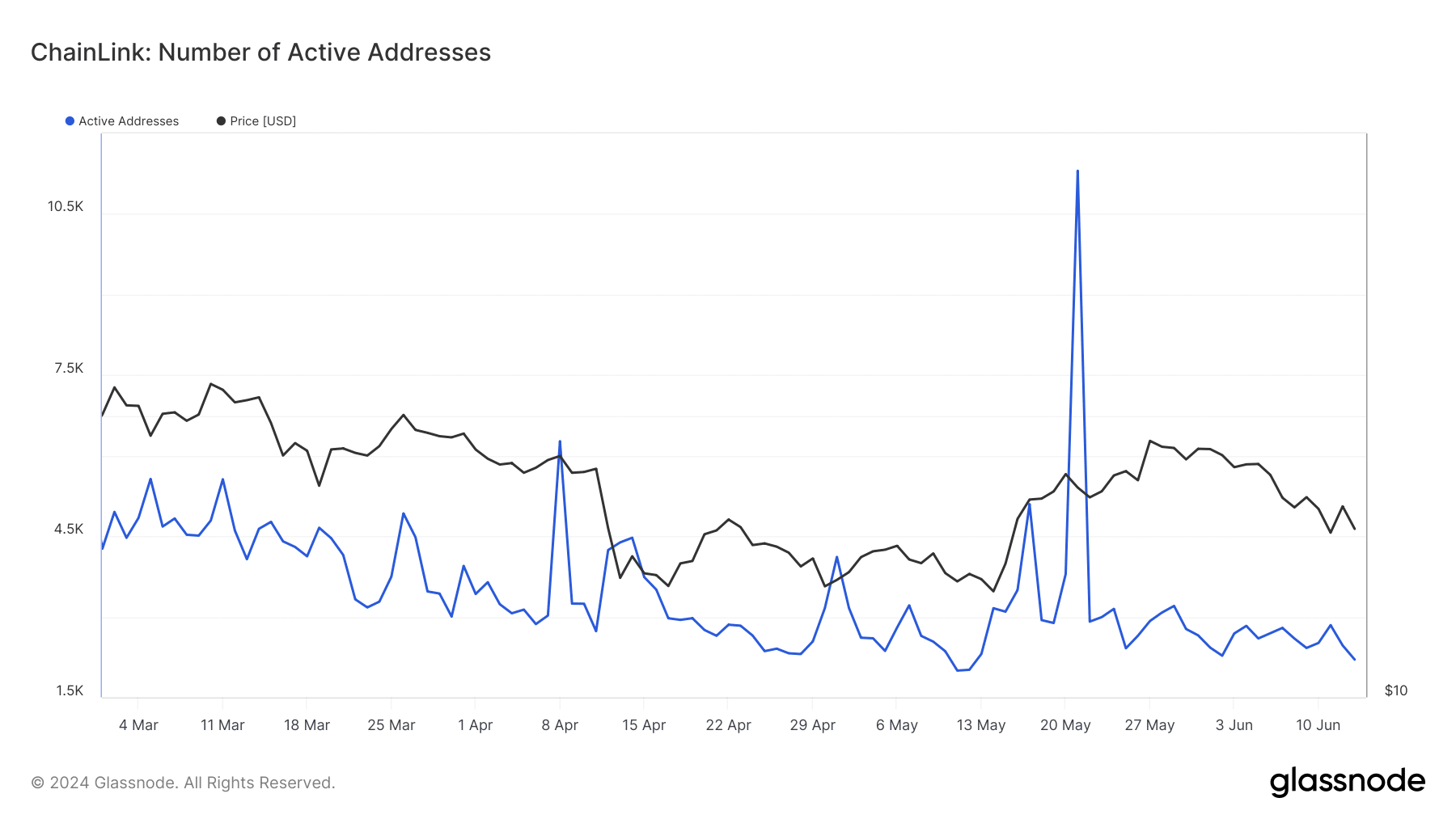

This recession was mirrored in the number of active addresses, which dropped significantly from over 90,000 in March to less than 60,000 today.

Source: Glassnode

This reduction in active addresses typically indicates a lower level of user engagement, which can negatively impact the token’s price stability and growth prospects.

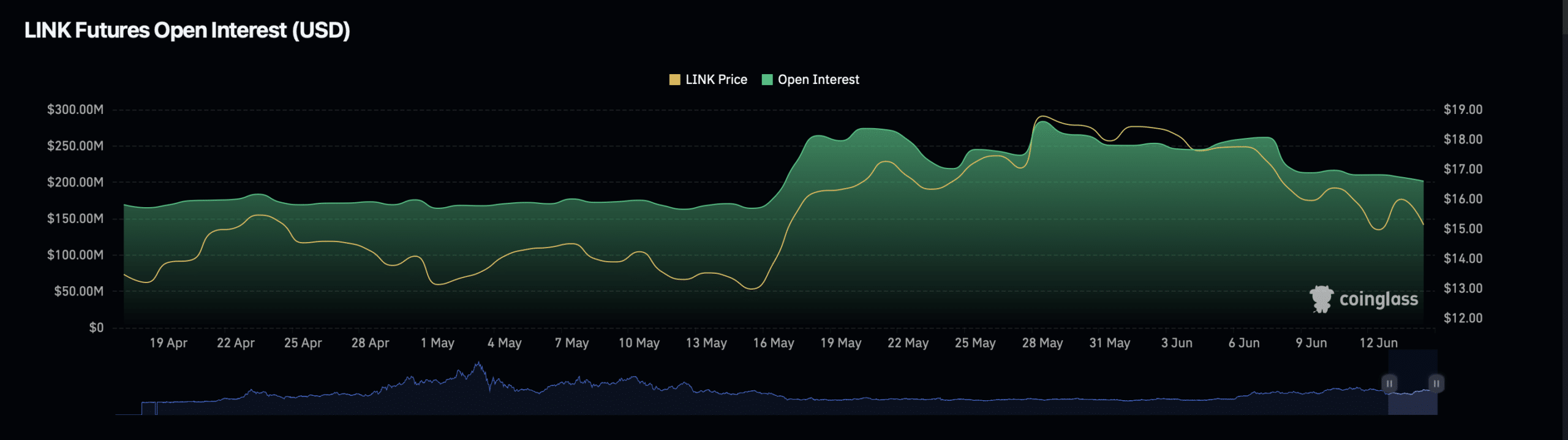

Additionally, open interest for LINK, which represents the total number of outstanding derivative contracts that have not settled, has seen a notable decrease by 40% in the last 24 hours.

Source: Coinglass

However, there is a silver lining with a modest increase of 0.52% over the same time frame. This mixed signal on open interest may suggest market uncertainty, but it also indicates some resilience among investors.

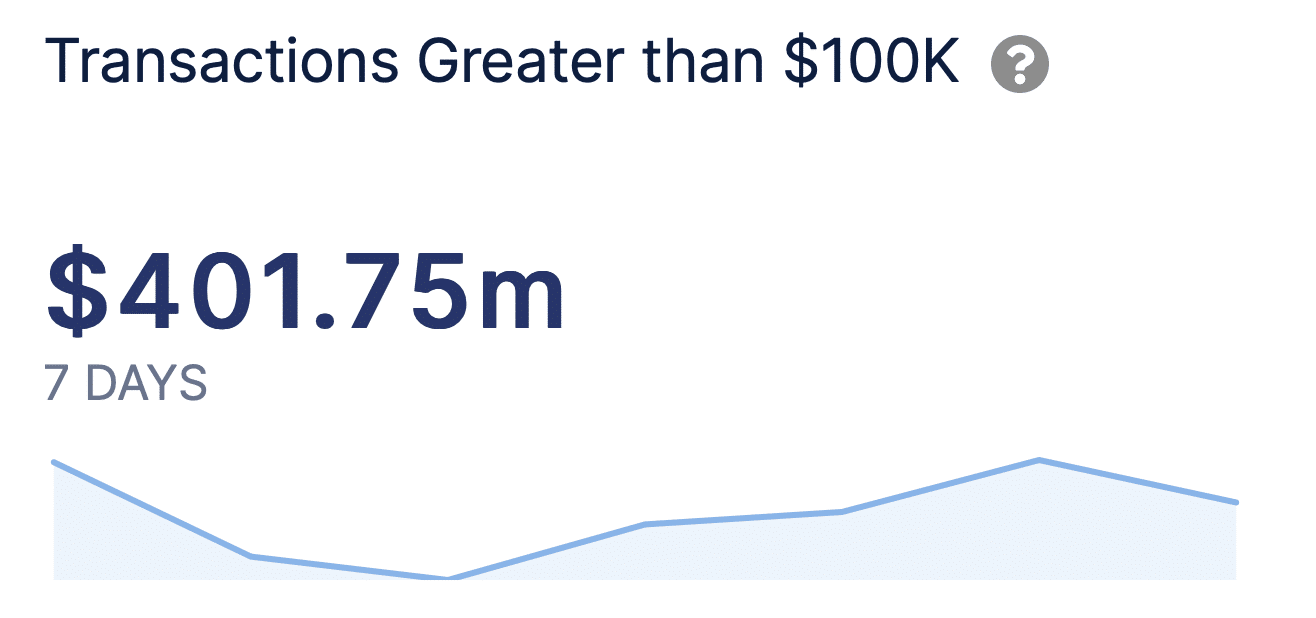

Despite these challenges, there is a glimmer of optimism. The number of large transactions involving LINK, particularly those exceeding $100,000, has increased significantly, from fewer than 90 at the start of the week to more than 200 on June 12.

Source: IntoTheBlock

Realistic or not, that’s it LINK market cap in BTC terms

This surge, as shown by IntoTheBlock datasuggests that despite the overall market crisis, larger investors, or “whales,” are actively accumulating LINK, potentially in anticipation of future price increases.

Furthermore, AMBCrypto has signaled a potentially bullish future for LINK, citing a Relative Strength Index (RSI) below 63, which traditionally indicates a strong uptrend is forming.

Altcoin

Top 3 Ethereum-Based Altcoins 3 Times

Despite the increasing selling pressure in the cryptocurrency market, mid-cap and small-cap altcoins have seen an increase in buying sentiment. This indicates a shift in interest among users towards these cryptocurrency tokens.

Are you thinking of investing in ETH-based altcoins for the next AltSeason?

Scroll down because in this article we have covered the top three Ethereum-based altcoins that have the potential to see a huge uptrend in their respective portfolios in the near future.

Safe Price Analysis (SAFE):

Despite the growing bearish sentiment in the cryptocurrency market, SAFE price has seen bullish price action for the third consecutive day, highlighting the increased price action for the altcoin in the market. Furthermore, it is currently trading at a discount of 76.3% from its ATH of $4.01.

TradingView: SAFE/USDT

The technical indicator, MACD, shows a steady decline in the red histogram, highlighting an increase in bullish sentiment in the cryptocurrency market. In addition, the averages show a potential bullish convergence, suggesting a high possibility of a positive reversal.

If the bulls continue to gain momentum, SAFE coin price will prepare to test its resistance level of $1,450. On the contrary, a bearish action could send this altcoin crashing towards a new all-time low (ATL).

Aethir (ATH) Price Analysis:

Aethir price has seen a bullish price action adding over 10% to its portfolio with a trading volume of $40.126 million despite a bearish cloud over the cryptocurrency space. Notably, with a market cap of $292.916 million, this altcoin has secured the 216th position in the global cryptocurrency list.

TradingView: ATH/USDT

The MACD indicator has been showing a steady rise in the green histogram. However, its RSI has been showing a strong bearish curve in the 1D time frame. This suggests mixed sentiment for the ATH price in the cryptocurrency market.

If the market holds Aethir price above its important support level of $0.07050, the bulls will gain momentum and prepare to test its upper resistance level of $0.08415. On the contrary, if the bears overpower the bulls, this altcoin will prepare to test its low of $0.06435.

Neiro Ethereum (NIERO) Price Analysis:

Built on the Ethereum chain, Neiro Ethereum is a project that has a total supply of only 1 billion tokens. Positively, it has no buy/sell fees or team tokens for governance or community approach. It operates on its own and promotes itself as the next big opportunity in the cryptocurrency world.

With a trading price of $0.1852 and a total supply of 1 billion tokens, it has successfully secured the 234th position in the global cryptocurrency ranking, with a market capitalization of $185.446 million.

Notably, it is up 53.86% over the past day with a trading volume of $36.64 million, a decline of 7.68%. Furthermore, it is up about 1,200% since its inception, highlighting a strong bullish outlook for the altcoin in the near future.

Altcoin

Top 6 Altcoins Set for Explosive Rally Before 2025

The cryptocurrency market is on the verge of significant change as we approach 2025. The Altcoin Daily Analyst Austin predicts that any changes in monetary policy could trigger a strong rally in altcoins, especially with a possible turn in the Federal Reserve’s benchmark interest rate expected in September.

This pivot could drive explosive growth in the cryptocurrency market, benefiting Ethereum, Solana, and several promising new altcoins. Here are some altcoins ranging from under $1 to $2 that can give you the highest returns in the current market crash.

We are excited, are you? Let’s dive in!

Top 6 Cryptocurrencies to Watch

Aethir: The Decentralized GPU Marketplace

Aethir is positioning itself as a leader in decentralized cloud infrastructure for gaming and AI. With over $36 million in annual recurring revenue, Aethir is addressing the growing demand for GPU computing driven by major tech companies like Google and Microsoft. Its decentralized infrastructure leverages underutilized GPUs, making it a key player in the burgeoning tech industry. The current price is $0.07176.

Ondo: The Best Bet in the RWA Sector

Next up is Ondo, whose real-world asset protocols are changing the tokenization of financial assets. With an annual dividend of 5.3% USDY, ONDO is the governance token for the Ondo DAO and Flux Finance. This token has seen strong demand, demonstrated by consistent investor buy-ins. Recently, ONDO’s price has dropped 35% in two months, forming a triangle pattern that suggests a breakout. Rising OTC holdings and reduced selling pressure suggest a bullish outlook. The current price is $0.9251.

Lukso: Blockchain for Creators and Social Media

Lukso’s social and cultural blockchain unites creators, brands, and users. An Ethereum doppelganger, Lukso adds Universal Profiles and gas-free transactions to blockchain usage. Its creative strategy and strong leadership make it a blockchain mass adoption project to watch. Current price is $1.71.

AIT Protocol: Decentralized AI Data Annotation

The AIT Protocol addresses the need for decentralized work in AI data annotation. Uniquely, the AIT Protocol connects human trainers with AI model owners to improve AI models through a decentralized marketplace. However, its adoption in Asia and strategic investments suggest that it could disrupt AI. The current price is $0.1169.

Foxy (Line): Meme coin with level 2 potential

Foxy, a meme coin for Linea Layer 2 Ethereum scaling, has an endorsement from ConsenSys. Foxy stands out in Ethereum Layer 2 due to Linea’s MetaMask integration and fast transactions. Additionally, Linea adoption and reduced transaction costs are influencing its growth. The current price is $0.01116.

Off the Grid: Emerging Altcoin for Gaming

Lastly, on the list is Off The Grid, developed by Godzilla. This highly anticipated AAA game promises to make waves in the crypto gaming industry. Although it hasn’t launched yet, positive feedback from industry experts supports its potential success.

Infrastructure projects like Immutable and specific games like Xers and Star Heroes are also worth considering for those interested in crypto gaming.

Altcoin

Top Analyst Admits He Ignored XRP For Years, But Now Finds XRP Chart Very Interesting

Scott Melker, host of The Wolf of All Streets podcast, said he hadn’t paid attention to XRP charts for a while, but now finds them intriguing.

Melker revealed this in a recent send after analyzing XRP’s pattern on the weekly timeframe. He shared a chart that suggests XRP is on track to break out of a significant resistance channel.

While acknowledging that a rejection is likely, Melker noted that a subsequent breakout is on the horizon. Furthermore, the analyst emphasized that regardless of an individual’s perception of XRP and its performance, this upcoming price action is worth keeping an eye on.

Notably, Melker’s latest analysis on XRP comes as the asset has outperformed the broader bear market, which staged a solitary comeback while others fell. XRP surged more than 10% on Wednesday, briefly emerging as the day’s best-performing cryptocurrency among the top 100.

This development has triggered renewed interest in XRPeven among market observers like Melker and Ali Martinez, who rarely comment on XRP’s price action.

XRP Resistance Levels to Watch

In his latest commentary, Melker identified immediate resistance levels that XRP must overcome on its climb to higher prices. These levels include $0.75 and $0.93, which XRP must overcome to reach $1, with additional barriers at $1.3 and $1.9.

Scott Melker’s XRP Chart

Scott Melker’s XRP Chart

Interestingly, for the immediate barrier of $0.75, Melker is not the only analyst to emphasize its importance before aiming higher. Analyst “Crypto Adict” also commented on this level yesterday, urging caution versus ambitious goals like $100 when there are more immediate challenges.

The impact of this resistance level was evident in March when XRP rose to $0.744 in one day but he was unable to continue his ascent.

In his analysis, Ali Martinez echoed Melker’s sentiment by highlighting the $0.93 price level as a significant hurdle. Martinez stressed out that once XRP breaks above this level, it will effectively end its nearly seven-year downtrend, opening the door to higher highs.

At press time, XRP is back just above $0.60 after hitting $0.6556 yesterday, reflecting an 8% decline in the past 24 hours. Notably, XRP’s uptrend has been interrupted by Bitcoin’s volatility, as the leading asset fell back to the $63K range yesterday.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the personal views of the author and do not reflect the views of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Announcement-

Altcoin

Dogecoin (DOGE), ETFSwap (ETFS), and Shiba Inu (SHIB) are poised to lead the altcoin rally in a big way

Dogecoin (DOGE): Altcoin Rises From Meme Origins to Market Rally’s Top Spotlight

Dogecoin (DOGE), initially launched in 2013 as a “joke currency” based on a popular Shiba Inu meme, is now positioned to lead a major altcoin rally. Despite its humorous origins, Dogecoin is gaining popularity among investors due to its platform utilities, including transaction speed and payment methods. Currently, Dogecoin (DOGE) is trade at around $9,139, a recovery followed by a weekly low of $0.11.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!