Ethereum

Ethereum ETF: here are all the applications awaiting approval by the SEC

Following the historical approval 11 place Bitcoin Exchange Traded Funds in January, industry observers are now wondering when the U.S. Securities and Exchange Commission (SEC) might give the green light to a Ethereum equivalent.

For those who don’t know, an exchange-traded fund (ETF) is a popular investment vehicle that trades on a stock exchange. It allows investors to buy stocks that track the price of an underlying asset, which can range from gold and foreign currencies to crypto and technology stocks.

If approved, an Ethereum spot ETF – much like a Bitcoin ETF – would mean that a fund manager would take charge of buying and storing ETH digital coins and invite people to buy stocks that track their value. This would give people exposure to the second largest cryptocurrency by market capitalization.

Several high-profile financial companies have filed S-1 forms with the SEC. In short, companies file such forms to alert the regulator of their intention to offer securities to the public and to provide a detailed breakdown of their activity.

Here are the documents currently filed on the SEC desk awaiting approval. The SEC decision deadline for proposed products ranges from late May to early August.

black rock

BlackRock, the world’s largest asset manager, deposit an S-1 form for his Proposed iShares Ethereum Trust in November.

The second delayed make a decision on the fund manager’s potential product earlier this year and now has until August 7.

The company’s CEO, Larry Fink, appears to be excited about the cryptocurrency and its network. said that there is “value in having an Ethereum ETF”. He also spoke of “tokenization” as inevitable.

Shades of grey

Crypto asset manager Grayscale awaits response from SEC after deposit a proposal in October to convert its Grayscale Ethereum Trust into a spot Ethereum ETF.

The current trust currently operates as a closed-end fund; the idea is that as an ETF it would be easier for investors to redeem shares. It is Bitcoin Trust converted to an ETF in January, so there is already precedent for how such a crypto vehicle can transition to a spot ETF.

Grayscale is a big part of why Bitcoin ETFs are currently trading in the United States. In a historic moment for the crypto industry last year, a judge on the company side in a lawsuit, agreeing with the company that Wall Street’s top regulator lacked a coherent explanation for denying its Bitcoin ETF conversion proposal after years of refusal.

The decision paved the way for the SEC to greenlight the detection of Bitcoin ETFs.

Despite this, the SEC does not seem to be in a hurry to say yes to the latest approval: it pushed back on the decision in January. The regulator now has until June 18 to say yes or no.

And last month, the company deposit for a “mini” Ethereum Trust as well. The idea of the fund is to reduce costs for shareholders.

Ark Invest/21Actions

ARK Invest, Cathie Wood’s leading technology investment management firm, deposit a proposal with the SEC for an Ethereum ETF in September.

The ETF is partnered with crypto ETF issuer 21Shares and names Coinbase, America’s largest digital asset exchange, as its custodian, meaning the recognized company would hold and store the ETH in the product . The decision deadline for the product is May 24.

loyalty

Financial services giant Fidelity made it clear it wanted to abandon an Ethereum ETF in November when Cboe – the exchange where the product would trade –deposit a 19b-4 in the name of the company.

Then, in March, the major company filed its S-1 with the SEC for its Fidelity Ethereum fund. The SEC will make a decision on the product on August 3.

VanEck

Asset manager VanEck was the first fund manager to deposit a proposal for an Ethereum ETF with the SEC in 2021. Later that year withdrew his proposal and has since filed again.

The company’s Bitcoin ETF has been a successful product, and VanEck even renounced its fees to better compete with other funds on the market. On May 23, the SEC is scheduled to issue a decision on the product.

Hashdex

The Nasdaq in September deposit a proposal on behalf of Brazilian fund manager Hashdex for its Hashdex Nasdaq Ethereum ETF.

Hashdex already owns several crypto ETFs in Brazil. In the United States, its Hashdex Bitcoin ETF received the green light from the SEC in January but is not yet traded on an exchange. It announced in March that it would eventually convert its Bitcoin futures ETF to a spot ETF. The SEC will make its decision on May 30.

Franklin Templeton

Wall Street giant Franklin Templeton entered the race in February when he deposit a proposal with the SEC. Its filing for the Franklin Ethereum Trust project mentions stakingthe process of locking digital coins or tokens to operate a blockchain.

Its proposal states that it “may, from time to time, invest a portion of the assets of the Fund through one or more trusted staking providers.” The SEC will make a decision on the product on June 11.

Invesco/Digital Galaxy

Asset management giant Invesco submitted a proposal with Mike Novogratz’s Galaxy Digital for an ETH ETF in September. THE Form S-1 mentions that Invesco would be the sponsor of the product, while Galaxy Digital would work as an “execution agent” by selling ETH to pay expenses of the Invesco Galaxy Ethereum ETF.

The SEC will approve, deny or delay the product on July 7.

Bitwise

Digital asset investment company Bitwise deposit It is Form S-1 with the SEC to propose a Spot Ethereum ETF in March. Like Franklin Templeton’s filing, Bitwise also mentions staking, noting that its Bitwise Ethereum Trust can stake a portion of the fund’s assets through trusted staking providers to earn additional rewards.

Matt Hougan, chief investment officer at Bitwise, said that he expects ETH ETFs to launch in December and predicted they would be more successful anyway if approved later in the year.

Edited by Andrew Hayward

Ethereum

Cryptocurrency liquidations surpass $200 million as Ethereum and Bitcoin plummet

Cryptocurrency market liquidations hit their highest level in a week on Wednesday as the price of Bitcoin fell below $60,000.

Over the past 24 hours, over 74,000 traders have been liquidated for $208 million, CoinGlass the data shows it.

The majority of those losses, about $184 million, went to investors holding long positions who had bet on a price rise.

The largest liquidations hit Ethereum investors, at $55.5 million, almost entirely on long positions, the data showed.

Current issues surrounding US monetary policy, geopolitical tensions, and the upcoming US presidential election in November are expected to impact the price of the leading cryptocurrency throughout 2024.

Bitcoin abandoned The stock price fell from $62,200 to $59,425 intraday. The asset has since recovered its losses above $60,200, but is still down 3% over the past 24 hours.

Solana, the world’s fifth-largest cryptocurrency by market capitalization, was the worst hit among the top 10 cryptocurrencies, down about 8% to $140. Solana had been riding high on New York investment management firm VanEck’s filing of its Solana Trust exchange-traded fund late last month.

Major cryptocurrencies have been falling over the past month. Ethereum has fallen more than 12% over 30 days despite growing interest in the launch of Ethereum spot ETFs.

Some analysts predict that new financial products could begin marketing in mid-Julywith at least one company predicting that the price of ETH will then take offBitcoin is down 12% over the same period.

Certainly, analysts always see further price increases this yearThe current market cooling represents a precursor to another major price surge in the coming months, Decrypt reported Monday.

On Wednesday, analytics firm CryptoQuant released a report examining Bitcoin Mining Metrics and highlighted the conditions for a return of prices to current levels.

Edited by Sebastian Sinclair.

Ethereum

Volume up 90%: good for ETH price?

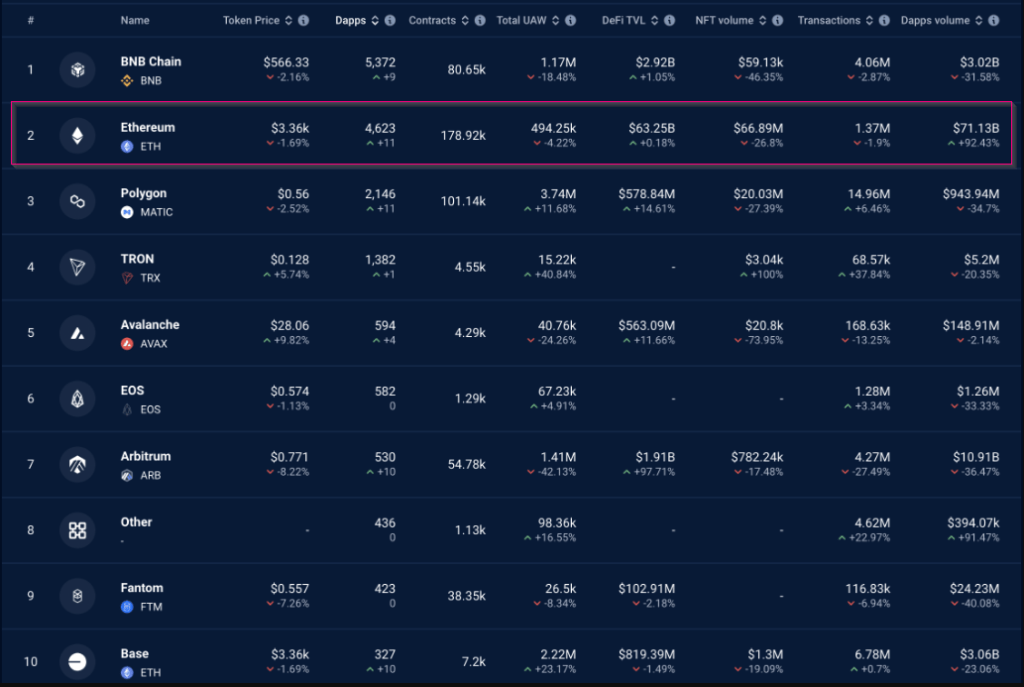

Ethereum (ETH) has emerged as a beacon in the sea of blockchains, with a staggering 92% increase in decentralized application (dApp) volume over the past week. But the news comes with a layer of complexity, revealing a landscape of both opportunity and potential setbacks for the leading blockchain.

Cheap gas fuels the fire

Analysts attribute the explosion in decentralized application volume to the Dencun upgrade in March, which significantly reduced gas costs – the cost associated with processing transactions on the Ethereum network.

Lower transaction fees have always attracted users, and this recent development seems to be no exception. The surge in activity suggests a revitalized Ethereum that is likely to attract new projects and foster a more vibrant dApp ecosystem.

NFT craze drives numbers up

While overall dApp volume (see chart below) paints a positive picture, a closer look reveals a more nuanced story. This surge appears to be driven primarily by an increase in NFT (non-fungible token) trading and staking activity.

Source: DappRadar

Source: DappRadar

Apps like Blur and Uniswap’s NFT aggregator have seen significant surges, highlighting the rise of the NFT market on Ethereum. This trend indicates a thriving niche in the Ethereum dApp landscape, but raises questions about the platform’s diversification beyond NFTs.

A look at user engagement

A curious problem emerges when looking at user engagement metrics. Despite the impressive increase in volume, the number of unique active wallets (UAWs) on the Ethereum network has actually decreased.

Ethereum is now trading at $3,316. Chart: TradingView

This disconnect suggests that current activity could be driven by a smaller, more active user base. While high volume is certainly a positive indicator, seeing broader user participation is essential to ensuring the sustainability of the dApp ecosystem.

A glimmer of hope ?

A positive long-term indicator for Ethereum is the trend of decreasing holdings on the exchange, as reported by Glass nodeThis suggests that ETH holders are moving their assets off exchanges, potentially reducing selling pressure and contributing to price stability.

If this trend continues, ETH could potentially target $4,000 this quarter or even surpass its all-time high. However, this price prediction remains speculative and depends on various market forces.

Ether price expected to rise in coming weeks. Source: CoinCodex

Ether price expected to rise in coming weeks. Source: CoinCodex

Ethereum at a Crossroads

Ethereum is at a crossroads. Dencun Upgrade has clearly revitalized dApp activity, particularly in the NFT space. However, uneven dApp performance and the decline of the UAW are raising concerns about the long-term sustainability of this growth. Network growth, measured by the number of new addresses joining the network, is also slowing, according to Santiment, which could potentially hamper wider adoption.

The short-term price outlook for ETH remains uncertain. While long-term indicators, such as declining exchange holdings, suggest potential for price appreciation, slowing network growth could lead to a price decline in the short term.

Look forward to

The coming months will be crucial for Ethereum. The platform must capitalize on the renewed interest in dApps by attracting a broader user base and fostering a more diverse dApp ecosystem beyond NFTs. Addressing scalability issues and ensuring user-friendly interfaces will also be essential to sustain growth.

If Ethereum can overcome these challenges, it has the potential to cement its position as the premier platform for decentralized applications. However, if it fails to adapt, other waiting blockchains could capitalize on its shortcomings.

Featured image from Pexels, chart from TradingView

Ethereum

Ethereum, Bitcoin, and XRP Behind $1.5 Billion Losses in Cryptocurrency Scams

The first half of 2024 has seen a surge in major hacks in the cryptocurrency sector. Ethereum (ETH)Bitcoin (BTC) and XRP have resulted in losses of over $1.5 billion due to cryptocurrency scams. This year, over 200 major incidents have resulted in losses of approximately $1.56 billion.

Cryptocurrency Scam Losses Reach $1.5 Billion

According to data from Peck Shield Alert, only $319 million in lost crypto funds have been recovered. Furthermore, this year’s losses represent a staggering 293% increase over the same period in 2023, when losses totaled $480 million.

Overview of Cryptocurrency Scams in 2024, Source: PeckShieldAlert | X

Additionally, DeFi protocols have been the top targets for hackers, accounting for 59% of the total value stolen. More than 20 public chains have suffered major hacks during this period. Additionally, Ethereum, Bitcoin, and XRP top the list for the amount lost via cryptocurrency hacks.

Additionally, Ethereum and BNB Chain were the most frequently targeted, each accounting for 31.3% of the total hacks. Meanwhile, Arbitrum followed with 12.5% of the attacks. One of the most significant incidents occurred on June 3, 2024.

Bitcoin DMMa major Japanese cryptocurrency exchange, reported a major breach. Attackers stole 4,502.9 BTC, worth over $300 million at the time. The incident highlighted the vulnerabilities of exchanges, especially those that handle large volumes of digital assets.

Read also : XRP News: Whale Moves 63 Million Coins as Ripple Strengthens Its Case

Major XRP, ETH and BTC hacks

A week after the DMM Bitcoin attack on June 10, UwU Loana decentralized finance (DeFi) lending protocol, was compromised. The breach resulted in a loss of approximately $19.3 million in digital assets. The hack underscores the ongoing risks associated with DeFi platforms, which often operate with less regulatory oversight. The platform later offered a $5 million reward to catch the hacker.

Earlier this year, on February 3, 2024, Ripple co-founder Chris Larsen confirmed a major security breach involving his personal wallets. Initially, rumors circulated that Ripple itself was targeted. However, Larsen clarified that the hack involved his digital wallets and not Ripple’s corporate assets.

The hackers managed to transfer 213 million XRP tokens, worth approximately $112.5 million. Additionally, on-chain detective ZachXBT first alerted the community about the suspicious transactions. In response to the theft, Larsen and various cryptocurrency exchanges took swift action to mitigate the impact.

Several exchanges, including MEXC, Gate, Binance, Kraken, OKX, HTX, and HitBTC, collaborated to freeze a significant portion of the stolen funds. Binance alone froze $4.2 million worth of XRP to aid in the investigation.

Additionally, on April 2, 2024, FixedFloat, a Bitcoin Lightning-based exchange, experienced a security breach. Unauthorized transactions resulted in financial losses exceeding $3 million. This incident highlighted ongoing security issues for FixedFloat, following a similar breach earlier in the year.

The company has also faced significant challenges securing its platform against repeated attacks. Additionally, in February, hackers stole $26 million worth of Ethereum and Bitcoin from FixedFloat. These digital assets were then transferred to exchanges for profit.

Read also : Ethereum Doubles Bitcoin’s Network Fee Revenue, Thanks to Layer-2

Ethereum

Ethereum’s Year-Over-Year Revenue Tops Charts, Hitting $2.7 Billion

Ethereum blockchain has been in first place for a year incomesurpassing all major blockchains.

According to data provided by Lookonchain, Ethereum generated $2.72 billion in annual revenue, surpassing the Bitcoin network by a margin of $1.42 billion. The data shows that Bitcoin accumulated $1.3 billion in revenue over the same period.

Defi Llama Data watch that Ethereum is still the leader in decentralized finance (challenge) with a total value locked (TVL) of $58.4 billion, or 60.9% of the entire market. The blockchain recorded a 30-day fee revenue of $131 million, according to the data aggregator.

Bitcoin’s TVL is currently set at $1 billion.

The network of the second largest cryptocurrency, ETH, witness a 155% year-over-year increase in its fee revenue in the first quarter of this year, as the cryptocurrency market saw a bullish trend.

Tron comes in third with annual revenue of $459 million. Solana and BSC also recorded nine-figure revenues of $241 million and $176 million, respectively.

Notably, Tron is the second largest chain in the challenge scene with a TVL of $7.7 billion. BSC and Solana take third and fourth place with TVLs of $4.8 billion and $4.5 billion, according to Defi Llama.

Avalanche, zkSync Era, Optimism and Polygon reached the top 10 with $68 million, $59 million, $40 million and $23 million in year-over-year revenue, respectively.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!