Ethereum

Ethereum, a new stage? VanEck predicts ETH price rise to $22,000

VanEck predicts that Ethereum will reach $22,000 by 2030, driven by significant growth in digital finance, AI, and blockchain utility.

Ethereum’s role in finance, AI and marketing positions it for a potential total addressable market (TAM) of $15 trillion by 2030, according to a recent report from the US investment management firm. .

This projection follows the recent approval Spot ETH ETFs, thus strengthening investor interest. VanEck bases his optimistic forecast on Ethereum’s $66 billion in free cash flow by 2030, applying a valuation multiple of 33x.

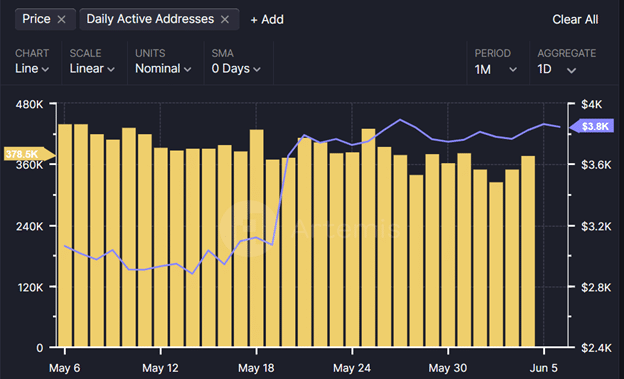

In addition to ETF inflows, upcoming U.S. nonfarm payroll numbers report June 7 could impact Ethereum price action in June 2024. At press time, the ETH price is listed at $3,843a growth of 0.72% in the last 24 hours.

We increased our 2030 ETH price target to $22,000, influenced by Ether ETF news, scaling progress, and our reading of on-chain data. Additionally, we analyzed the performance of ETH and BTC in traditional and crypto-only wallets for optimal returns. @Matthew_Sigel @Patrick_Bush_VE…

–VanEck (@vaneck_us) June 5, 2024

Ethereum’s dominance in the digital economy

Ethereum has become a dominant digital economy, with 20 million monthly active users. Over the past year, it has settled $4 trillion in transactions and $5.5 trillion in stablecoin transfers. ETH controls approximately $91.2 billion in stablecoins, $6.7 billion in tokenized off-chain assets, and $308 billion in virtual currency.

– Advertisement –

VanEck’s analysis focuses on Ethereum’s potential to disrupt finance, banking, marketing, infrastructure and artificial intelligence. The projected TAM of $15 trillion covers various industries. Ethereum’s platform could generate considerable revenue, with a projected penetration of 7.5% in banking, 20% in marketing, 10% in infrastructure and 5% in AI.

Unique value proposition and revenue growth

According to VanEck, Ethereum’s unique value proposition as a “Digital Oil”, “Programmable Money”, “Yielding Commodity” and “Internet Reserve Currency” supports its growth potential.

Blockchain income has grown, generating $3.4 billion over the past year. This revenue, which accrues to ETH holders, is bolstered by ETH buybacks and burns, permanently removing 0.4% of the supply in six months.

Additionally, Ethereum’s user base and revenue growth exceed traditional ones. web2 application like Etsy and Roblox. The average Ethereum user generates $172 in annual revenue, comparable to Apple Music and Netflix. This economic activity drives demand for ETH, benefiting all holders.

Ethereum’s competitive advantage lies in its lower cost structure. While Apple and Google extract around 30% of app revenueEthereum’s adoption rate is around 24%, and is expected to drop to 5-10% with the adoption of Layer 2. This efficiency could attract more businesses and users to the platform.

VanEck also sees Ethereum as playing a crucial role in AI applications, providing the infrastructure needed for AI agents. By 2030, the AI sector could generate $1.2 billion in revenue for ETH holders. While finance is expected to dominate Ethereum revenue, layer 2 solutions will improve scalability, thereby driving future growth.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-