Bitcoin

Cryptocurrency grows in political respect as Donald Trump courts bitcoin enthusiasts

Cryptocurrency is rising again on a new wave of political respect as former President Donald Trump is preparing to speak at a bitcoin conference this week in Nashville.

The price of bitcoin (BTC-USD) has surged more than 13% in the past month and surpassed $68,000 in the past 24 hours, putting the world’s largest cryptocurrency within striking distance of an all-time high set earlier this year.

This week, cryptocurrency investors are anticipating several reasons to get excited, including Securities and Exchange Commission Approvals for exchange-traded funds that hold ether (ETH-USD), the second largest cryptocurrency in the world.

These ETFs could make ether a potential staple in 401(k)s, IRAs and pension plans and ensure the digital asset gains more mainstream acceptance. Many of the same money managers hoping for approval already have ETFs that invest directly in bitcoin.

But the big event that is creating the most excitement in the cryptocurrency community will be this weekend, when Trump will speak at the Bitcoin 2024 conference in Nashville.

The Republican presidential candidate’s stamp of approval has many in the industry hoping for a friendlier regulatory approach from Washington, D.C., in 2025 and beyond.

Trump and many in his party have embraced digital assets in an attempt to create a contrast with the Biden administration, which has led a crackdown on many of the industry’s major players following the 2022 market crash.

The Republican Party said in its 16-page party platform last week that “Republicans will end Democrats’ illegal and un-American crackdown on cryptocurrencies.”

Trump, who has in the past called bitcoin a “fraud,” has referred to cryptocurrencies as “incredible” in an interview with Bloomberg published last week.

Republican presidential candidate former President Donald Trump reacts after speaking at a campaign rally, Saturday, July 20, 2024, in Grand Rapids, Mich. (AP Photo/Evan Vucci) (ASSOCIATED PRESS)

“The Trump administration is likely to be more supportive of crypto than the Democrats have been, I think that’s clear,” Ian Katz, managing director at Capital Alpha Partners, told Yahoo Finance.

“We believe the market has not priced in a positive change in the regulatory environment for cryptocurrencies, and we see significant room for institutional investors to allocate to cryptocurrencies and crypto stocks,” Bernstein analyst Gautam Chhugani added in a note on Monday.

Trump’s economic policies could also help digital assets surge in the coming years, according to some observers.

“What will drive the price of BTC is lower tax rates and tariffs, which, if history is any guide (and it isn’t always), will be inflationary,” Dallas Mavericks owner and manager Mark Cuban said last week.

Bitcoin is up more than 50% in 2024 so far, driven by a series of developments that have led many in the industry to bet on higher prices.

The story continues

These range from expectations of lower interest rates from the Federal Reserve to greater public acceptance of digital assets by some prominent Wall Street figures.

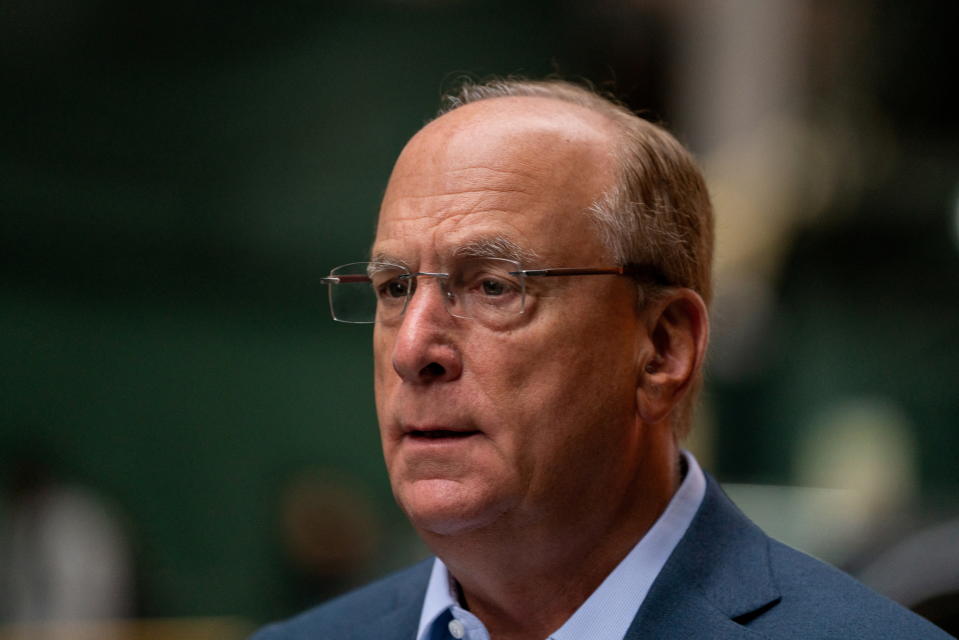

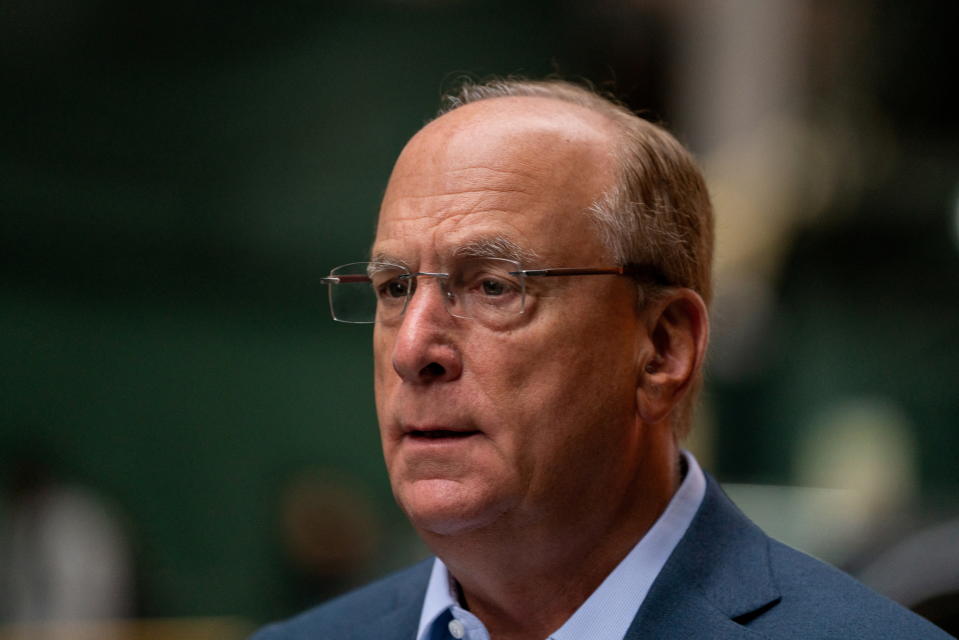

One such figure is BlackRock CEO Larry Fink, who last week in an interview with CNBC referred to bitcoin as a “bullish hedge” and a “legitimate financial instrument.”

“I firmly believe that bitcoin has a role in portfolios,” Fink said.

Larry Fink, CEO of BlackRock. (REUTERS/David ‘Dee’ Delgado) (REUTERS/Reuters)

BlackRock was among the companies that received approval in January to begin issuing a spot bitcoin ETF, which turned out to be a big boon for the first half of the year. Its iShares bitcoin ETF (I BITE) recorded $18 billion in net inflows in the first six months.

He is also expected to be among the money managers to win SEC approval this week to launch the first U.S.-regulated ether ETFs. The SEC has already approved exchanges to list such products.

Bitcoin was created in the wake of the 2008 financial crisis as a new type of money beyond the reach of governments. That led some in financial markets to view it as a type of digital gold or even a safe haven for storing value — though cryptocurrencies have traded more closely with volatile technology stocks in recent years.

Indeed, investors flocked to bitcoin during sudden changes in the monetary order, such as at the start of the war between Russia and Ukraine, when the US and its allies began imposing a series of sanctions on Russia.

The next chance for this to happen is when the Fed starts cutting interest rates, which investors expect to happen as early as September.

“Bitcoin hasn’t had the opportunity to really shine as a safe haven store of value asset,” said Joel Kruger, market strategist at LMAX, a London-based currency and cryptocurrency trading platform.

“It’s all been built around what’s been happening in the US stock market for years and I think there’s going to be a rotation. Typically what triggers that is [interest] rates changing.”

Correction: An earlier version of this article listed an incorrect spelling of Gautam Chhugani’s name. We regret the error.

David Hollerith is a senior reporter at Yahoo Finance covering banking, cryptocurrencies, and other areas of finance.

Click here for the latest cryptocurrency news, updates and more related to ethereal It is bitcoin Prices, Cryptocurrency ETFs and Market Implications for Cryptocurrencies

Read the latest financial and business news from Yahoo Finance

Bitcoin

Bitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

Risk assets fell on Thursday as China’s second rate cut in a week raised concerns of instability in the world’s second-largest economy.

Bitcoin (BTC)the leading cryptocurrency by market cap, is down nearly 2% since midnight UTC to around $64,000 and ether (ETH) fell more than 5%, dragging the broader altcoin market lower. The CoinDesk 20 Index (CD20), a measure of the broader cryptocurrency market, lost 4.6% in 24 hours.

In equity markets, Germany’s DAX, France’s CAC and the euro zone’s Euro Stoxx 50 all fell more than 1.5%, and futures linked to the tech-heavy Nasdaq 100 were down slightly after the index’s 3% drop on Wednesday, according to the data source. Investing.com.

On Thursday morning, the People’s Bank of China (PBoC) announced a surprise, cut outside the schedule in its one-year medium-term lending rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market. That is the biggest reduction since 2020.

The movement, together with similar reductions in other lending rates earlier this week shows the urgency among policymakers to sustain growth after their recent third plenary offered little hope of a boost. Data released earlier this month showed China’s economy expanded 4.7% in the second quarter at an annualized pace, much weaker than the 5.1% estimated and slower than the 5.3% in the first quarter.

“Equity futures are flat after yesterday’s bloody session that shook sentiment across asset classes,” Ilan Solot, senior global strategist at Marex Solutions, said in a note shared with CoinDesk. “The PBoC’s decision to cut rates in a surprise move has only added to the sense of panic.” Marex Solutions, a division of global financial platform Marex, specializes in creating and distributing custom derivatives products and issuing structured products tied to cryptocurrencies.

Solot noted the continued “steepening of the US Treasury yield curve” as a threat to risk assets including cryptocurrencies, echoing CoinDesk Reports since the beginning of this month.

The yield curve steepens when the difference between longer-duration and shorter-duration bond yields widens. This month, the spread between 10-year and two-year Treasury yields widened by 20 basis points to -0.12 basis points (bps), mainly due to stickier 10-year yields.

“For me, the biggest concern is the shape of the US yield curve, which continues to steepen. The 2- and 10-year curve is not only -12 bps inverted, compared to -50 bps last month. The recent moves have been led by the rise in back-end [10y] yields and lower-than-expected decline in yields,” Solot said.

That’s a sign that markets expect the Fed to cut rates but see tighter inflation and expansionary fiscal policy as growing risks, Solot said.

Bitcoin

How systematic approaches reduce investor risk

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

July 24, 2024, 5:30 p.m.

Updated July 24, 2024, 5:35 p.m.

(Benjamin Cheng/Unsplash)

Fuente

Bitcoin

India to Release Crypto Policy Position by September After Consultations with Stakeholders: Report

“The policy position is how one consults with relevant stakeholders, so it’s to go out in public and say here’s a discussion paper, these are the issues and then stakeholders will give their views,” said Seth, who is the Secretary for Economic Affairs. “A cross-ministerial group is currently looking at a broader policy on cryptocurrencies. We hope to release the discussion paper before September.”

Bitcoin

Bitcoin (BTC), Ether (ETH) slide as risk aversion spreads to crypto markets

Ether, the second-largest token, fueled a slide in digital assets after a stock rout spread unease across global markets.

Ether fell about 6%, the most in three weeks, and was trading at $3,188 as of 6:45 a.m. Thursday in London. Market leader Bitcoin fell about 3% to $64,260.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!