News

Coinbase State of Cryptocurrency Report: Here’s What We Learned

A staggering 86% of Fortune 500 executives believe tokenization could be valuable to their companies, and The State of Crypto report says they are bullish on stablecoins as well.

Coinbase’s latest The State of Crypto report is here, and as always, it’s an interesting read.

The exchange’s research struck a bullish tone and noted ETFs based on That of Bitcoin The spot price in the United States has absorbed “significant pent-up demand” allowing investors to gain exposure to the world’s largest cryptocurrency. Assets under management in these funds now stand at $63 billion, and Coinbase expects a healthy appetite for that Ether ETFs are expected to get the green light from the US Securities and Exchange Commission.

Beyond that, it wasn’t the buoyant recovery in cryptocurrency markets that was Coinbase’s focus relationshipbut the high levels of enthusiasm for on-chain projects found among some of America’s largest companies.

Data suggests that the number of on-chain projects among Fortune 100 companies has increased by 39% over the past 12 months. Additionally, 56% of executives at Fortune 500 companies say they are starting to experiment and build using this technology, with “consumer-facing payment applications” a pressing priority for some. They aren’t afraid to spend money, with the typical on-chain project boasting a budget of $9.5 million.

Source: Coinbase

Second CoinBasethere is a wide range of benefits stablecoins AND tokenization that entrepreneurs find attractive.

When it comes to digital assets pegged to the US dollar, the prospect of instant settlements was found to be the main benefit identified by Fortune 500 executives. There is also optimism that accepting stablecoins as a payment method could help reduce fees for merchants with razor-thin profit margins, but given the known scalability issues plaguing major blockchains, this is not always a given. The list also includes the most efficient transfers within a company, as well as immediate cross-border payments.

The report also highlights how tokenization of real-world assets has the potential to transform the global economy in the years to come. In this case, the key benefits and use cases that fascinate senior executives include reduced transaction times, operational efficiency, increased transparency, simplified regulatory processes and the ability to drag loyalty programs into the 21st century by improving audience engagement target. Coinbase cited data suggesting the value of tokenized assets could reach $16 trillion by the start of the next decade. Illustrating how significant this is, the exchange pointed out that this is equivalent to the GDP of the European Union.

Tokenization in action

To borrow an often used item cryptocurrency phrase here, “we are still early” when it comes to seeing how the push towards tokenization will develop. Many potential use cases have not yet emerged. But a company that has great ambitions here is MasterCard.

Earlier this week, the payments giant revealed that it is working to radically modernize the world of e-commerce and ultimately make the need to type in long credit card numbers when purchasing something online a thing of the past .

It’s about more than just saving shoppers some time at the checkout, as this approach could prove to be the silver bullet in the fight against fraud. Artificial intelligence and the growing demand for e-commerce in emerging markets have seen an increase in the value of fake and illegal transactions taking place online. Mastercard cited Juniper Research data that estimated merchants worldwide will lose $362 billion between 2023 and 2028.

In practice, Mastercard wants to make the 16 digits on payment cards obsolete by replacing them with a secure token. The company believes tokenization also has the potential to turn smartphones and cars into “commercial devices,” building on the great progress made with contactless payments.

As part of the company’s plans, e-commerce will be 100% tokenized in Europe by 2030, with Mastercard executive vice president Valerie Nowak describing this as a “win-win-win for shoppers, retailers and card issuers”.

“In Europe we have seen tokenization gain momentum across the ecosystem, the convenience and reduced fraud rates sell themselves.”

Valerie Nowak

Returning to Coinbase and its report, it was noted that on-chain government bonds have emerged as a particularly popular use case, with the value of tokenized US Treasury products now reaching $1.29 billion, a 1,000% increase since the beginning of last year.

Franklin Templeton, who was highlighted in The State of Crypto as a case study due to his tokenized money market funds, described the adoption of this technology as a necessity.

“The market infrastructure on which we issue, trade and package assets into wallets is 50 years old… What we are starting to see with blockchain technologies is that there are ways to improve them tremendously. There are ways to reduce processing time, get more real-time information, and enable 24/7/365 trading, because we live in a global world where our businesses operate 24 hours a day. 24″.

Sandy Kaull, head of digital assets at Franklin Templeton

Overall, the report indicates that 86% of Fortune 500 executives believe tokenization could be valuable to their operations – a remarkable figure.

The power of stablecoins

Elsewhere, Coinbase reflected on how stablecoins are gradually starting to play an increasingly important role in the global economy, with daily stablecoin transfer volumes breaking records and reaching $150 billion in the first quarter of this year. Of course, this exchange plays an important role as it has a stake in Circle, which issues USD Coin.

The authors of the report highlighted how the companies behind USDC and USDT now hold huge amounts of US Treasuries in reserve, equivalent to Norway, Saudi Arabia and South Korea combined.

This has also coincided with concerted efforts to simplify the process of using stablecoins, which is especially important for consumers who are unfamiliar with digital assets.

“Through Circle, merchants on Stripe can now accept USDC payments via Ethereum, Solana, and Polygon, with payments automatically converted to fiat currency. PayPal supports cross-border transfers for stablecoin users in approximately 160 countries, with no transaction fees.”

CoinBase

Remittances, which sees foreign workers send funds home to loved ones, are one particular area where stablecoins could offer a faster and fairer service.

As Coinbase notes, this is an $860 billion market. But at the moment, cross-border payments made through traditional channels often incur fees of up to 6.39%. In other words, this means that hard-working consumers, their families and local economies lose up to $55 billion every year.

There was another fascinating use case in the form of a Washington DC chain called Compass Coffee. With many of its customers switching from cash to cards, the company said it is fed up with paying high transaction fees, funds that could be reinvested in the business. It has now started offering stablecoins as an alternative payment method.

“Accepting cryptocurrency payments could be transformative for our business. We hope to help transform retail experiences by accepting USDC.”

Michael Haft, founder of Compass Coffee

Challenges that await us

While there is a lot to be optimistic about and a lot of traction in the cryptocurrency industry, Coinbase has warned that there are external factors holding back progress.

“The increase in activity increases the urgency for clear cryptocurrency rules that help keep cryptocurrency developers and other talent in the United States, deliver on the promise of better access, and enable U.S. leadership in the cryptocurrency industry globally.”

CoinBase

Illustrating the impact of regulatory paralysis that has seen several companies move overseas, the exchange warned that the American share of cryptocurrency developers has plummeted 14 percentage points since 2019, meaning only 26% are now based in the United States

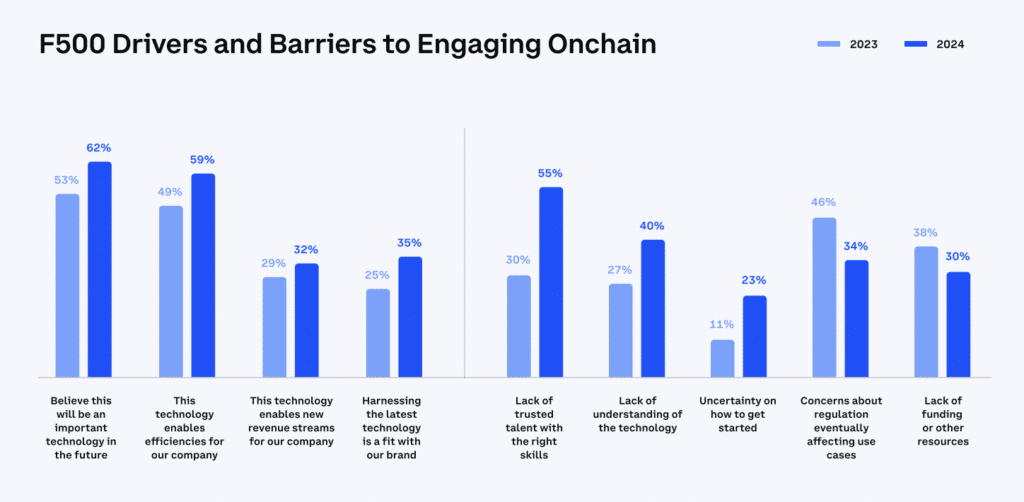

Interestingly, 55% of Fortune 500 executives surveyed said a lack of trusted talent with the right skills was the biggest barrier to implementing an on-chain project, up from 30% in 2023. This obstacle then changed. a ripple effect in other ways. For example, 40% of respondents admitted they don’t fully understand how this technology works and a further 23% wouldn’t know how to start developing their idea.

Source: Coinbase

With crypto-literate legislation starting to make its way through Congress and the SEC softening its stance on Bitcoin and Ether ETFs, it’s telling that only 34% of entrepreneurs now cite regulation as a barrier, declining by 12 percentage points compared to the previous year.

We have already seen how digital assets are becoming a highly controversial issue in the upcoming presidential election, with Donald Trump – who had once spoken of his disdain for Bitcoin due to its competition with the dollar – now declaring that he would like every single one of the remaining 1.3 million BTC to be mined in US Reports suggest that Joe Biden is also now considering whether or not to accept cryptocurrency donations from supporters.

For its part, Coinbase has also stepped up its efforts to advocate for the industry and give its customers the resources they need to make their voices heard.

After a turbulent few years, there are only three words to describe the current state of cryptocurrencies: an impressive turnaround.

News

How Ether Spot ETF Approval Could Impact Crypto Prices: CNBC Crypto World

ShareShare article via FacebookShare article via TwitterShare article via LinkedInShare article via email

CNBC Crypto World features the latest news and daily trading updates from the digital currency markets and gives viewers a glimpse of what’s to come with high-profile interviews, explainers and unique stories from the ever-changing cryptocurrency industry. On today’s show, Ledn Chief Investment Officer John Glover weighs in on what’s driving cryptocurrency prices right now and how the potential approval of spot ether ETFs could impact markets.

News

Miners’ ‘Capitulation’ Signals Bitcoin Price May Have Bottomed Out: CryptoQuant

According to CryptoQuant, blockchain data shows signs that the Bitcoin mining industry is “capitulating,” a likely precursor to Bitcoin hitting a local price bottom before reaching new highs.

CryptoQuant analyzed metrics for miners, who are responsible for securing the Bitcoin network in exchange for newly minted BTC. As outlined in the market intelligence platform’s Wednesday report, multiple signs of capitulation have emerged over the past month, during which Bitcoin’s price has fallen 13% from $68,791 to $59,603.

One such sign includes a significant drop in Bitcoin’s hash rate, the total computing power that backs Bitcoin. After hitting a record high of 623 exashashes per second (EH/s) on April 27, the hash rate has fallen 7.7% to 576 EH/s, its lowest level in four months.

“Historically, extreme hash rate drawdowns have been associated with price bottoms,” CryptoQuant wrote. In particular, the 7.7% drawdown is reminiscent of an equivalent hash rate drawdown in December 2022, when Bitcoin’s price bottomed at $16,000 before rallying over 300% over the next 15 months.

This latest hash rate drop follows Bitcoin’s fourth cyclical “halving” event in April, which cut the number of coins paid out to miners in half. According to CryptoQuant’s Miner Profit/Loss Sustainability Indicator, this has left miners “mostly extremely underpaid” since April 20, forcing many to shut down mining machines that have now become unprofitable.

CrypotoQuant said that miners faced a 63% drop in daily revenue after the halving, when both Bitcoin block rewards and transaction fee revenues were much higher.

During this time, Bitcoin miners were seen moving coins from their on-chain wallets at a faster rate than usual, indicating that they may be selling their BTC reserves“Daily miner outflows reached their highest volume since May 21,” the company wrote.

Among the sales of Bitcoin miners, whales and national governmentsBitcoin’s price drop in June also hurt Bitcoin’s “hash price,” a metric of Bitcoin Miner Profitability per unit of computing power.

“Average mining revenue per hash (hash price) continues to hover near all-time lows,” CryptoQuant wrote. “Hashprice stands at $0.049 per EH/s, just above the all-time low hashprice of $0.045 reached on May 1st.”

By Ryan-Ozawa.

News

US Congressman French Hill Doubles Down on Trump’s Pro-Crypto Stance

US lawmaker French Hill has noted that Donald Trump will take a more pro-crypto approach than the current administration. The run-up to the presidential election has seen cryptocurrencies become an issue with lawmakers making huge statements ahead of the polls. Donald Trump has also been reaching out to the industry, making a pro-crypto case.

French Hill Backs Trump’s Pro-Crypto Stance

Republican Congressman French Hill has explained the type of cryptocurrency regulatory framework he believes Donald Trump could adopt in the country. In a recent interview with CNBC, French Hill said that the recently passed FIT21 bill is the type of regulatory framework the Trump administration will adopt in the sector.

#FIT21 passed the House with 71 Democratic votes, it’s exactly the kind of digital asset regulatory framework former President Trump would support if re-elected.

See more on @SquawkCNBC🔽 photo.twitter.com/ceTmU4LApU

— French Hill (@RepFrenchHill) July 3, 2024

THE FIT21 Bill It is intended to protect investors and consumers in the market by establishing clear rules and powers for the various regulators in the sector. According to Hill, Trump will adopt it because it directs the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on the specific regulatory framework needed in the market.

“… for people who are innovating and starting a crypto token, a related business, custody of those assets, how to ensure consumer protection, so I think that framework is the right approach and that’s what I’m going to recommend to the President to pass, which is that we have not passed it between now and the end of this Congress.”

He also called Trump an innovative and pro-growth president in financial matters.

Cryptocurrency is going mainstream

This election cycle saw the cryptocurrency industry taking a place in mainstream issues following broader adoption across demographics. From candidates moving toward enthusiasts to recent pro-Congress legislation, cryptocurrencies have become a rallying point for officials. The U.S. regulatory landscape has been criticized for stifling growth due to frequent SEC LawsuitsThis has led executives to push for pro-cryptocurrency laws and raise money for pro-industry candidates.

Read also: Federal Reserve Predicts “AI Will Be Deflationary” to Stimulate Economy

David is a financial news contributor with 4 years of experience in Blockchain and cryptocurrency. He is interested in learning about emerging technologies and has an eye for breaking news. Keeping up to date with trends, David has written in several niches including regulation, partnerships, cryptocurrency, stocks, NFTs, etc. Away from the financial markets, David enjoys cycling and horseback riding.

News

US Court Orders Sam Ikkurty to Pay $84 Million for Cryptocurrency Ponzi Scheme

A federal court has ordered Jafia LLC and its owner, Sam Ikkurty, to pay nearly $84 million to cryptocurrency investors after ruling that the company was operating a Ponzi scheme.

The ruling, issued by Judge Mary Rowland in the U.S. District Court for the Northern District of Illinois, follows a lawsuit filed by the Commodity Futures Trading Commission (CFTC) in 2022 after the fund collapsed.

Judge Rowland found that Ikkurty, based in Portland, Oregon, did numerous false claims on his company’s hedge funds.

These included misleading statements about his trading experience and the promise of high and stable profits. Instead, Ikkurty used funds from new investors to pay off previous investors, a hallmark of a Ponzi scheme.

The Ponzi Scheme

The court found that Ikkurty misappropriated investment funds for personal use without the knowledge of the investors. These funds were used for personal use and were reported as Fraudulent Investmentscausing significant financial losses to customers.

This non-transparent operation violated Transparency Commission regulations, which led to the imposition of a hefty fine to compensate defrauded investors and restore some public confidence in the financial system.

Judge Rowland emphasized that fraudulent activity such as this violates the law and undermines the integrity of modern financial markets. The $84 million award seeks to address the financial harm inflicted on investors and reinforce the importance of legal compliance in cryptocurrency trading.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!