Bitcoin

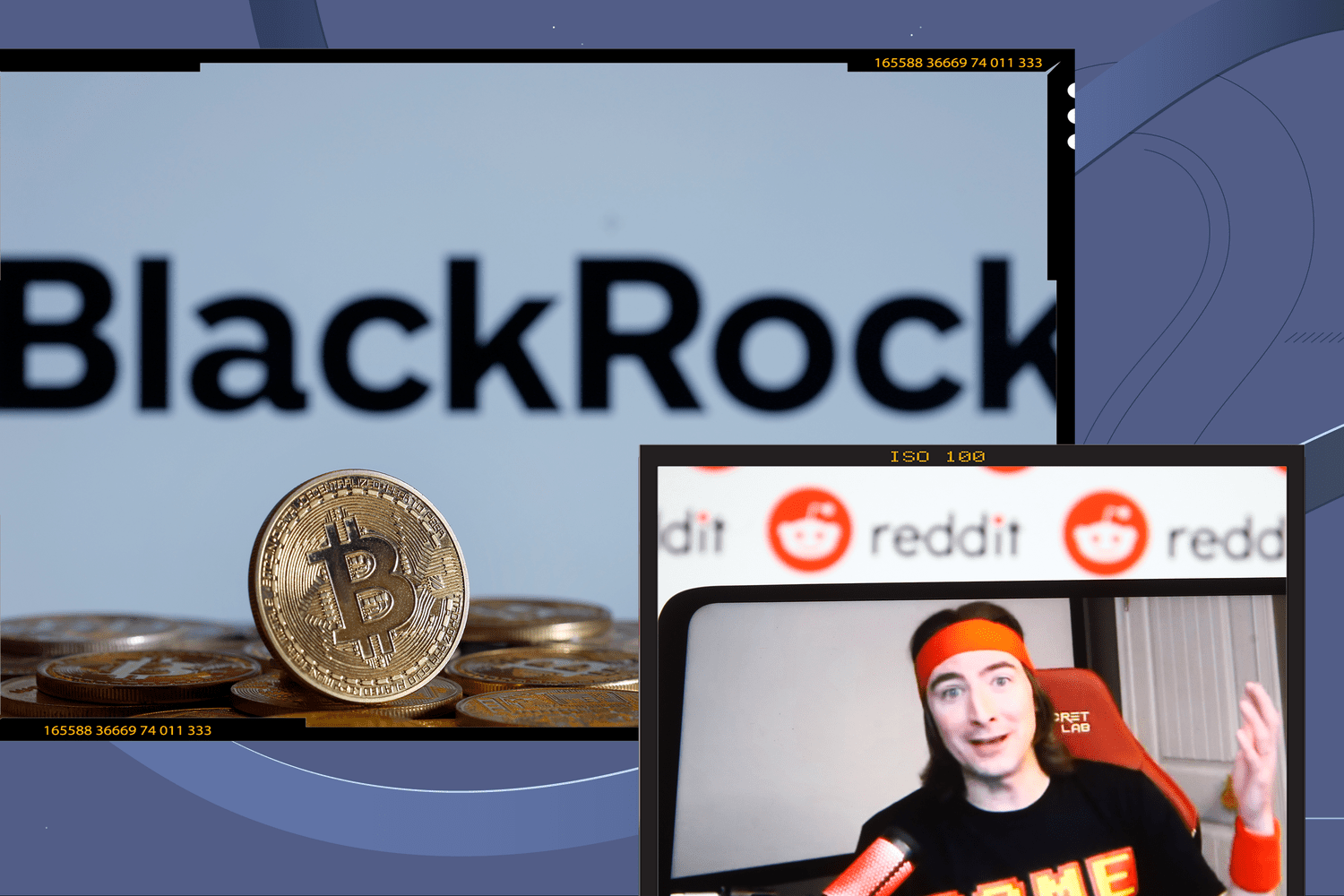

BlackRock Bitcoin ETF Largest, RoaringKitty Fuels Meme Coins

Key Takeaways

- Blackrock’s IBIT has overtaken Grayscale’s GBTC as the largest bitcoin ETF on the market.

- President Joe Biden vetoed a bill that would have allowed traditional banks to more easily serve as custodians of crypto assets on behalf of their customers.

- Japanese crypto exchange DMM Bitcoin was hacked for around $308 million worth of bitcoin.

- This week, all eyes are on meme coins as infamous Reddit user Keith Gill returned to GameStop trading.

Bitcoin (Bitcoin) briefly surpassed $70,000 on Monday, after spending most of last week below that mark. However, it was BlackRock’s iShares Bitcoin Trust (I BITE) that made headlines after taking down the Grayscale Bitcoin Trust (GBTC) as the largest cash bitcoin exchange-traded fund (ETF) in assets.

Additionally, US President Joe Biden vetoed a cryptocurrency bill that passed both houses of Congress and a Japanese cryptocurrency exchange was hacked for more than $300 million worth of bitcoins. Meanwhile, Keith Gill, the man behind the meme stock frenzy in 2021, fueled a rally in some meme coins with his latest bet.

Blackrock’s IBIT is now the largest Bitcoin ETF

Just over four months since it began trading on January 11, BlackRock’s bitcoin ETF has become the largest Spot bitcoin ETF by assets, overtaking Grayscale’s GBTC for first place. At the end of May, IBIT’s assets were US$19.5 billion, while GBTC’s were US$19.385 billion.

GBTC is the oldest fund with bitcoin investments that were converted to ETFs when the U.S. Securities and Exchange Commission allowed spot bitcoin ETFs earlier this year. At that time, GBTC’s assets exceeded US$24 billion.

However, as soon as other comparable products began trading, investors withdrew large sums of money from GBTC, resulting in around $17.9 billion in net outflows since January 11. In sharp contrast, BlackRock’s IBIT reported substantial inflows, attracting around $16.6 billion. this year, according to Farside Investors.

The disparity in fees between Grayscale’s ETF and other bitcoin ETFs from Blackrock, Fidelity and others has played a crucial role in the competition Grayscale’s fund has faced. For example, GBTC charges a fee of 1.5%, while IBIT charges a fee of 0.25%. Notably, shades of gray plans will soon launch an alternative spot bitcoin ETF offering with lower fees under the ticker BTC.

President Biden Vetoes Crypto Bill

President Biden, as predicted, vetoed a bill that sought to nullify the SEC’s special regulations for crypto asset custodians. This SEC policy could pose significant challenges for traditional financial firms looking to offer crypto custody services.

The White House had already signaled its intention to veto the legislation. In a statement, President Biden expressed a desire to establish a balanced regulatory framework for digital assets under the authority of existing regulatory agencies.

According to Axios, critics noted that the deadline for Congress to review the SEC’s procedural action under the Administrative Procedure Act had expired and argued that the policy did not constitute a rule, a point disputed by the Government Accountability Office.

Banking trade organizations urged the president to support removing the rule, claiming it would make cryptocurrency custody services prohibitively expensive for traditional financial firms, ultimately harming their customers.

This move from the Biden White House follows a perceived reversal in crypto policy when several filings for spot ether ETFs were approved late last month by the SEC, after it was assumed that the rejection of these financial products was imminent.

Former President Donald Trump also reversed his initial stance on bitcoin and other crypto assets, going so far as to make a campaign promise to release convicted Silk Road online marketplace operator Ross Ulbricht from prison. Ulbricht is serving a life sentence for running a platform where illegal drugs and other illicit items were purchased using bitcoin.

More than $300 million stolen from Japanese cryptocurrency exchange

On Friday, Japanese exchange DMM Bitcoin announced a hack or “unauthorized leak” during which 4,502.9 bitcoins, valued at approximately 48.2 million yen, were stolen. This translates to about $308 million worth of bitcoin.

DMM Bitcoin assured customers that their bitcoin deposits would be fully compensated through purchases supported by the group’s companies, although no timeline was provided. The theft occurred at 1:26 pm Tokyo time, coinciding with a 4,502 bitcoin transaction seen on Bitcoin blockchain.

In response, the exchange suspended cryptocurrency withdrawals, spot market purchases and new leveraged trading positions, while also delaying yen-denominated withdrawals. DMM Bitcoin stated that further updates would be shared in a subsequent announcement. According to blockchain analytics provider Elliptic, this incident ranks as the eighth largest crypto exchange hack in history and the largest since the $477 million FTX theft in late 2021.

What to expect from the markets this week

A speculative surge has driven up the prices of some meme tokens and GameStop (GME) shares on Monday, just hours after renowned retail trader Keith Gill, of 2021 GME short squeeze fame, released his latest bet on the stock. Using his nickname “DeepF—ingValue” on Reddit, Gill shared his GME picks positions on the r/Superstonk subreddit, revealing bets worth more than $115 million in shares and $65 million in call options expiring on June 21.

Gill also passes Roaring Kitty on YouTube and his most recent viral post sparked an outcry, with cat-themed meme tokens such as POPCAT and MOG. Meanwhile, unrelated GME meme coin on the Solana network it increased by around 200%. Gill’s social media activity previously sparked similar rallies in Mayemphasizing his significant influence and impact on the market since his initial analysis of GameStop in 2019, which culminated in the January 2021 short squeeze.

Although bitcoin has been in a sustained bull market throughout the year, the so-called altseason, referring to a rally in altcoins or non-bitcoin tokens, has yet to materialize. However, the frenzy surrounding meme tokens shows that there is still a lot of speculation taking place in the crypto market outside of bitcoin. Of course, it’s worth noting that trading small-cap tokens in the crypto market often amounts to nothing more than gambling.

Bitcoin

Bitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

Risk assets fell on Thursday as China’s second rate cut in a week raised concerns of instability in the world’s second-largest economy.

Bitcoin (BTC)the leading cryptocurrency by market cap, is down nearly 2% since midnight UTC to around $64,000 and ether (ETH) fell more than 5%, dragging the broader altcoin market lower. The CoinDesk 20 Index (CD20), a measure of the broader cryptocurrency market, lost 4.6% in 24 hours.

In equity markets, Germany’s DAX, France’s CAC and the euro zone’s Euro Stoxx 50 all fell more than 1.5%, and futures linked to the tech-heavy Nasdaq 100 were down slightly after the index’s 3% drop on Wednesday, according to the data source. Investing.com.

On Thursday morning, the People’s Bank of China (PBoC) announced a surprise, cut outside the schedule in its one-year medium-term lending rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market. That is the biggest reduction since 2020.

The movement, together with similar reductions in other lending rates earlier this week shows the urgency among policymakers to sustain growth after their recent third plenary offered little hope of a boost. Data released earlier this month showed China’s economy expanded 4.7% in the second quarter at an annualized pace, much weaker than the 5.1% estimated and slower than the 5.3% in the first quarter.

“Equity futures are flat after yesterday’s bloody session that shook sentiment across asset classes,” Ilan Solot, senior global strategist at Marex Solutions, said in a note shared with CoinDesk. “The PBoC’s decision to cut rates in a surprise move has only added to the sense of panic.” Marex Solutions, a division of global financial platform Marex, specializes in creating and distributing custom derivatives products and issuing structured products tied to cryptocurrencies.

Solot noted the continued “steepening of the US Treasury yield curve” as a threat to risk assets including cryptocurrencies, echoing CoinDesk Reports since the beginning of this month.

The yield curve steepens when the difference between longer-duration and shorter-duration bond yields widens. This month, the spread between 10-year and two-year Treasury yields widened by 20 basis points to -0.12 basis points (bps), mainly due to stickier 10-year yields.

“For me, the biggest concern is the shape of the US yield curve, which continues to steepen. The 2- and 10-year curve is not only -12 bps inverted, compared to -50 bps last month. The recent moves have been led by the rise in back-end [10y] yields and lower-than-expected decline in yields,” Solot said.

That’s a sign that markets expect the Fed to cut rates but see tighter inflation and expansionary fiscal policy as growing risks, Solot said.

Bitcoin

How systematic approaches reduce investor risk

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

July 24, 2024, 5:30 p.m.

Updated July 24, 2024, 5:35 p.m.

(Benjamin Cheng/Unsplash)

Fuente

Bitcoin

India to Release Crypto Policy Position by September After Consultations with Stakeholders: Report

“The policy position is how one consults with relevant stakeholders, so it’s to go out in public and say here’s a discussion paper, these are the issues and then stakeholders will give their views,” said Seth, who is the Secretary for Economic Affairs. “A cross-ministerial group is currently looking at a broader policy on cryptocurrencies. We hope to release the discussion paper before September.”

Bitcoin

Bitcoin (BTC), Ether (ETH) slide as risk aversion spreads to crypto markets

Ether, the second-largest token, fueled a slide in digital assets after a stock rout spread unease across global markets.

Ether fell about 6%, the most in three weeks, and was trading at $3,188 as of 6:45 a.m. Thursday in London. Market leader Bitcoin fell about 3% to $64,260.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!