Ethereum

Bitcoin Could Grow Big By Being More Like Ethereum — TradingView News

The idea of Bitcoin BTCUSD drawing ideas from another blockchain may seem absurd. Bitcoin is the one that started it all. It was copied and served as inspiration for Litecoin. LTCUSDDogecoin

DOGEUSDMonero

XMRUSDEthereum

ETHUSDjust to name a few.

But a lot has changed over the past 15 years. Although Bitcoin’s dominance has remained constant, the industry has moved beyond simply “buying and holding” coins whose profitability depends on other people buying them. Today, there are many ways to deploy digital assets to earn yield, generate income, and just have fun.

While much of this innovation has emanated from Ethereum and the multi-token, multi-chain landscape it has spawned, the pendulum is swinging back towards Bitcoin. Now equipped with its own Layer 2 protocols, native tokens, non-fungible tokens (NFTs), and decentralized finance (DeFi), Bitcoin has the opportunity to experience explosive growth in active users, total value locked ( TVL) and active wallets.

Related: 5 Things Ethereum ETFs Could Mean for Altcoins

Can Bitcoin replicate the explosive growth trajectory that Ethereum experienced in 2017 and 2020, fueled by the frenzy of initial coin offerings and DeFi? Taking a cue from the Ethereum playbook, Bitcoin has the potential to grow exponentially over the coming years – if Bitcoin developers work to adopt some of Ethereum’s features.

Ethereum’s selling points

Chief among them is interoperability. Ethereum multi-tokenism has been so successful in part because of universal standards. ERC-20s work everywhere by default and are easily transferred between EVM chains. Bitcoin, in comparison, faces competing token and registration standards whose acceptance is at the discretion of each platform.

Some prefer the BRC-20 standard. Others prefer Runes, developed by Ordinals creator Casey Rodarmor. The cursed inscriptions are an entirely different emanation. Bitcoin has a multitude of competing and overlapping standards for token issuance, and its L2 ecosystem is equally complex.

Stacks is the largest Bitcoin L2, unless you count Lightning Network, but there are now dozens of other networks competing to become the preeminent Bitcoin scaling solution, including EVM implementations. Some are sidechains, some are L2s, and some appear, at best, to have only a tangential connection to Bitcoin. This is all very confusing.

If Bitcoin is to become a home for DeFi, NFTs, real-world assets (RWA), and every other on-chain use case that developers try to impose on it, it needs to be more like Ethereum. This doesn’t mean turning to proof-of-stake or changing its underlying code base every six months. Rather, it calls for the judicious adoption of universal standards that will allow value to flow freely across chains.

If Bitcoin developers can work together rather than formulating ideas in isolation, its ecosystem has the potential to grow exponentially in every meaningful metric, from daily active users to TVL. If you succeed, Bitcoin of 2025 will not only be the world’s largest cryptocurrency, it will also become the world’s largest multi-token ecosystem.

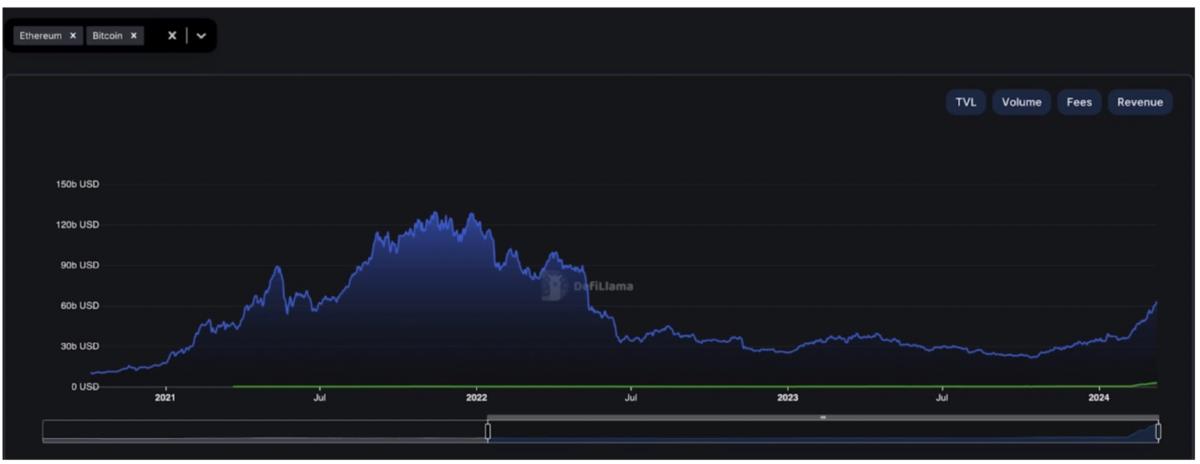

Total Value Locked (TVL) describes the value of assets that exist on a blockchain protocol for staking and DeFi and is a good starting point for comparing the respective ecosystems of Ethereum and Bitcoin. TVL is an inaccurate measure because it is possible to “double count” assets that have been reassigned across multiple protocols. Nonetheless, it provides a baseline for assessing network activity and overall liquidity. Cointelegraph

Cointelegraph

Bitcoin’s $1.15 billion TVL is dwarfed by Ethereum’s more than $65 billion – and that’s not counting the billions of other EVM chains, all tightly integrated into the main chain. However, zoom out and it’s evident that Bitcoin’s TVL currently sits at the same level as Ethereum’s four years ago, just before the “DeFi summer” sparked a Cambrian explosion in activity economical and inspires crazes such as yield farming, algorithmic stablecoins and new tokens. and liquidity models like Ampleforth and Ohm.

History doesn’t repeat itself, but it rhymes

Ethereum was at the height of its ICO craze in 2016 – but none of the new assets launched that year did so on Ethereum. Twelve months later, this figure had increased to over 50%, with over 75% of the value of all crypto assets in existence as of mid-2017 based on Ethereum. The temptation to compare the current growth of Bitcoin assets with Ethereum tokens from this period is overwhelming.

By 2020, Ethereum ICOs had largely disappeared as regulators began cracking down on token sales. But Ethereum has reinvented itself, designing decentralized finance (DeFi) and also becoming the network of choice for another emerging craze: NFTs.

By 2024, Ethereum’s NFT sector has significantly declined in value and volume, exacerbated by high network fees and the growth of L2s, providing users with cheaper ecosystems in which to conduct business. But as the success of Bitcoin Ordinals has shown, NFTs are not dead: they have simply changed their name. The most popular Bitcoin Ordinals collection, NodeMonkes, now has a market cap of over $150 million, and the Ordinals sector saw volume of over $50 million on March 3, a yearly high. Cointelegraph

Cointelegraph

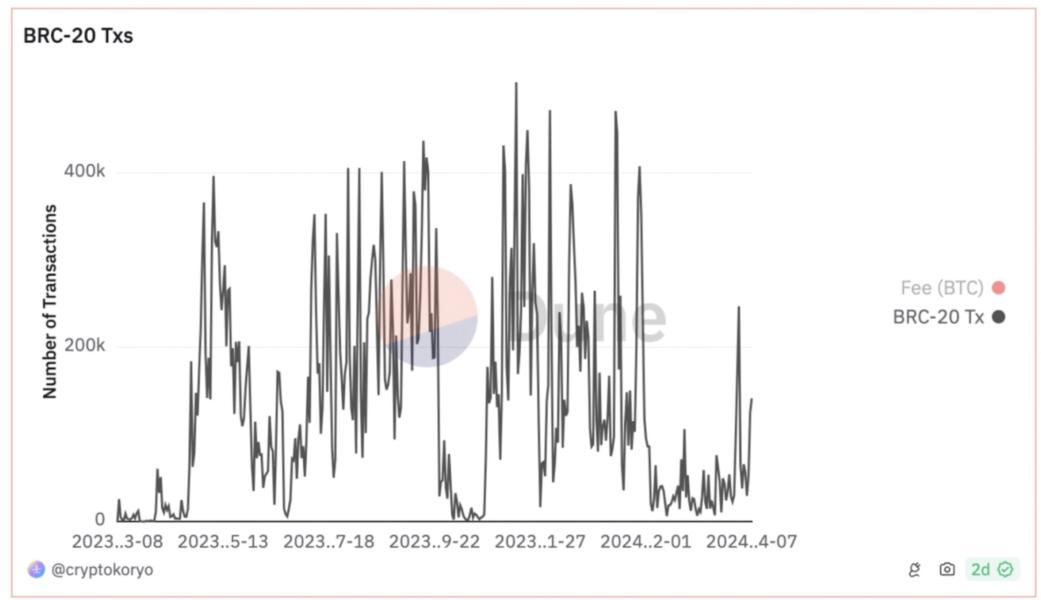

For a long time, the crypto community perceived BRC-20 tokens as insignificant compared to Bitcoin. However, with the growing number of these digital assets, network activity is also increasing. Drawing parallels with the history of Ethereum, we can expect a similar increase in transaction demand.

Current daily trading data for BRC-20 tokens resembles statistics and trading activity patterns for ERC-20 tokens in 2018, with an average daily trading volume of around 300,000. The average price of ETH for this period was about five times lower than this year’s average. Cointelegraph

Cointelegraph

The existence of 14,000 tokens built on this technology adds value to BTC in the eyes of users. This factor can counterbalance the influence of the speculative component and multiply the wealth of BTC holders.

Bitcoin is on the cusp of a parabolic breakout

Could Bitcoin be on the cusp of a similar parabolic breakout? Current on-chain metrics make a compelling case. The market capitalization of all BRC-20 tokens now stands at over $2 trillion, an increase of over 250,000% in less than a year. Meanwhile, the growth in listings – the process by which unique assets such as ordinals are created on the Bitcoin blockchain – has been equally meteoric.

Related: Bitcoin’s OP_CAT Proposal Could Transform the Bitcoin Blockchain

To date, over 66 million registrations have been recorded on the Bitcoin chain, with over 6.8 BTC spent in fees during the process, or over $466 million. The total number of registrations has doubled since October. It’s easy to spot analogies between Bitcoin assets and the ICO craze that saw Ethereum’s multi-token era begin in earnest in 2017.

ETH saw a tenfold increase in price between early 2020 (less than $200) and mid-2021 ($2,000 and beyond) thanks to the development of the booming DeFi sector. Subsequently, a positive feedback loop emerged: the growth of ETH made DeFi more attractive, thus stimulating demand for this cryptocurrency. Judging by the TVL chart data, Bitcoin is now the point where Ethereum began its active growth in 2020. As decentralized finance increasingly adopts BRC-20 tokens, which can begin to supplant competitors, Bitcoin will respond positively to these changes due to increased demand.

Despite Bitcoin’s higher capitalization, it may not see as meteoric growth as ETH in 2020, given the lack of a low base effect and stricter regulatory conditions. However, even a small increase could still produce a significant change in value.

Bitcoin developers would do well to copy Ethereum’s homework by taking into account the innovations that have served as catalysts for this blockchain over the better part of the last decade.

Gracie Chen is a guest columnist for Cointelegraph and CEO of cryptocurrency exchange Bitget. She is also a delegate to the United Nations Conference on the Status of Women. She holds a bachelor’s degree from the National University of Singapore (NUS) and an MBA from the Massachusetts Institute of Technology (MIT). She previously held leadership roles at Fortune 500 unicorn company Accumulus and venture-backed VR startups XRSPACE and ReigVR.

This article is intended for general information purposes and is not intended to be and should not be considered legal or investment advice. The views, thoughts and opinions expressed herein are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Ethereum

Cryptocurrency liquidations surpass $200 million as Ethereum and Bitcoin plummet

Cryptocurrency market liquidations hit their highest level in a week on Wednesday as the price of Bitcoin fell below $60,000.

Over the past 24 hours, over 74,000 traders have been liquidated for $208 million, CoinGlass the data shows it.

The majority of those losses, about $184 million, went to investors holding long positions who had bet on a price rise.

The largest liquidations hit Ethereum investors, at $55.5 million, almost entirely on long positions, the data showed.

Current issues surrounding US monetary policy, geopolitical tensions, and the upcoming US presidential election in November are expected to impact the price of the leading cryptocurrency throughout 2024.

Bitcoin abandoned The stock price fell from $62,200 to $59,425 intraday. The asset has since recovered its losses above $60,200, but is still down 3% over the past 24 hours.

Solana, the world’s fifth-largest cryptocurrency by market capitalization, was the worst hit among the top 10 cryptocurrencies, down about 8% to $140. Solana had been riding high on New York investment management firm VanEck’s filing of its Solana Trust exchange-traded fund late last month.

Major cryptocurrencies have been falling over the past month. Ethereum has fallen more than 12% over 30 days despite growing interest in the launch of Ethereum spot ETFs.

Some analysts predict that new financial products could begin marketing in mid-Julywith at least one company predicting that the price of ETH will then take offBitcoin is down 12% over the same period.

Certainly, analysts always see further price increases this yearThe current market cooling represents a precursor to another major price surge in the coming months, Decrypt reported Monday.

On Wednesday, analytics firm CryptoQuant released a report examining Bitcoin Mining Metrics and highlighted the conditions for a return of prices to current levels.

Edited by Sebastian Sinclair.

Ethereum

Volume up 90%: good for ETH price?

Ethereum (ETH) has emerged as a beacon in the sea of blockchains, with a staggering 92% increase in decentralized application (dApp) volume over the past week. But the news comes with a layer of complexity, revealing a landscape of both opportunity and potential setbacks for the leading blockchain.

Cheap gas fuels the fire

Analysts attribute the explosion in decentralized application volume to the Dencun upgrade in March, which significantly reduced gas costs – the cost associated with processing transactions on the Ethereum network.

Lower transaction fees have always attracted users, and this recent development seems to be no exception. The surge in activity suggests a revitalized Ethereum that is likely to attract new projects and foster a more vibrant dApp ecosystem.

NFT craze drives numbers up

While overall dApp volume (see chart below) paints a positive picture, a closer look reveals a more nuanced story. This surge appears to be driven primarily by an increase in NFT (non-fungible token) trading and staking activity.

Source: DappRadar

Source: DappRadar

Apps like Blur and Uniswap’s NFT aggregator have seen significant surges, highlighting the rise of the NFT market on Ethereum. This trend indicates a thriving niche in the Ethereum dApp landscape, but raises questions about the platform’s diversification beyond NFTs.

A look at user engagement

A curious problem emerges when looking at user engagement metrics. Despite the impressive increase in volume, the number of unique active wallets (UAWs) on the Ethereum network has actually decreased.

Ethereum is now trading at $3,316. Chart: TradingView

This disconnect suggests that current activity could be driven by a smaller, more active user base. While high volume is certainly a positive indicator, seeing broader user participation is essential to ensuring the sustainability of the dApp ecosystem.

A glimmer of hope ?

A positive long-term indicator for Ethereum is the trend of decreasing holdings on the exchange, as reported by Glass nodeThis suggests that ETH holders are moving their assets off exchanges, potentially reducing selling pressure and contributing to price stability.

If this trend continues, ETH could potentially target $4,000 this quarter or even surpass its all-time high. However, this price prediction remains speculative and depends on various market forces.

Ether price expected to rise in coming weeks. Source: CoinCodex

Ether price expected to rise in coming weeks. Source: CoinCodex

Ethereum at a Crossroads

Ethereum is at a crossroads. Dencun Upgrade has clearly revitalized dApp activity, particularly in the NFT space. However, uneven dApp performance and the decline of the UAW are raising concerns about the long-term sustainability of this growth. Network growth, measured by the number of new addresses joining the network, is also slowing, according to Santiment, which could potentially hamper wider adoption.

The short-term price outlook for ETH remains uncertain. While long-term indicators, such as declining exchange holdings, suggest potential for price appreciation, slowing network growth could lead to a price decline in the short term.

Look forward to

The coming months will be crucial for Ethereum. The platform must capitalize on the renewed interest in dApps by attracting a broader user base and fostering a more diverse dApp ecosystem beyond NFTs. Addressing scalability issues and ensuring user-friendly interfaces will also be essential to sustain growth.

If Ethereum can overcome these challenges, it has the potential to cement its position as the premier platform for decentralized applications. However, if it fails to adapt, other waiting blockchains could capitalize on its shortcomings.

Featured image from Pexels, chart from TradingView

Ethereum

Ethereum, Bitcoin, and XRP Behind $1.5 Billion Losses in Cryptocurrency Scams

The first half of 2024 has seen a surge in major hacks in the cryptocurrency sector. Ethereum (ETH)Bitcoin (BTC) and XRP have resulted in losses of over $1.5 billion due to cryptocurrency scams. This year, over 200 major incidents have resulted in losses of approximately $1.56 billion.

Cryptocurrency Scam Losses Reach $1.5 Billion

According to data from Peck Shield Alert, only $319 million in lost crypto funds have been recovered. Furthermore, this year’s losses represent a staggering 293% increase over the same period in 2023, when losses totaled $480 million.

Overview of Cryptocurrency Scams in 2024, Source: PeckShieldAlert | X

Additionally, DeFi protocols have been the top targets for hackers, accounting for 59% of the total value stolen. More than 20 public chains have suffered major hacks during this period. Additionally, Ethereum, Bitcoin, and XRP top the list for the amount lost via cryptocurrency hacks.

Additionally, Ethereum and BNB Chain were the most frequently targeted, each accounting for 31.3% of the total hacks. Meanwhile, Arbitrum followed with 12.5% of the attacks. One of the most significant incidents occurred on June 3, 2024.

Bitcoin DMMa major Japanese cryptocurrency exchange, reported a major breach. Attackers stole 4,502.9 BTC, worth over $300 million at the time. The incident highlighted the vulnerabilities of exchanges, especially those that handle large volumes of digital assets.

Read also : XRP News: Whale Moves 63 Million Coins as Ripple Strengthens Its Case

Major XRP, ETH and BTC hacks

A week after the DMM Bitcoin attack on June 10, UwU Loana decentralized finance (DeFi) lending protocol, was compromised. The breach resulted in a loss of approximately $19.3 million in digital assets. The hack underscores the ongoing risks associated with DeFi platforms, which often operate with less regulatory oversight. The platform later offered a $5 million reward to catch the hacker.

Earlier this year, on February 3, 2024, Ripple co-founder Chris Larsen confirmed a major security breach involving his personal wallets. Initially, rumors circulated that Ripple itself was targeted. However, Larsen clarified that the hack involved his digital wallets and not Ripple’s corporate assets.

The hackers managed to transfer 213 million XRP tokens, worth approximately $112.5 million. Additionally, on-chain detective ZachXBT first alerted the community about the suspicious transactions. In response to the theft, Larsen and various cryptocurrency exchanges took swift action to mitigate the impact.

Several exchanges, including MEXC, Gate, Binance, Kraken, OKX, HTX, and HitBTC, collaborated to freeze a significant portion of the stolen funds. Binance alone froze $4.2 million worth of XRP to aid in the investigation.

Additionally, on April 2, 2024, FixedFloat, a Bitcoin Lightning-based exchange, experienced a security breach. Unauthorized transactions resulted in financial losses exceeding $3 million. This incident highlighted ongoing security issues for FixedFloat, following a similar breach earlier in the year.

The company has also faced significant challenges securing its platform against repeated attacks. Additionally, in February, hackers stole $26 million worth of Ethereum and Bitcoin from FixedFloat. These digital assets were then transferred to exchanges for profit.

Read also : Ethereum Doubles Bitcoin’s Network Fee Revenue, Thanks to Layer-2

Ethereum

Ethereum’s Year-Over-Year Revenue Tops Charts, Hitting $2.7 Billion

Ethereum blockchain has been in first place for a year incomesurpassing all major blockchains.

According to data provided by Lookonchain, Ethereum generated $2.72 billion in annual revenue, surpassing the Bitcoin network by a margin of $1.42 billion. The data shows that Bitcoin accumulated $1.3 billion in revenue over the same period.

Defi Llama Data watch that Ethereum is still the leader in decentralized finance (challenge) with a total value locked (TVL) of $58.4 billion, or 60.9% of the entire market. The blockchain recorded a 30-day fee revenue of $131 million, according to the data aggregator.

Bitcoin’s TVL is currently set at $1 billion.

The network of the second largest cryptocurrency, ETH, witness a 155% year-over-year increase in its fee revenue in the first quarter of this year, as the cryptocurrency market saw a bullish trend.

Tron comes in third with annual revenue of $459 million. Solana and BSC also recorded nine-figure revenues of $241 million and $176 million, respectively.

Notably, Tron is the second largest chain in the challenge scene with a TVL of $7.7 billion. BSC and Solana take third and fourth place with TVLs of $4.8 billion and $4.5 billion, according to Defi Llama.

Avalanche, zkSync Era, Optimism and Polygon reached the top 10 with $68 million, $59 million, $40 million and $23 million in year-over-year revenue, respectively.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!