Bitcoin

Why I Chose Bitcoin Ordinals to Launch ‘Frontline’

I like to say that I do pixels very well, but I am not a blockchain expert. I am afraid of anything related to statistics and security, because any mistake usually means that you are either completely wrong (when dealing with statistics) or you lose a lot of money (when it comes to security). Writing a smart contract is a daunting task for me. That doesn’t mean that I have no idea about the underlying technology that powers blockchains and NFTs/Ordinals, however: it just means that I stop at understanding.

For my latest collection, I’m partnering with Metagood, the creators of the Ordinals OnChainMonkey collection, to launch on the Ordinals protocol. This collection will be my first on Bitcoin, which is different from what I’ve used in the past (mostly NFTs on Ethereum and Tezos) and is taking all the lessons learned from other chains to do some clever things out of the box.

The first thing I love about Ordinals is that it has to be on-chain. That’s it. No external assets, no links. What you have is what you get. Many generative art pieces rely on code libraries (e.g. p5.js, three.js) to help with commonly used features that are needed to generate the pieces.

The protocol has a solution to this problem that is elegant by design. Any Ordinal can refer to another Ordinal. It can be a library, it can be an asset, it can be the whole thing to create remixes. It’s up to you to find creative uses for the asset. You can find the widely used libraries on-chain, in Bitcoin: p5js, three.js are already there. Do you know who ported them? Danny Yangcreator of OnChainMonkey.

But how exactly does this work? How can my Ordinal refer to another Ordinal? In Ethereum (and others, as far as I know), NFTs are basically token IDs that are issued from a given contract. You then need the contract address to explore which NFTs are there and who owns them.

Ordinals have (again) found a clever solution to this problem. This feature is called recursion. A Bitcoin is a collection of one hundred million satoshis, each with a number, according to its minting order. An Ordinal is linked to a unique Satoshi, so they are ordered. That’s why they are called Ordinals. You can use another Ordinal (or other Ordinals) on your Ordinal to make a new Ordinal. You can then create complex pieces using different assets that already exist, and anyone can access them.

The other feature that is also interesting is the parent-child relationship. It is similar to the recursion feature in that it is a reference to another Ordinal. But this one is secured in the same way that blockchains work (remember the cryptographic part of “cryptocurrency”? That refers to signing messages using cryptography, the private key/public key thing). You can only refer to another Ordinal as the parent if you can prove that you own that Ordinal.

What can you do with this? It turns out that this is also a clever way to establish provenance and more. You can make an Ordinal your signature and use it to be the parent of all your future pieces. You can make an Ordinal the “generator” of a generative collection and have all the individual mints in that collection refer to the code as their parent. And much more.

Ordinals offer elegant solutions to serve the purpose of creating generative art collections on the Bitcoin chain. They are, of course, not as flexible as smart contracts and do not claim to be. They provide enough to build something amazing.

FrontLine is my latest collection of long-form generative art. I’m honored to be able to share it with you, this time on Ordinals, with the OnChainMonkey community as the initial target audience. It took me about a year to get to the finish line, and it’s a personal journey.

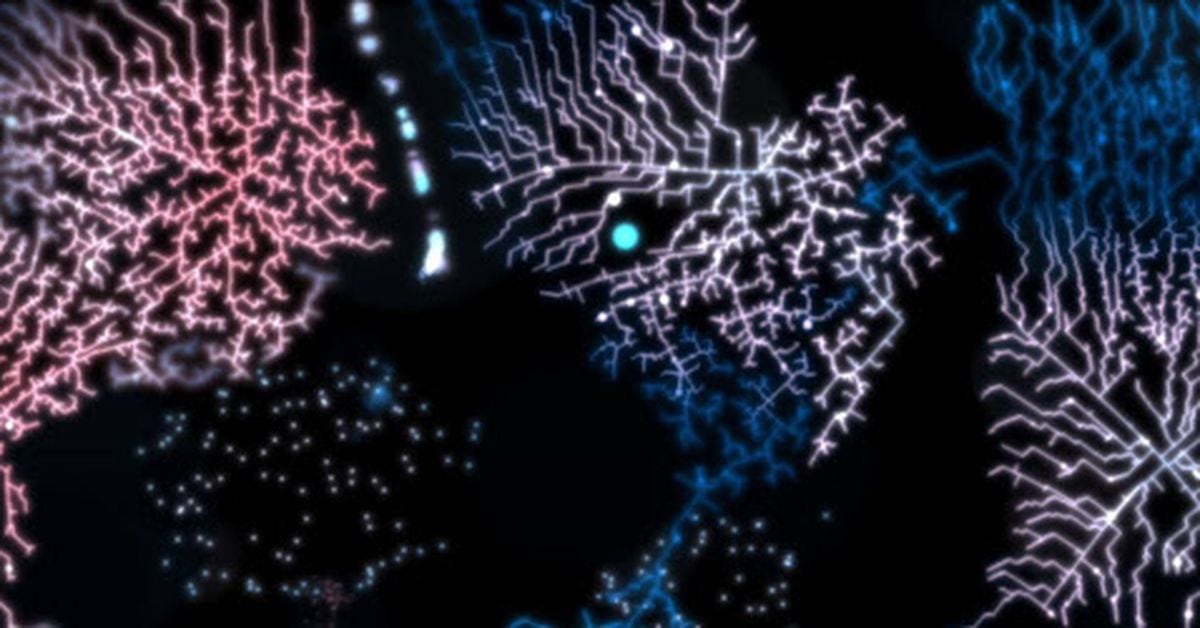

“FrontLine” reflects what’s been happening recently on a number of levels. The piece was challenging to create and satisfying to complete. From the beginning, this was conceived as a collaborative piece with OnChainMonkey. I was partly inspired by the general ethos behind the community around OCM: pushing people towards “good,” but there is no clear definition of good, only vague cultural concepts around what societies accept as values to strive for. Good only exists if its opposite makes sense: there is a dimension of good versus evil, lawful versus chaotic, light versus dark, A versus B. Two sides of something, with something in between.

FrontLine tries to represent this struggle, this fight that happens in every moment. What seemed like an obvious “good” choice a few seconds ago is now its opposite, thanks to the additional knowledge. The division between the two sides is never clear: the battle continues, and a lot is happening in Frontline.

The piece combines several algorithms competing to occupy the space: one that will search for the negative space and another that will try to connect the dots; the connecting algorithm is also clearly divided into two sides with different approaches to the task at hand. As each new iteration of the algorithm is almost unpredictable, but explainable a posteriori: the rules of the underlying algorithms are actually quite straightforward. Once all the space has been explored, the battle begins and the front line appears, sometimes complex and vibrant, sometimes irregular and vague – but always present.

There is no perfect world. There is no good without evil. What matters is where to draw the line. It’s up to you to figure out what you want both sides to be. It could be ETH/BTC. I personally root for the people who innovate: they will be on the front lines.

Do I have an answer to all the questions? No. I just know that you have to try things to move forward. You have to be where it happens. You have to fight there. You have to be on the front lines.

Please note: The opinions expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Bitcoin

Bitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

Risk assets fell on Thursday as China’s second rate cut in a week raised concerns of instability in the world’s second-largest economy.

Bitcoin (BTC)the leading cryptocurrency by market cap, is down nearly 2% since midnight UTC to around $64,000 and ether (ETH) fell more than 5%, dragging the broader altcoin market lower. The CoinDesk 20 Index (CD20), a measure of the broader cryptocurrency market, lost 4.6% in 24 hours.

In equity markets, Germany’s DAX, France’s CAC and the euro zone’s Euro Stoxx 50 all fell more than 1.5%, and futures linked to the tech-heavy Nasdaq 100 were down slightly after the index’s 3% drop on Wednesday, according to the data source. Investing.com.

On Thursday morning, the People’s Bank of China (PBoC) announced a surprise, cut outside the schedule in its one-year medium-term lending rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market. That is the biggest reduction since 2020.

The movement, together with similar reductions in other lending rates earlier this week shows the urgency among policymakers to sustain growth after their recent third plenary offered little hope of a boost. Data released earlier this month showed China’s economy expanded 4.7% in the second quarter at an annualized pace, much weaker than the 5.1% estimated and slower than the 5.3% in the first quarter.

“Equity futures are flat after yesterday’s bloody session that shook sentiment across asset classes,” Ilan Solot, senior global strategist at Marex Solutions, said in a note shared with CoinDesk. “The PBoC’s decision to cut rates in a surprise move has only added to the sense of panic.” Marex Solutions, a division of global financial platform Marex, specializes in creating and distributing custom derivatives products and issuing structured products tied to cryptocurrencies.

Solot noted the continued “steepening of the US Treasury yield curve” as a threat to risk assets including cryptocurrencies, echoing CoinDesk Reports since the beginning of this month.

The yield curve steepens when the difference between longer-duration and shorter-duration bond yields widens. This month, the spread between 10-year and two-year Treasury yields widened by 20 basis points to -0.12 basis points (bps), mainly due to stickier 10-year yields.

“For me, the biggest concern is the shape of the US yield curve, which continues to steepen. The 2- and 10-year curve is not only -12 bps inverted, compared to -50 bps last month. The recent moves have been led by the rise in back-end [10y] yields and lower-than-expected decline in yields,” Solot said.

That’s a sign that markets expect the Fed to cut rates but see tighter inflation and expansionary fiscal policy as growing risks, Solot said.

Bitcoin

How systematic approaches reduce investor risk

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

July 24, 2024, 5:30 p.m.

Updated July 24, 2024, 5:35 p.m.

(Benjamin Cheng/Unsplash)

Fuente

Bitcoin

India to Release Crypto Policy Position by September After Consultations with Stakeholders: Report

“The policy position is how one consults with relevant stakeholders, so it’s to go out in public and say here’s a discussion paper, these are the issues and then stakeholders will give their views,” said Seth, who is the Secretary for Economic Affairs. “A cross-ministerial group is currently looking at a broader policy on cryptocurrencies. We hope to release the discussion paper before September.”

Bitcoin

Bitcoin (BTC), Ether (ETH) slide as risk aversion spreads to crypto markets

Ether, the second-largest token, fueled a slide in digital assets after a stock rout spread unease across global markets.

Ether fell about 6%, the most in three weeks, and was trading at $3,188 as of 6:45 a.m. Thursday in London. Market leader Bitcoin fell about 3% to $64,260.

-

News12 months ago

News12 months agoCryptocurrency exchanges Binance and KuCoin register with India’s financial intelligence unit as cryptocurrency credibility improves

-

News10 months ago

News10 months agoMiners’ ‘Capitulation’ Signals Bitcoin Price May Have Bottomed Out: CryptoQuant

-

Altcoin9 months ago

Altcoin9 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Bitcoin10 months ago

Bitcoin10 months agoBitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

-

Videos1 year ago

Videos1 year agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Videos1 year ago

Videos1 year agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Bitcoin12 months ago

Bitcoin12 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos1 year ago

Videos1 year agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos12 months ago

Videos12 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!

-

Videos1 year ago

Videos1 year agoCryptocurrency Crash Caused by THIS…

-

Altcoin12 months ago

Altcoin12 months agoBinance Announces Investment: Altcoin Price Jumps!

-

Videos12 months ago

Videos12 months agoThe REAL reason why cryptocurrency is going up!