Bitcoin

Why AI’s Energy Usage Isn’t Demonized Like Bitcoin’s

That said, just like with Bitcoin, not everyone is totally excited about AI. And AI detractors have valid concerns: bias, transparency, privacy, security, validity, and (worst of all) stealing my bad art to make even worse art.

But to anyone who has ever been involved in reporting on Bitcoin, there is something very obvious that is missing from the AI hysteria, which has been Bitcoin’s political Achilles heel: energy use.

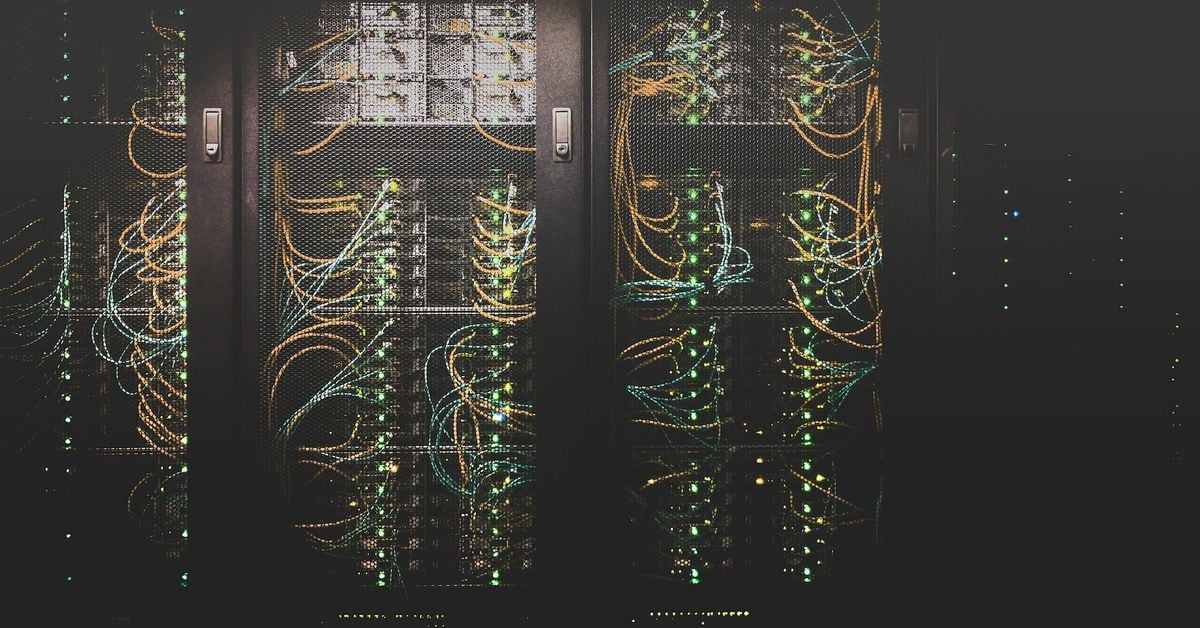

AI, if it is to grow as proponents believe it should, will require much more energy to power the data centers that make AI possible. Investment bank Goldman Sachs has predicted that data centers will use 8% of the world’s Total US energy supply by 2030 (above 3% in 2022), of which AI is a strong driving force. Additional research from French energy company Schneider Electric suggests that AI’s share of data center energy demand will rise to 15%-20% by 2028 (up from an estimated 8% in 2023). There are countless other projections and estimates out there and none that I have found suggest anything other than more.

Now, whether this energy demand is “worth it” is a pertinent question for another day, but why are there mountains and mountains of articles and ideas about Bitcoin using “XYZ country’s amount of energy” and not for AI?

Money, power, respect (the last one is the best)

Money: The path of all people.

There is hundreds of billions of investment capital invested in AI and its speculative future — as a proxy, just look at AI chipmaker Nvidia (NVDA), which is up 175% this year. Bitcoin didn’t have that when the hype started, and even now, near its peak, no one is actively looking for ways to invest hundreds of billions in Bitcoin-related ventures (aside from perhaps one of the Bitcoin ETFs).

With all this money coming in comes the big companies: Google, Microsoft, Amazon, Meta, and with it the power of influence they wield. These four companies are omnipresent, trillion-dollar giants and masters of PR. How many people hear the word “data center” and think, “Wow, what a waste! All that energy!”? Not very often.

And with all that money and influence comes respect for big-brained AI intellectuals. Microsoft CEO Satya Nadella and Meta boss Mark Zuckerberg both say AI is world-changing and good. That comes with prestige. When someone with a crazy X tweets that Bitcoin is world-changing and good, that comes with prestige too, but of a different kind.

The worst case scenario is very bad

Humans are really good at constructing realities at logical extremes, especially on the bad side. Here’s a bad case for the world with AI: AI gets really good at art and then instead of making art, we give up writing, drawing and painting and we all focus on work.

As for Bitcoin, the worst-case scenario is… what? It crashes and some people you know lose a lot of money? Or maybe it succeeds and takes down the Federal Reserve and Bitcoin becomes the world’s reserve currency?

Both scenarios are long shots. In the meantime: Have you seen how much energy Bitcoin uses?

Besides, people have more pressing things to worry about. Their livelihoods, for example.

“It affects me”

If Bitcoin succeeds, some people will get rich, and while “fix the money, fix the world” is a common saying about Bitcoin, will our lives really change that much if Bitcoin wins?

Meanwhile, the main narrative around AI is that it will… obsolete my work? No thanks, we need to stop this at all costs.

The author and his friends fighting against AI.

Who cares how much energy AI uses? I have bills to pay and I need a job to make money. My only fear is that there won’t be enough of us to stem the tide.

On the other hand, many ordinary people are using AI to create art that they share all day long on social media. cheating on term papers or generate Wojak memes. No doubt many are also using AI for salubrious purposes. The point is that the usefulness of AI is obvious to ordinary people, mitigating any concerns they might have about energy use, in a way that the value of bitcoin is not. (Censorship-resistant payments or hard-to-confiscate assets don’t matter until the day you need them, at which point they’re the only things that matter.)

AI and Bitcoin: Same, but Different

Admittedly, there are some who have raised the alarm about Bitcoin’s energy usage, which are giving the same alarm to the AI. I I wrote articles (It is research reports) in defense of Bitcoin’s energy usage, and while I’m not going to write anything in defense of AI’s energy usage, I’m waiting for the day when its vast energy usage becomes the main argument against AI.

Though I suspect I’ll have to wait a while, because, justified or not, the relative lack of loud noises around AI’s energy usage can be quickly and easily explained: AI and Bitcoin are different.

Please note: The opinions expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Edited by Marc Hochstein.

Bitcoin

Bitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

Risk assets fell on Thursday as China’s second rate cut in a week raised concerns of instability in the world’s second-largest economy.

Bitcoin (BTC)the leading cryptocurrency by market cap, is down nearly 2% since midnight UTC to around $64,000 and ether (ETH) fell more than 5%, dragging the broader altcoin market lower. The CoinDesk 20 Index (CD20), a measure of the broader cryptocurrency market, lost 4.6% in 24 hours.

In equity markets, Germany’s DAX, France’s CAC and the euro zone’s Euro Stoxx 50 all fell more than 1.5%, and futures linked to the tech-heavy Nasdaq 100 were down slightly after the index’s 3% drop on Wednesday, according to the data source. Investing.com.

On Thursday morning, the People’s Bank of China (PBoC) announced a surprise, cut outside the schedule in its one-year medium-term lending rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market. That is the biggest reduction since 2020.

The movement, together with similar reductions in other lending rates earlier this week shows the urgency among policymakers to sustain growth after their recent third plenary offered little hope of a boost. Data released earlier this month showed China’s economy expanded 4.7% in the second quarter at an annualized pace, much weaker than the 5.1% estimated and slower than the 5.3% in the first quarter.

“Equity futures are flat after yesterday’s bloody session that shook sentiment across asset classes,” Ilan Solot, senior global strategist at Marex Solutions, said in a note shared with CoinDesk. “The PBoC’s decision to cut rates in a surprise move has only added to the sense of panic.” Marex Solutions, a division of global financial platform Marex, specializes in creating and distributing custom derivatives products and issuing structured products tied to cryptocurrencies.

Solot noted the continued “steepening of the US Treasury yield curve” as a threat to risk assets including cryptocurrencies, echoing CoinDesk Reports since the beginning of this month.

The yield curve steepens when the difference between longer-duration and shorter-duration bond yields widens. This month, the spread between 10-year and two-year Treasury yields widened by 20 basis points to -0.12 basis points (bps), mainly due to stickier 10-year yields.

“For me, the biggest concern is the shape of the US yield curve, which continues to steepen. The 2- and 10-year curve is not only -12 bps inverted, compared to -50 bps last month. The recent moves have been led by the rise in back-end [10y] yields and lower-than-expected decline in yields,” Solot said.

That’s a sign that markets expect the Fed to cut rates but see tighter inflation and expansionary fiscal policy as growing risks, Solot said.

Bitcoin

How systematic approaches reduce investor risk

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

July 24, 2024, 5:30 p.m.

Updated July 24, 2024, 5:35 p.m.

(Benjamin Cheng/Unsplash)

Fuente

Bitcoin

India to Release Crypto Policy Position by September After Consultations with Stakeholders: Report

“The policy position is how one consults with relevant stakeholders, so it’s to go out in public and say here’s a discussion paper, these are the issues and then stakeholders will give their views,” said Seth, who is the Secretary for Economic Affairs. “A cross-ministerial group is currently looking at a broader policy on cryptocurrencies. We hope to release the discussion paper before September.”

Bitcoin

Bitcoin (BTC), Ether (ETH) slide as risk aversion spreads to crypto markets

Ether, the second-largest token, fueled a slide in digital assets after a stock rout spread unease across global markets.

Ether fell about 6%, the most in three weeks, and was trading at $3,188 as of 6:45 a.m. Thursday in London. Market leader Bitcoin fell about 3% to $64,260.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!