News

What the data really shows

Few platforms have faced as much skepticism as Solana. Critics often describe it as a centralized network plagued by frequent outages. However, that narrative does not align with the actual data and progress witnessed within the Solana ecosystem. This article seeks to dispel these misconceptions by comprehensively analyzing Solana’s key parameters.

Contrary to the prevailing negative perception, Solana shows remarkable growth and innovation on multiple fronts. The growing volumes of stablecoins traded on its network and larger decentralized exchange (DEX) volumes compared to Ethereum highlight Solana’s expanding utility. Additionally, the platform’s superior data rate showcases its technical capabilities and resilience. Additionally, the surge in new addresses and daily active users further reflects the growing trust and adoption among the broader crypto community.

By examining these metrics, this article aims to provide a balanced, data-driven perspective on why Solana is an undervalued asset in the cryptocurrency market as of June 2024.

Centralization

The decentralization of a blockchain network is complex and cannot be evaluated simply on one metric. An in-depth look at how the network is truly decentralized based on every detail could fill an entire article. Therefore, we will focus on the Nakamoto coefficient. The Nakamoto coefficient measures the minimum number of entities in a network needed to collude to disrupt the system. For proof-of-stake networks like Solana and Ethereum, a 33% share is significant, while for proof-of-work networks like Bitcoin, 51% control is crucial.

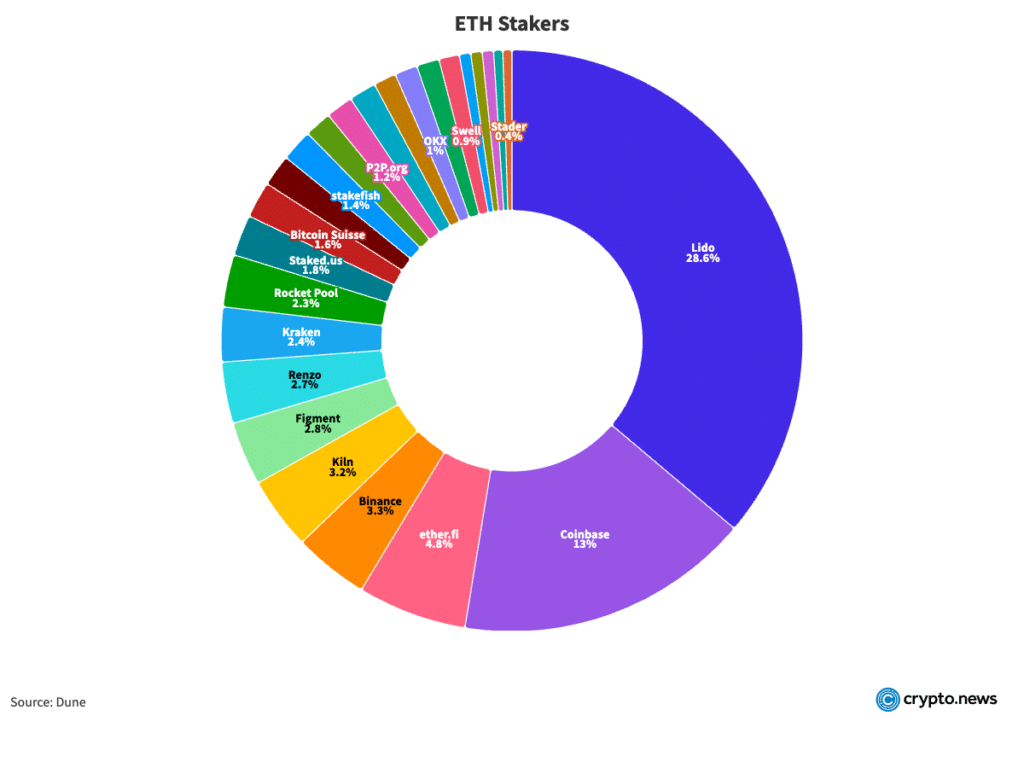

As of June 20, 2024, Solana has 1,525 active validators, including 20 holding more than 33% stake. On the other hand, Ethereum has 1,024,619 active validators, with only two entities controlling more than 33% of the stake. A validator must stake 32 ETH to become a node on the Ethereum network. The problem here is that one entity can control multiple validators, masking the actual level of decentralization.

Active validators and Nakamoto coefficient, June 20, 2024

Second Dune, Lido and Coinbase hold over 33% stake in Ethereum. If each node contains 32 ETH, then of the 1,024,629 active nodes, these two entities potentially control 432,389 unique validators. This concentration of control under two entities undermines the ethics of decentralization.

ETH Stakers Pie Chart, June 20, 2024

For Bitcoin, the network has 17,692 full nodes that have not been pruned, of which 7,516 are capable of disrupting the network. Unfortunately, there is no information about the individual hashrate of each node. The Peer Index (PIX) was used to calculate this number. The PIX value, ranging from 0.0 to 10.0, updates every 24 hours based on node properties and network parameters, with 10.0 being the most desirable. Nodes with a PIX value equal to or greater than 5 were considered.

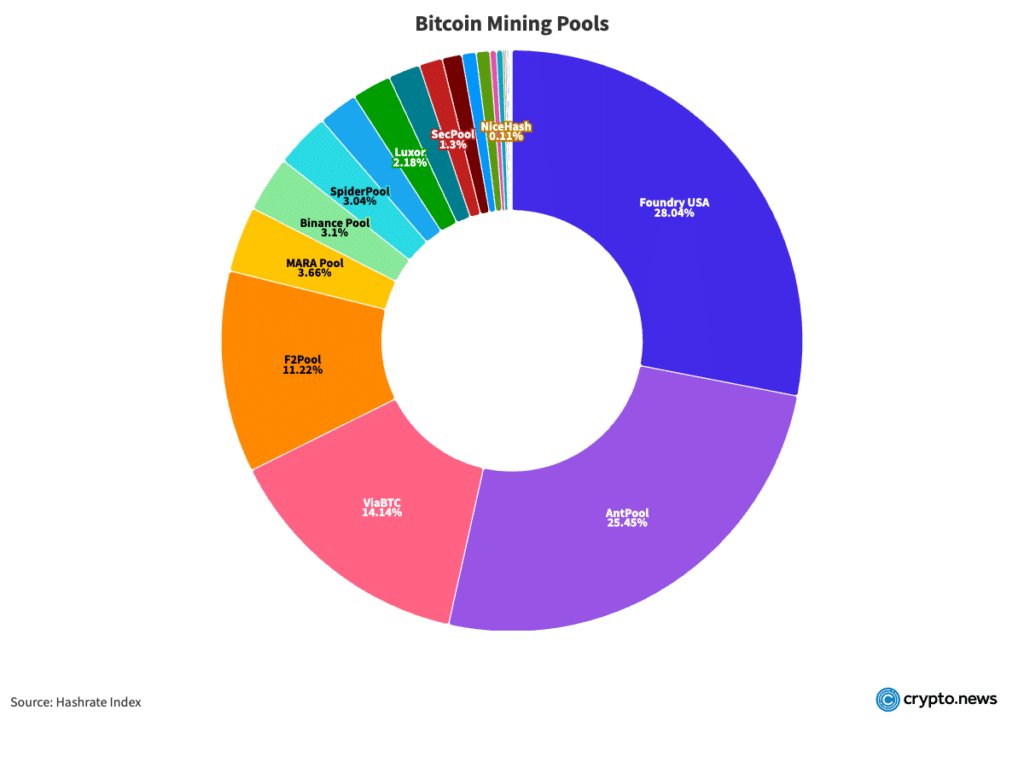

Some may argue that Bitcoin’s decentralization should be assessed through hashrate distribution. Currently, two mining poolsFoundry USA and Antpool, control over 51% of the network’s hashrate.

Bitcoin Mining Pools Pie Chart, June 20, 2024

However, it is incorrect to consider these pools as the controllers of the network because they are pools of individual miners. Mining pools allow miners to combine their computational resources to increase their chances of solving blocks and earning rewards. If a pool begins to act maliciously, individual miners can simply switch to a different pool, maintaining the decentralization of the network.

Although the decentralization of blockchain networks is multifaceted and cannot be accurately assessed by a single metric, the Nakamoto coefficient provides a useful lens for comparison. Solana’s position is not as worrying as it might initially seem. With a Nakamoto coefficient indicating that 20 validators hold more than 33% of the share, Solana appears more decentralized than Ethereum, where only two entities hold more than 33% of the share. Furthermore, even though Solana is not as decentralized as Bitcoin, it still maintains a solid level of decentralization, contributing to its security and reliability.

Stability

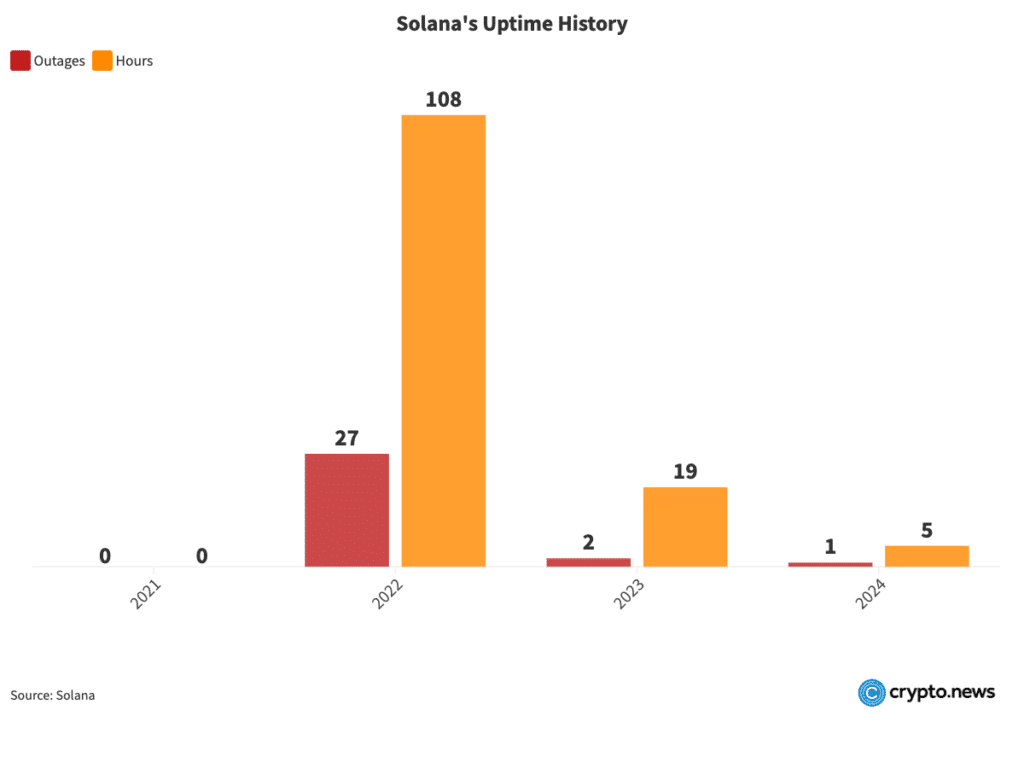

Solana, known for its high-speed transactions and low fees, has faced scrutiny regarding the stability of its network due to numerous outages it has suffered in recent years. However, a closer look reveals that the situation may be exaggerated. The stability of the network becomes evident despite the occasional hiccup when examining Solana’s uptime history.

In 2021, Solana experienced no outages and demonstrated a full year of uninterrupted service. However, 2022 saw a significant increase, with 27 outages totaling 108 hours. Moving forward, 2023 showed notable improvement, with only two outages totaling 19 hours. In 2024, until June 19, the network had only one outage lasting five hours. These numbers, while notable, only tell part of the story.

Solana Uptime Timeline, 2021-2024

When considering uptime, these outages represent a small fraction of total operating hours. For example, in 2022, despite 27 outages, the network maintained functionality 99.47% of the year. Likewise, the 19 hours of downtime in 2023 and 5 hours in 2024 through mid-June represent negligible interruptions in an otherwise stable performance.

The main culprit for these interruptions is Solana’s design. The network emphasizes speed and low costs, which attract heavy usage. This high traffic can lead to congestion and instability. For example, Solana produces a block every 400 ms, much faster than other blockchains. Due to the rapid production speed, when block creation stops for an hour or two, the problem appears more serious. However, other blockchains, including Bitcoin, also face downtime. For example, it took more than two hours to extract the block 689301 next block 689300.

Solana’s strategy of pushing its performance limits allows it to address and solve real-world challenges that theoretical models and simulations cannot predict. This approach is reminiscent of SpaceX’s iterative process of learning from failures to achieve rapid innovation. While some critics view Solana’s historic downtime as a liability, this rigorous testing and troubleshooting phase ultimately provides a significant competitive advantage.

Solana in numbers

Daily active portfolios

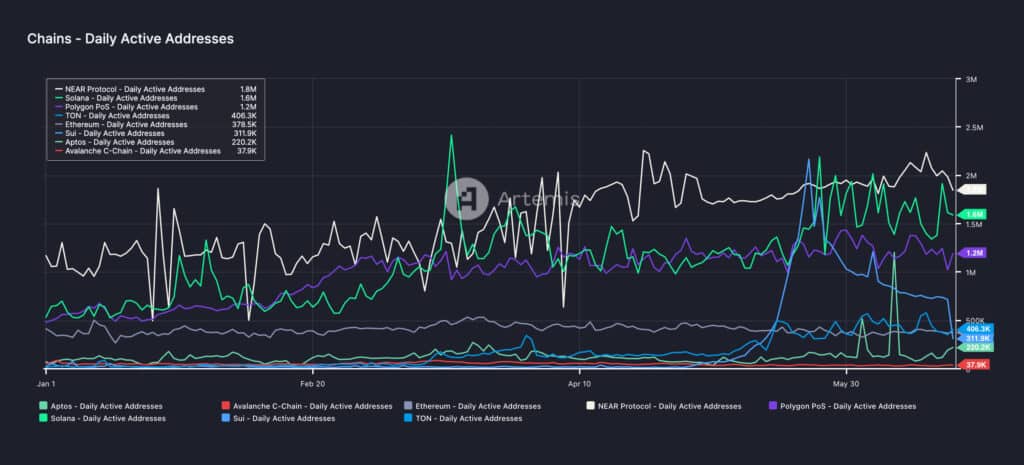

Solana currently has 1,600,000 daily active wallets, significantly higher than Ethereum’s 367,000 daily active wallets.

Daily active addresses, January 2024 – June 2024

Inflows and outflows

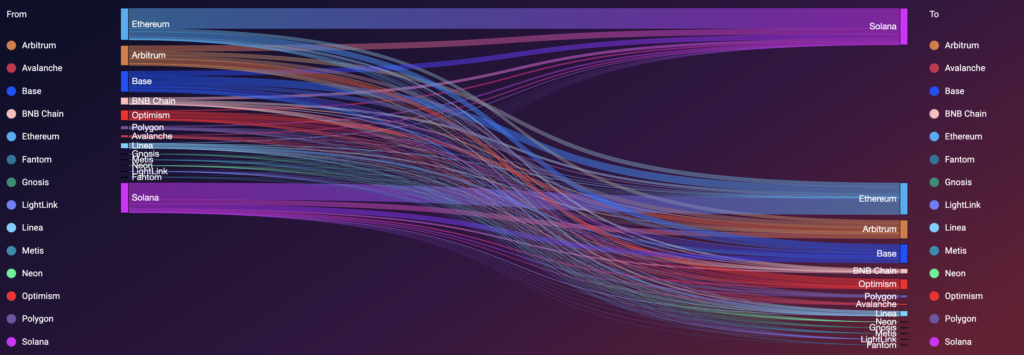

Furthermore, between April 2023 and June 2024, Solana recorded inflows of $801.73 million and outflows of $654.21 million. In contrast, Ethereum recorded inflows of $694.17 million and outflows of $694.1 million. This translates to a net inflow of around $150 million for Solana, compared to Ethereum’s net inflow of around $70,000.

Total amount transferred between bridges, April 2023 – June 2024

Total amount transferred between bridges, April 2023 – June 2024

DEX volumes

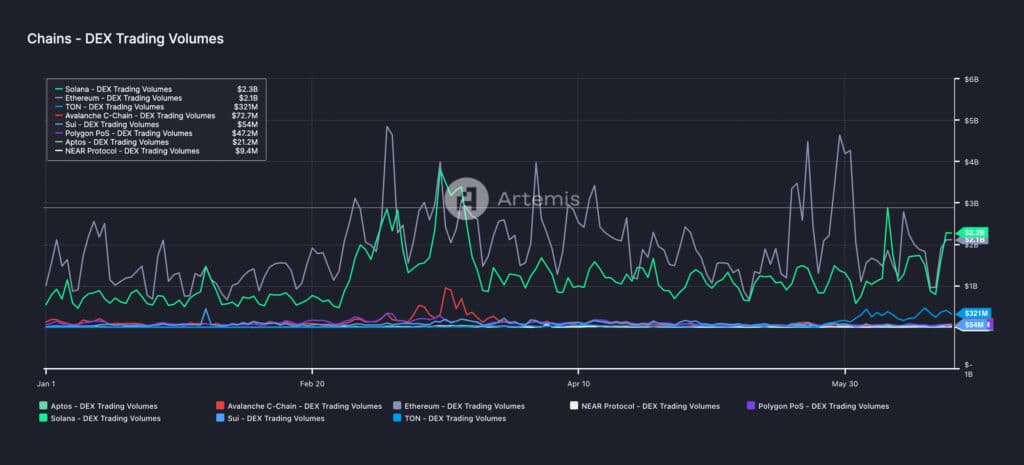

In terms of DEX volumes, Solana also performed excellently. She began to match or exceed Ethereum’s trading volumes on several occasions. This is significant because Solana’s market capitalization is around $63 billion, much lower than Ethereum’s $430 billion. Furthermore, the Solana token was launched just four years ago, compared to Ethereum’s nine years on the market. Despite being newer and smaller, Solana’s ability to compete with Ethereum in DEX volumes shows its potential.

DEX trading volumes, January 2024 – June 2024

Stablecoin transfer volumes

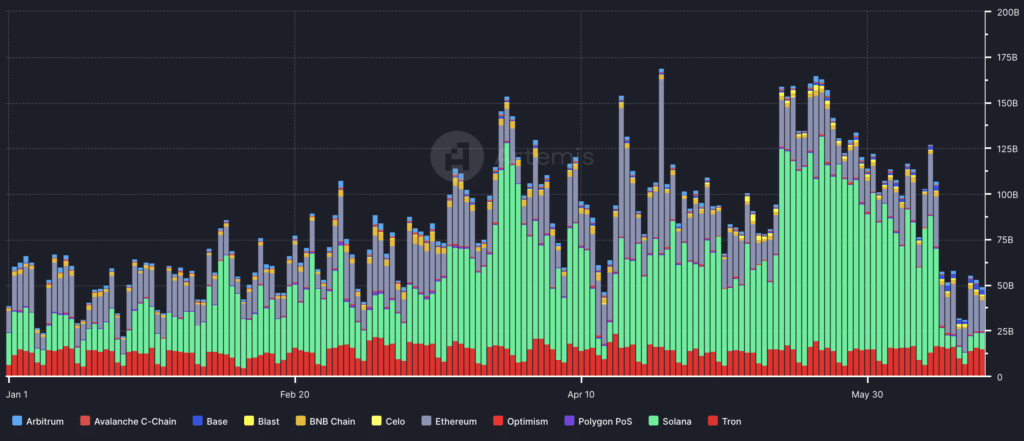

Solana’s high volumes of stablecoin transfers stem from its high transaction speeds and low fees, which make it attractive to users. The network’s ability to process many transactions efficiently supports high-volume activities. Furthermore, Solana’s focus on scalability and user-friendly experience further pushes its dominance in stablecoin transfers.

Stablecoin transfer volumes, January 2024 – June 2024

Income

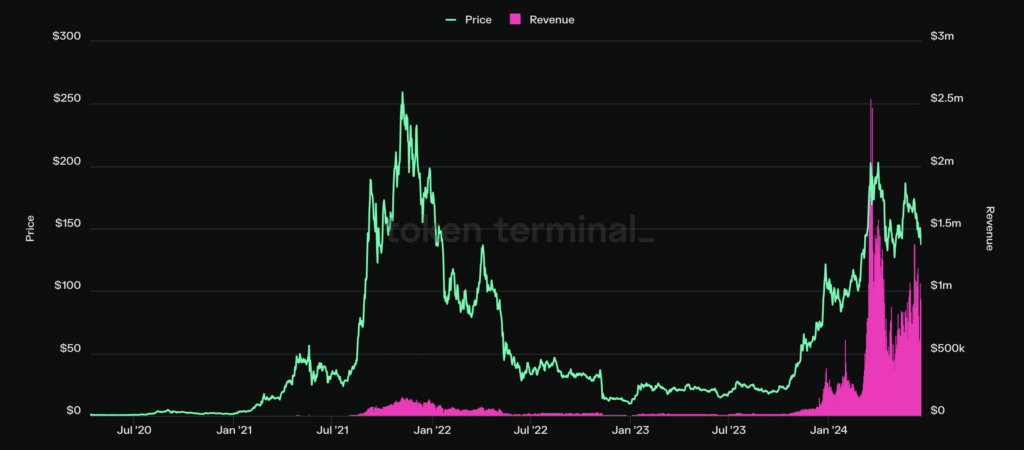

Solana’s revenue increased to 50% of Ethereum’s by mid-2024, an unprecedented level. Historically, during peak periods of activity in 2021 and 2022, Solana’s revenue was less than 1% of Ethereum’s. At the beginning of 2024 this figure stood at around 10%. This dramatic increase in revenue ratio indicates Solana’s growing usage and economic activity on the network.

Solana revenue, April 2020 – June 2024

Conclusion

The narrative of Solana as a centralized and unreliable network does not hold up against the real data. With its strong technical capabilities and growing adoption, Solana demonstrates significant progress and resilience. The Nakamoto coefficient shows that Solana’s decentralization is more favorable than that of Ethereum, with fewer entities required to collude to disrupt the network. While not as decentralized as Bitcoin, Solana still maintains a substantial level of decentralization, which contributes to its security and reliability.

Network stability, often criticized due to past outages, shows marked improvement, with substantial uptime and continuous improvements. Solana’s strategic focus on high performance and scalability results in occasional instability but also rapid innovation and resilience similar to the iterative development seen in other cutting-edge technology fields.

Metrics such as daily active wallets, inflows and outflows, decentralized trading volumes, and revenue indicate Solana’s growing importance in the cryptocurrency ecosystem. Despite its small market capitalization and young age, the network’s ability to handle high transaction volumes at low costs positions it as a formidable competitor to Ethereum.

Overall, Solana’s performance and growth reflects a platform that is not only maturing but also setting new standards in the industry, challenging prevailing negative perceptions and establishing itself as a valuable asset in the market.

Disclosure: This article does not constitute investment advice. The contents and materials on this page are for educational purposes only.

News

How Ether Spot ETF Approval Could Impact Crypto Prices: CNBC Crypto World

ShareShare article via FacebookShare article via TwitterShare article via LinkedInShare article via email

CNBC Crypto World features the latest news and daily trading updates from the digital currency markets and gives viewers a glimpse of what’s to come with high-profile interviews, explainers and unique stories from the ever-changing cryptocurrency industry. On today’s show, Ledn Chief Investment Officer John Glover weighs in on what’s driving cryptocurrency prices right now and how the potential approval of spot ether ETFs could impact markets.

News

Miners’ ‘Capitulation’ Signals Bitcoin Price May Have Bottomed Out: CryptoQuant

According to CryptoQuant, blockchain data shows signs that the Bitcoin mining industry is “capitulating,” a likely precursor to Bitcoin hitting a local price bottom before reaching new highs.

CryptoQuant analyzed metrics for miners, who are responsible for securing the Bitcoin network in exchange for newly minted BTC. As outlined in the market intelligence platform’s Wednesday report, multiple signs of capitulation have emerged over the past month, during which Bitcoin’s price has fallen 13% from $68,791 to $59,603.

One such sign includes a significant drop in Bitcoin’s hash rate, the total computing power that backs Bitcoin. After hitting a record high of 623 exashashes per second (EH/s) on April 27, the hash rate has fallen 7.7% to 576 EH/s, its lowest level in four months.

“Historically, extreme hash rate drawdowns have been associated with price bottoms,” CryptoQuant wrote. In particular, the 7.7% drawdown is reminiscent of an equivalent hash rate drawdown in December 2022, when Bitcoin’s price bottomed at $16,000 before rallying over 300% over the next 15 months.

This latest hash rate drop follows Bitcoin’s fourth cyclical “halving” event in April, which cut the number of coins paid out to miners in half. According to CryptoQuant’s Miner Profit/Loss Sustainability Indicator, this has left miners “mostly extremely underpaid” since April 20, forcing many to shut down mining machines that have now become unprofitable.

CrypotoQuant said that miners faced a 63% drop in daily revenue after the halving, when both Bitcoin block rewards and transaction fee revenues were much higher.

During this time, Bitcoin miners were seen moving coins from their on-chain wallets at a faster rate than usual, indicating that they may be selling their BTC reserves“Daily miner outflows reached their highest volume since May 21,” the company wrote.

Among the sales of Bitcoin miners, whales and national governmentsBitcoin’s price drop in June also hurt Bitcoin’s “hash price,” a metric of Bitcoin Miner Profitability per unit of computing power.

“Average mining revenue per hash (hash price) continues to hover near all-time lows,” CryptoQuant wrote. “Hashprice stands at $0.049 per EH/s, just above the all-time low hashprice of $0.045 reached on May 1st.”

By Ryan-Ozawa.

News

US Congressman French Hill Doubles Down on Trump’s Pro-Crypto Stance

US lawmaker French Hill has noted that Donald Trump will take a more pro-crypto approach than the current administration. The run-up to the presidential election has seen cryptocurrencies become an issue with lawmakers making huge statements ahead of the polls. Donald Trump has also been reaching out to the industry, making a pro-crypto case.

French Hill Backs Trump’s Pro-Crypto Stance

Republican Congressman French Hill has explained the type of cryptocurrency regulatory framework he believes Donald Trump could adopt in the country. In a recent interview with CNBC, French Hill said that the recently passed FIT21 bill is the type of regulatory framework the Trump administration will adopt in the sector.

#FIT21 passed the House with 71 Democratic votes, it’s exactly the kind of digital asset regulatory framework former President Trump would support if re-elected.

See more on @SquawkCNBC🔽 photo.twitter.com/ceTmU4LApU

— French Hill (@RepFrenchHill) July 3, 2024

THE FIT21 Bill It is intended to protect investors and consumers in the market by establishing clear rules and powers for the various regulators in the sector. According to Hill, Trump will adopt it because it directs the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on the specific regulatory framework needed in the market.

“… for people who are innovating and starting a crypto token, a related business, custody of those assets, how to ensure consumer protection, so I think that framework is the right approach and that’s what I’m going to recommend to the President to pass, which is that we have not passed it between now and the end of this Congress.”

He also called Trump an innovative and pro-growth president in financial matters.

Cryptocurrency is going mainstream

This election cycle saw the cryptocurrency industry taking a place in mainstream issues following broader adoption across demographics. From candidates moving toward enthusiasts to recent pro-Congress legislation, cryptocurrencies have become a rallying point for officials. The U.S. regulatory landscape has been criticized for stifling growth due to frequent SEC LawsuitsThis has led executives to push for pro-cryptocurrency laws and raise money for pro-industry candidates.

Read also: Federal Reserve Predicts “AI Will Be Deflationary” to Stimulate Economy

David is a financial news contributor with 4 years of experience in Blockchain and cryptocurrency. He is interested in learning about emerging technologies and has an eye for breaking news. Keeping up to date with trends, David has written in several niches including regulation, partnerships, cryptocurrency, stocks, NFTs, etc. Away from the financial markets, David enjoys cycling and horseback riding.

News

US Court Orders Sam Ikkurty to Pay $84 Million for Cryptocurrency Ponzi Scheme

A federal court has ordered Jafia LLC and its owner, Sam Ikkurty, to pay nearly $84 million to cryptocurrency investors after ruling that the company was operating a Ponzi scheme.

The ruling, issued by Judge Mary Rowland in the U.S. District Court for the Northern District of Illinois, follows a lawsuit filed by the Commodity Futures Trading Commission (CFTC) in 2022 after the fund collapsed.

Judge Rowland found that Ikkurty, based in Portland, Oregon, did numerous false claims on his company’s hedge funds.

These included misleading statements about his trading experience and the promise of high and stable profits. Instead, Ikkurty used funds from new investors to pay off previous investors, a hallmark of a Ponzi scheme.

The Ponzi Scheme

The court found that Ikkurty misappropriated investment funds for personal use without the knowledge of the investors. These funds were used for personal use and were reported as Fraudulent Investmentscausing significant financial losses to customers.

This non-transparent operation violated Transparency Commission regulations, which led to the imposition of a hefty fine to compensate defrauded investors and restore some public confidence in the financial system.

Judge Rowland emphasized that fraudulent activity such as this violates the law and undermines the integrity of modern financial markets. The $84 million award seeks to address the financial harm inflicted on investors and reinforce the importance of legal compliance in cryptocurrency trading.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoCryptocurrency exchanges Binance and KuCoin register with India’s financial intelligence unit as cryptocurrency credibility improves

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!