Bitcoin

GameStop, Bitcoin, Saudi Aramco and Hipgnosis

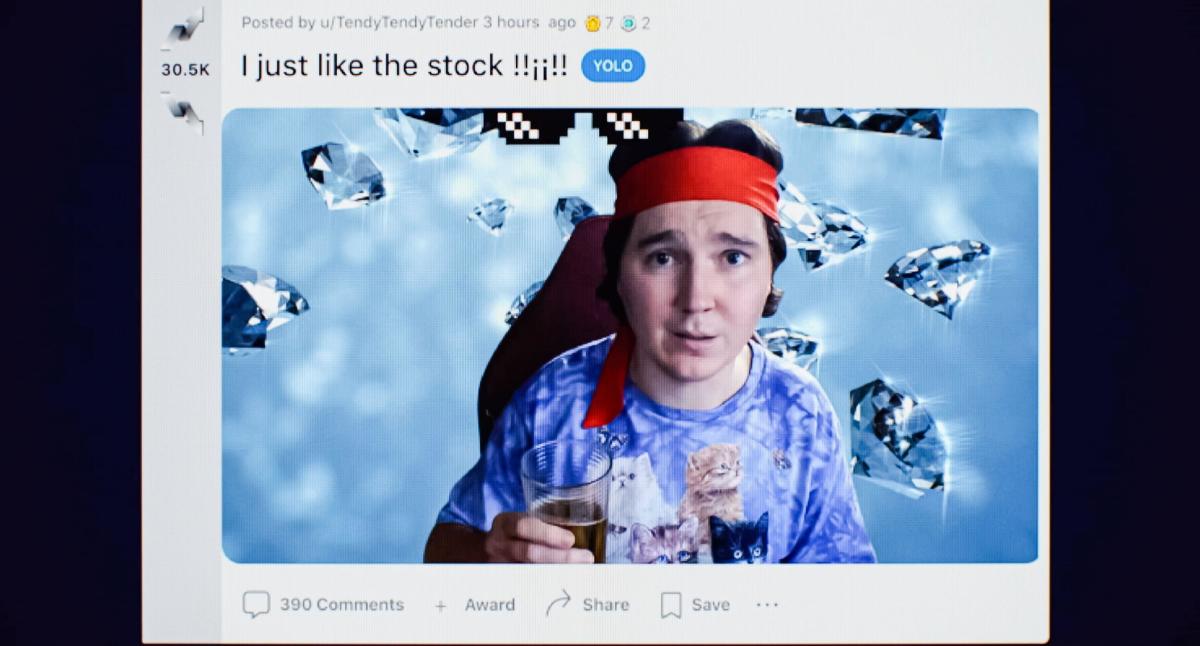

Paul Dano in the 2023 film Dumb Money, which chronicles the January 2021 GameStop short squeeze. GameStop shares soared on Monday after Keith Gill, the man who inspired the 2021 short squeeze, appeared to show a position of $181.4 million in GameStop shares and options. (Reference media, Reference media)

GameStop (GME)

Meme GameStop shares rebounded and were the number one trending ticker in pre-market trading on Monday on speculation that Keith Gill, the man who inspired the 2021 short squeeze, could currently have a significant position at the video game retailer.

Gill, who goes by Roaring Kitty on X and YouTube and DeepF — Value on Reddit, appeared to post a screenshot showing a $181.4 million (£142.6 million) position in GameStop shares and options.

The options would allow him to buy the shares at $20 per share.

See more information: FTSE 100 LIVE: Europe in the green as London shares make biggest jump in a month

“The recent renewed interest in meme stocks, coming as major U.S. indexes struggle to reach new highs, is a sign of excessive exuberance and is more likely a negative omen given the growing headwinds in the markets,” Robert Lea, a Bloomberg Intelligence analyst, he said.

GameStop largely relies on brick-and-mortar stores and has struggled with customers turning to the Internet to buy video games and collectibles.

The price of Bitcoin rose slightly on Monday, adding 1.74% on the day, reaching $68,858 at the time of writing. However, overall it has remained heavily range-bound since failing to break above $70,000 again in late May.

Bitcoin saw little price movement even as El Salvador President Nayib Bukele – who adopted the cryptocurrency as legal tender in 2021 – was re-elected to a second term over the weekend.

See more information: Live Crypto Prices

The price was also supported by Donald Trump fans after the former US president added the option to accept bitcoin as campaign donations.

Despite the drop in earnings, bitcoin investor Peter Brandt is predicting that the cryptocurrency could reach $150,000 by September 2025.

Saudi Aramco (2222.SR)

Saudi Aramco executives are expected to hold a series of events in the UK and US as they look to drum up interest for a $12 billion share sale.

Saudi Arabia’s state-owned oil giant abandoned an international roadshow for its $29.4 billion initial public offering five years ago after foreign investors raised doubts about its valuation expectations, leaving the government dependent on local buyers. .

The story continues

See more information: Stocks that are trending today

However, its secondary listing plans were exceeded within hours of the opening of trading on Sunday.

As a result, Aramco is planning investor-attracting events in London this week, at least one of which will be attended by Chief Executive Amin Nasser, according to Bloomberg News.

The Saudi government owns about 82% of Aramco, while the kingdom’s wealth fund holds an additional 16% stake.

Black stone (BX) announced plans to improve its bid for Hipgnosis as part of a restructured offer for the music rights owner designed to facilitate the completion of the deal.

On Monday, the US private equity firm said it had revised the offer price following discussions with Hipgnosis’ board.

It rose by a cent per share, valuing Hipgnosis at around $1.58 billion (£1.27 billion), a premium of almost 50% over the closing price of Hipgnosis shares before an offer was made .

See more information: Stocks to watch this week: WH Smith, B&M, BAT and Inditex

The two companies had previously agreed to a deal that will see Hipgnosis removed from the public markets.

However, the process was complicated by tensions between the London-listed fund and its founder, Merck Mercuriadis, who runs consultancy firm Hipgnosis Songs Management (HSM).

Watch: What Happened in Meme Star GameStop’s $933 Million Stock Sale

Download the Yahoo Finance app, available for Litter It is Android.

Bitcoin

Bitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

Risk assets fell on Thursday as China’s second rate cut in a week raised concerns of instability in the world’s second-largest economy.

Bitcoin (BTC)the leading cryptocurrency by market cap, is down nearly 2% since midnight UTC to around $64,000 and ether (ETH) fell more than 5%, dragging the broader altcoin market lower. The CoinDesk 20 Index (CD20), a measure of the broader cryptocurrency market, lost 4.6% in 24 hours.

In equity markets, Germany’s DAX, France’s CAC and the euro zone’s Euro Stoxx 50 all fell more than 1.5%, and futures linked to the tech-heavy Nasdaq 100 were down slightly after the index’s 3% drop on Wednesday, according to the data source. Investing.com.

On Thursday morning, the People’s Bank of China (PBoC) announced a surprise, cut outside the schedule in its one-year medium-term lending rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market. That is the biggest reduction since 2020.

The movement, together with similar reductions in other lending rates earlier this week shows the urgency among policymakers to sustain growth after their recent third plenary offered little hope of a boost. Data released earlier this month showed China’s economy expanded 4.7% in the second quarter at an annualized pace, much weaker than the 5.1% estimated and slower than the 5.3% in the first quarter.

“Equity futures are flat after yesterday’s bloody session that shook sentiment across asset classes,” Ilan Solot, senior global strategist at Marex Solutions, said in a note shared with CoinDesk. “The PBoC’s decision to cut rates in a surprise move has only added to the sense of panic.” Marex Solutions, a division of global financial platform Marex, specializes in creating and distributing custom derivatives products and issuing structured products tied to cryptocurrencies.

Solot noted the continued “steepening of the US Treasury yield curve” as a threat to risk assets including cryptocurrencies, echoing CoinDesk Reports since the beginning of this month.

The yield curve steepens when the difference between longer-duration and shorter-duration bond yields widens. This month, the spread between 10-year and two-year Treasury yields widened by 20 basis points to -0.12 basis points (bps), mainly due to stickier 10-year yields.

“For me, the biggest concern is the shape of the US yield curve, which continues to steepen. The 2- and 10-year curve is not only -12 bps inverted, compared to -50 bps last month. The recent moves have been led by the rise in back-end [10y] yields and lower-than-expected decline in yields,” Solot said.

That’s a sign that markets expect the Fed to cut rates but see tighter inflation and expansionary fiscal policy as growing risks, Solot said.

Bitcoin

How systematic approaches reduce investor risk

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

July 24, 2024, 5:30 p.m.

Updated July 24, 2024, 5:35 p.m.

(Benjamin Cheng/Unsplash)

Fuente

Bitcoin

India to Release Crypto Policy Position by September After Consultations with Stakeholders: Report

“The policy position is how one consults with relevant stakeholders, so it’s to go out in public and say here’s a discussion paper, these are the issues and then stakeholders will give their views,” said Seth, who is the Secretary for Economic Affairs. “A cross-ministerial group is currently looking at a broader policy on cryptocurrencies. We hope to release the discussion paper before September.”

Bitcoin

Bitcoin (BTC), Ether (ETH) slide as risk aversion spreads to crypto markets

Ether, the second-largest token, fueled a slide in digital assets after a stock rout spread unease across global markets.

Ether fell about 6%, the most in three weeks, and was trading at $3,188 as of 6:45 a.m. Thursday in London. Market leader Bitcoin fell about 3% to $64,260.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!