Ethereum

EIGEN riches tempt Ethereum developers, even as ETF approval nears

A sudden surge of optimism over the prospect that US regulators could soon approve Ethereum spot ETFs has sent the price of ETH soaring – up 21% this week, its best performance since August 2021.

But beneath the surface, there has been tension within the Ethereum developer community over the future of the largest smart contract blockchain and progress toward decentralization. The sniping became particularly acute with revelations this week that two of the Ethereum Foundation’s biggest stars accepted multimillion-dollar token incentive packages from EigenLayer, the pioneering takeover protocol that was reported to potentially posing a systemic risk to Ethereum. Continue reading.

This article is featured in the latest issue of The protocolour weekly newsletter exploring the technology behind crypto, one block at a time. register here to receive it in your inbox every Wednesday. Please also consult our weekly The protocol podcast.

Dankrad Feist of the Ethereum Foundation, namesake of “danksharding” and central figure in this week’s drama in the Ethereum community (Bradley Keoun)

MEV SNIPER! It’s unclear what exactly sparked all this, but Ethereum’s core developers clashed on social media platform maximum extractable value, or MEV – essentially, the use of sophisticated trading robots to execute user trades at the point of execution. On May 16, Péter Szilágyi, lead developer of Ethereum tweeted about his despair at the lack of progress in solving some of blockchain’s thorniest problems. “Voila, the banking system recreated,” he wrote. One of his arguments was that Ethereum had “glorified” the MEV, remarking, pointedly with sarcasm, that it was “vain to fight against the MEV, so we might as well lean hard on it, right ? (As reported in last week’s issue of The Protocol, even U.S. government officials now appear to be calling MEV a standard operating procedure on the blockchain.) Dankrad Feist, a researcher at the Ethereum Foundation, retweeted Szilágyi’s message with the comment, “This is such a lazy take if you can’t also tell me what your supposed solutions are that allow local block producers to mine MEV.” A back-And-ahead ensued, and then Ethereum co-founder Vitalik Buterin chimed in, tweeting, “I’m really proud that Ethereum doesn’t have a culture of trying to stop people from saying what they think, even if they have very negative feelings about important things in the world. protocol or ecosystem. Buterin, who is known for writing for a long timeinterrupted work on a project in Kenya to create a Essay of more than 3,000 words breaking down the issues, concluding: “I also don’t think the situation is as desperate as Peter’s tweets suggest.”

AND YOU, DANKRAD? Buterin’s tweet referenced in this episode ^^^ triggered a completely different matter Donnybrook. Pseudonymous crypto influencer Cobie responded to Buterin’s tweet, asking the very pointed question about what he thought about “developers or principal researchers taking life-changing $packages from projects built on Ethereum to become ‘advisors’, when those projects may have incentives that conflict with Ethereum, now or in the future. At first it was not very clear what the comment was referring to. But then, like reported by Margaux Nijkerk of CoinDesk, one of the main developers of the Ethereum Foundation, Justin Drake, disclosed that he had taken on an advisory role with EigenFoundation, with “a significant token incentive that could easily be worth more than the combined value of all my other assets (primarily ETH)” and a value of “millions of dollars in tokens acquired over 3 years.” EigenFoundation supports the EigenLayer recovery protocol, a controversial project in part because experts have warned against its potential systemic risks to the Ethereum blockchain. Shortly after, Feist (also mentioned ^^^) confessed that he too had accepted a paid position at EigenFoundation. The news sparked a debate on crypto Twitter over whether advising the EigenFoundation would constitute a conflict of interest. “Even if you make a pinky promise not to let this cloud your judgment and to do it in your personal capacity, it’s impossible,” wrote Lefteris Karapetsas. A clever joker said that Ethereum researchers were “get back together now“.

Last week’s top picks our Village Protocol column, highlighting key blockchain technology upgrades and news.

Throughput-latency graph comparing Mysticeti-C performance with state-of-the-art consensus protocols (Arxiv)

1. Sui Foundationsupporting the Sui blockchain built around the Moving the language of smart contractsannounced the successful deployment of testnet of Mysticetes“a new consensus protocol that reduces consensus time on Sui by 80% to 390ms, making it the fastest consensus layer in the industry,” according to the team.

3. Gnosis revealed “Metri“, an on-chain self-custodial wallet operating within the Gnosis ecosystem allowing a broader set of users to access an area of decentralized finance applications, according to the team.

4.COTI V2describing himself as a “Privacy-centric Layer 2 on Ethereum“, revealed his Devnetfeaturing Garbled Circuits, “an innovation that delivers blockchain privacy 1,000 times faster and 250 times more efficient than current solutions,” according to the team.

5. Bitcoin layer 2 Bitfini presented its Ethereum Virtual Machine (EVM) to bring smart contracts, Bitcoin protocols and leverage runes to enable Bitcoin DeFi applications. Built on the Internet Computer Protocol (ICP), Bitfinity integrates with the Bitcoin network and allows assets to be linked to other blockchains. Internet Computer’s technology stack will allow applications that use Ethereum’s smart contract programming language, Solidity, to access Bitcoin-based tokens.

Cosmos co-founder and Informal Systems CEO Ethan Buchman is expected to speak on the “bitcoinization of Cosmos” at Consensus 2024. (Bradley Keoun)

Bitcoin 2s layer. Resumption of Ethereum. Interoperability. AI. Of pine. Next generation cryptography.

These are just some of the cutting-edge blockchain technology topics on CoinDesk’s agenda. Consensus Conference 2024which will take place from Wednesday, May 29 to Friday, May 31 in Austin, Texas.

For blockchain developers, this is red meat. The three days are packed with opportunities to learn about the hottest crypto technologies across Bitcoin, Ethereum, Solana, Cosmos and XRP Ledger, from the world’s top experts.

We scoured the agenda to identify stages and sessions that might be of interest to blockchain developers and those interested in the technology. Please consult our guide!

WeatherXM “M5” Bundle (WeatherXM)

EDITOR’S NOTE: This blog post by influencer Cobie on abusive crypto fundraising practices is generating a lot of interest. Also see this detailed article on node sales by Calvin Chu of Impossible Finance.

June 11-13: Summitthe XRP Ledger Developer Summit, Amsterdam.

July 8-11: EthCCBrussels.

Ethereum

Cryptocurrency liquidations surpass $200 million as Ethereum and Bitcoin plummet

Cryptocurrency market liquidations hit their highest level in a week on Wednesday as the price of Bitcoin fell below $60,000.

Over the past 24 hours, over 74,000 traders have been liquidated for $208 million, CoinGlass the data shows it.

The majority of those losses, about $184 million, went to investors holding long positions who had bet on a price rise.

The largest liquidations hit Ethereum investors, at $55.5 million, almost entirely on long positions, the data showed.

Current issues surrounding US monetary policy, geopolitical tensions, and the upcoming US presidential election in November are expected to impact the price of the leading cryptocurrency throughout 2024.

Bitcoin abandoned The stock price fell from $62,200 to $59,425 intraday. The asset has since recovered its losses above $60,200, but is still down 3% over the past 24 hours.

Solana, the world’s fifth-largest cryptocurrency by market capitalization, was the worst hit among the top 10 cryptocurrencies, down about 8% to $140. Solana had been riding high on New York investment management firm VanEck’s filing of its Solana Trust exchange-traded fund late last month.

Major cryptocurrencies have been falling over the past month. Ethereum has fallen more than 12% over 30 days despite growing interest in the launch of Ethereum spot ETFs.

Some analysts predict that new financial products could begin marketing in mid-Julywith at least one company predicting that the price of ETH will then take offBitcoin is down 12% over the same period.

Certainly, analysts always see further price increases this yearThe current market cooling represents a precursor to another major price surge in the coming months, Decrypt reported Monday.

On Wednesday, analytics firm CryptoQuant released a report examining Bitcoin Mining Metrics and highlighted the conditions for a return of prices to current levels.

Edited by Sebastian Sinclair.

Ethereum

Volume up 90%: good for ETH price?

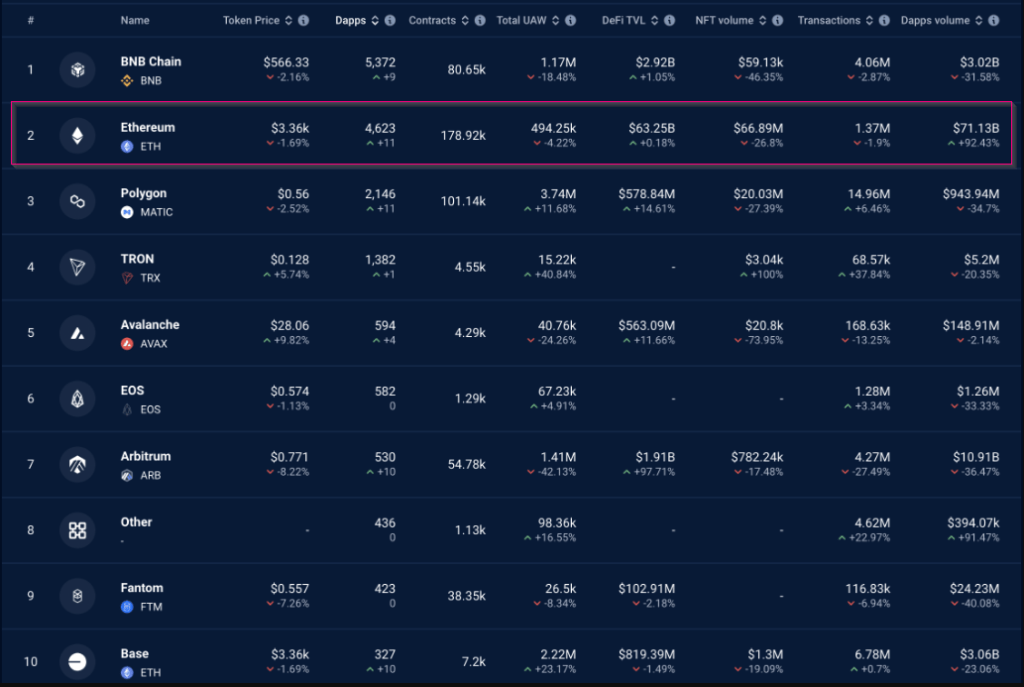

Ethereum (ETH) has emerged as a beacon in the sea of blockchains, with a staggering 92% increase in decentralized application (dApp) volume over the past week. But the news comes with a layer of complexity, revealing a landscape of both opportunity and potential setbacks for the leading blockchain.

Cheap gas fuels the fire

Analysts attribute the explosion in decentralized application volume to the Dencun upgrade in March, which significantly reduced gas costs – the cost associated with processing transactions on the Ethereum network.

Lower transaction fees have always attracted users, and this recent development seems to be no exception. The surge in activity suggests a revitalized Ethereum that is likely to attract new projects and foster a more vibrant dApp ecosystem.

NFT craze drives numbers up

While overall dApp volume (see chart below) paints a positive picture, a closer look reveals a more nuanced story. This surge appears to be driven primarily by an increase in NFT (non-fungible token) trading and staking activity.

Source: DappRadar

Source: DappRadar

Apps like Blur and Uniswap’s NFT aggregator have seen significant surges, highlighting the rise of the NFT market on Ethereum. This trend indicates a thriving niche in the Ethereum dApp landscape, but raises questions about the platform’s diversification beyond NFTs.

A look at user engagement

A curious problem emerges when looking at user engagement metrics. Despite the impressive increase in volume, the number of unique active wallets (UAWs) on the Ethereum network has actually decreased.

Ethereum is now trading at $3,316. Chart: TradingView

This disconnect suggests that current activity could be driven by a smaller, more active user base. While high volume is certainly a positive indicator, seeing broader user participation is essential to ensuring the sustainability of the dApp ecosystem.

A glimmer of hope ?

A positive long-term indicator for Ethereum is the trend of decreasing holdings on the exchange, as reported by Glass nodeThis suggests that ETH holders are moving their assets off exchanges, potentially reducing selling pressure and contributing to price stability.

If this trend continues, ETH could potentially target $4,000 this quarter or even surpass its all-time high. However, this price prediction remains speculative and depends on various market forces.

Ether price expected to rise in coming weeks. Source: CoinCodex

Ether price expected to rise in coming weeks. Source: CoinCodex

Ethereum at a Crossroads

Ethereum is at a crossroads. Dencun Upgrade has clearly revitalized dApp activity, particularly in the NFT space. However, uneven dApp performance and the decline of the UAW are raising concerns about the long-term sustainability of this growth. Network growth, measured by the number of new addresses joining the network, is also slowing, according to Santiment, which could potentially hamper wider adoption.

The short-term price outlook for ETH remains uncertain. While long-term indicators, such as declining exchange holdings, suggest potential for price appreciation, slowing network growth could lead to a price decline in the short term.

Look forward to

The coming months will be crucial for Ethereum. The platform must capitalize on the renewed interest in dApps by attracting a broader user base and fostering a more diverse dApp ecosystem beyond NFTs. Addressing scalability issues and ensuring user-friendly interfaces will also be essential to sustain growth.

If Ethereum can overcome these challenges, it has the potential to cement its position as the premier platform for decentralized applications. However, if it fails to adapt, other waiting blockchains could capitalize on its shortcomings.

Featured image from Pexels, chart from TradingView

Ethereum

Ethereum, Bitcoin, and XRP Behind $1.5 Billion Losses in Cryptocurrency Scams

The first half of 2024 has seen a surge in major hacks in the cryptocurrency sector. Ethereum (ETH)Bitcoin (BTC) and XRP have resulted in losses of over $1.5 billion due to cryptocurrency scams. This year, over 200 major incidents have resulted in losses of approximately $1.56 billion.

Cryptocurrency Scam Losses Reach $1.5 Billion

According to data from Peck Shield Alert, only $319 million in lost crypto funds have been recovered. Furthermore, this year’s losses represent a staggering 293% increase over the same period in 2023, when losses totaled $480 million.

Overview of Cryptocurrency Scams in 2024, Source: PeckShieldAlert | X

Additionally, DeFi protocols have been the top targets for hackers, accounting for 59% of the total value stolen. More than 20 public chains have suffered major hacks during this period. Additionally, Ethereum, Bitcoin, and XRP top the list for the amount lost via cryptocurrency hacks.

Additionally, Ethereum and BNB Chain were the most frequently targeted, each accounting for 31.3% of the total hacks. Meanwhile, Arbitrum followed with 12.5% of the attacks. One of the most significant incidents occurred on June 3, 2024.

Bitcoin DMMa major Japanese cryptocurrency exchange, reported a major breach. Attackers stole 4,502.9 BTC, worth over $300 million at the time. The incident highlighted the vulnerabilities of exchanges, especially those that handle large volumes of digital assets.

Read also : XRP News: Whale Moves 63 Million Coins as Ripple Strengthens Its Case

Major XRP, ETH and BTC hacks

A week after the DMM Bitcoin attack on June 10, UwU Loana decentralized finance (DeFi) lending protocol, was compromised. The breach resulted in a loss of approximately $19.3 million in digital assets. The hack underscores the ongoing risks associated with DeFi platforms, which often operate with less regulatory oversight. The platform later offered a $5 million reward to catch the hacker.

Earlier this year, on February 3, 2024, Ripple co-founder Chris Larsen confirmed a major security breach involving his personal wallets. Initially, rumors circulated that Ripple itself was targeted. However, Larsen clarified that the hack involved his digital wallets and not Ripple’s corporate assets.

The hackers managed to transfer 213 million XRP tokens, worth approximately $112.5 million. Additionally, on-chain detective ZachXBT first alerted the community about the suspicious transactions. In response to the theft, Larsen and various cryptocurrency exchanges took swift action to mitigate the impact.

Several exchanges, including MEXC, Gate, Binance, Kraken, OKX, HTX, and HitBTC, collaborated to freeze a significant portion of the stolen funds. Binance alone froze $4.2 million worth of XRP to aid in the investigation.

Additionally, on April 2, 2024, FixedFloat, a Bitcoin Lightning-based exchange, experienced a security breach. Unauthorized transactions resulted in financial losses exceeding $3 million. This incident highlighted ongoing security issues for FixedFloat, following a similar breach earlier in the year.

The company has also faced significant challenges securing its platform against repeated attacks. Additionally, in February, hackers stole $26 million worth of Ethereum and Bitcoin from FixedFloat. These digital assets were then transferred to exchanges for profit.

Read also : Ethereum Doubles Bitcoin’s Network Fee Revenue, Thanks to Layer-2

Ethereum

Ethereum’s Year-Over-Year Revenue Tops Charts, Hitting $2.7 Billion

Ethereum blockchain has been in first place for a year incomesurpassing all major blockchains.

According to data provided by Lookonchain, Ethereum generated $2.72 billion in annual revenue, surpassing the Bitcoin network by a margin of $1.42 billion. The data shows that Bitcoin accumulated $1.3 billion in revenue over the same period.

Defi Llama Data watch that Ethereum is still the leader in decentralized finance (challenge) with a total value locked (TVL) of $58.4 billion, or 60.9% of the entire market. The blockchain recorded a 30-day fee revenue of $131 million, according to the data aggregator.

Bitcoin’s TVL is currently set at $1 billion.

The network of the second largest cryptocurrency, ETH, witness a 155% year-over-year increase in its fee revenue in the first quarter of this year, as the cryptocurrency market saw a bullish trend.

Tron comes in third with annual revenue of $459 million. Solana and BSC also recorded nine-figure revenues of $241 million and $176 million, respectively.

Notably, Tron is the second largest chain in the challenge scene with a TVL of $7.7 billion. BSC and Solana take third and fourth place with TVLs of $4.8 billion and $4.5 billion, according to Defi Llama.

Avalanche, zkSync Era, Optimism and Polygon reached the top 10 with $68 million, $59 million, $40 million and $23 million in year-over-year revenue, respectively.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!