Bitcoin

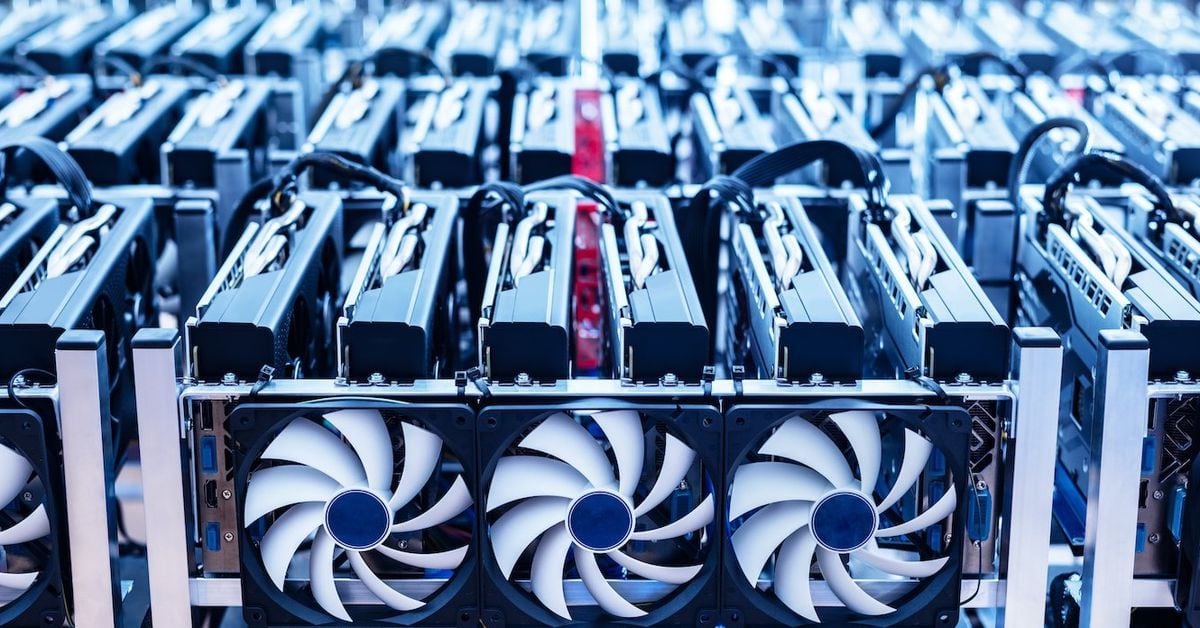

Bitcoin Miner Northern Data Moves to Dismiss Whistleblower Lawsuit by Former Employees

European bitcoin mining company Northern Data is responding to a whistleblower lawsuit filed by two former company executives who claim they were unfairly fired after raising concerns about the company’s financial health and alleging tax evasion.

On Monday night, Northern Data attorneys filed a motion to dismiss the federal case, calling it a “textbook example of bad-faith litigation” and claiming that the two plaintiffs — Gulsen Kama and Joshua Porter — had “brief, unproductive periods at the company,” after which Kama was terminated for cause and Porter was fired for his “lack of productivity.”

“When Porter and Kama made extortionate demands for ‘severance’ payments, Northern Data rejected them,” Northern Data’s attorneys wrote in the motion to dismiss. “In response, both employees now call themselves ‘whistleblowers’ and seek to profit personally and financially from allegations they know—and have every reason to know—are false.”

Monday’s filing also noted that Kama’s lawsuit against Northern Data is not her first round of litigation against her former employers. In 2019, she filed a whistleblower lawsuit against tax preparer Jackson Hewitt, alleging she was wrongfully fired after raising concerns that the company lied about a potential relocation to get a job. $2.7 million tax reduction of New Jersey. Last year, Kama filed a lawsuit against another employer, Quest Diagnostics, alleging workplace discrimination based on her gender and ethnicity. The outcome of those lawsuits was not immediately clear.

An attorney for Kama and Porter did not respond to CoinDesk’s request for comment.

Northern Data’s motion to dismiss is largely procedural in nature, arguing that the California court overseeing the case should dismiss it due to its lack of jurisdiction over the corporate defendants (in this case, the German tech company’s U.S. subsidiaries), which are incorporated in Delaware and have principal places of business in Virginia. The lawyers also argue that the fraud allegations — which they describe as “inflammatory but completely unsupported” — lack sufficient particularity.

A hearing to discuss the motion to dismiss will be held in a Los Angeles court on August 19, 2024 at 1:30 p.m. local time (20:30 UTC).

Kama and Porter’s first amended complaint against their former employer contained explosive allegations that Northern Data lied to investors about the strength of its finances, concealed the fact that it was “nearly insolvent” and was “knowingly committing tax evasion worth potentially tens of millions of dollars.”

The allegations come amid growing media buzz that the Tether-backed tech company is considering a U.S. initial public offering (IPO) of its artificial intelligence unit, which Bloomberg reported was valued at up to US$16 billion.

In their Monday motion, Northern Data’s lawyers declined to comment on market speculation but stressed that if it were true, “the run-up to an IPO is a particularly sensitive time for a company. As plaintiffs are no doubt aware, public accusations of fraud — no matter how irresponsible — can disrupt that process.”

Porter and Kama claimed that the company had a “$30 [million] German tax liability and additional liabilities of almost $8 [million] while simultaneously having only $17 [million] money on balance and a monthly burn rate of $3 [million]-$4 [million].” The lawsuit also alleges that the company engaged in “rampant tax evasion” in its early years and had no plans to take corrective steps to explain it, which would leave it potentially liable for “tens of millions of dollars” in U.S. tax liabilities if it were audited.

Both Kama and Porter claimed they were fired after raising their concerns with supervisors.

A Northern Data spokesperson said the company “refutes the allegations in the strongest terms.”

“It is no coincidence that these allegations from disgruntled former employees have come just days after unconfirmed media speculation that the company is considering a potential capital markets event and shortly before the publication of our 2023 accounts. The allegations are clearly financially motivated and completely unfounded. We will vigorously contest them to protect ourselves against false claims that harm our company and our business.”

The spokesperson added that the company is “well capitalized” and has a “very robust growth plan, with revenue expected to more than triple by 2024.”

Bitcoin

Bitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

Risk assets fell on Thursday as China’s second rate cut in a week raised concerns of instability in the world’s second-largest economy.

Bitcoin (BTC)the leading cryptocurrency by market cap, is down nearly 2% since midnight UTC to around $64,000 and ether (ETH) fell more than 5%, dragging the broader altcoin market lower. The CoinDesk 20 Index (CD20), a measure of the broader cryptocurrency market, lost 4.6% in 24 hours.

In equity markets, Germany’s DAX, France’s CAC and the euro zone’s Euro Stoxx 50 all fell more than 1.5%, and futures linked to the tech-heavy Nasdaq 100 were down slightly after the index’s 3% drop on Wednesday, according to the data source. Investing.com.

On Thursday morning, the People’s Bank of China (PBoC) announced a surprise, cut outside the schedule in its one-year medium-term lending rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market. That is the biggest reduction since 2020.

The movement, together with similar reductions in other lending rates earlier this week shows the urgency among policymakers to sustain growth after their recent third plenary offered little hope of a boost. Data released earlier this month showed China’s economy expanded 4.7% in the second quarter at an annualized pace, much weaker than the 5.1% estimated and slower than the 5.3% in the first quarter.

“Equity futures are flat after yesterday’s bloody session that shook sentiment across asset classes,” Ilan Solot, senior global strategist at Marex Solutions, said in a note shared with CoinDesk. “The PBoC’s decision to cut rates in a surprise move has only added to the sense of panic.” Marex Solutions, a division of global financial platform Marex, specializes in creating and distributing custom derivatives products and issuing structured products tied to cryptocurrencies.

Solot noted the continued “steepening of the US Treasury yield curve” as a threat to risk assets including cryptocurrencies, echoing CoinDesk Reports since the beginning of this month.

The yield curve steepens when the difference between longer-duration and shorter-duration bond yields widens. This month, the spread between 10-year and two-year Treasury yields widened by 20 basis points to -0.12 basis points (bps), mainly due to stickier 10-year yields.

“For me, the biggest concern is the shape of the US yield curve, which continues to steepen. The 2- and 10-year curve is not only -12 bps inverted, compared to -50 bps last month. The recent moves have been led by the rise in back-end [10y] yields and lower-than-expected decline in yields,” Solot said.

That’s a sign that markets expect the Fed to cut rates but see tighter inflation and expansionary fiscal policy as growing risks, Solot said.

Bitcoin

How systematic approaches reduce investor risk

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

July 24, 2024, 5:30 p.m.

Updated July 24, 2024, 5:35 p.m.

(Benjamin Cheng/Unsplash)

Fuente

Bitcoin

India to Release Crypto Policy Position by September After Consultations with Stakeholders: Report

“The policy position is how one consults with relevant stakeholders, so it’s to go out in public and say here’s a discussion paper, these are the issues and then stakeholders will give their views,” said Seth, who is the Secretary for Economic Affairs. “A cross-ministerial group is currently looking at a broader policy on cryptocurrencies. We hope to release the discussion paper before September.”

Bitcoin

Bitcoin (BTC), Ether (ETH) slide as risk aversion spreads to crypto markets

Ether, the second-largest token, fueled a slide in digital assets after a stock rout spread unease across global markets.

Ether fell about 6%, the most in three weeks, and was trading at $3,188 as of 6:45 a.m. Thursday in London. Market leader Bitcoin fell about 3% to $64,260.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!