Bitcoin

Bitcoin Creates New Environmental Injustices for Black Texas

Bitcoin is more than just a shiny new way to lose money. It’s also fueling Texas’ energy woes as the state braces for another year of record-breaking heat. And communities of color are caught in the crosshairs of climate change, those sprawling data centers, and the power plants needed to meet both demands.

Last year, during the deadliest summer in Texas history, Black people bore the brunt of the heat. Stories like the deaths of a 5-day-old Black infant and a 66-year-old Black postal worker from heat illness led to national indignation. The brutal summer only fueled the fire that the state’s power grid operator, the Electric Reliability Council of Texas, has spent years trying to put out.

After a 2021 winter storm revealed just how unprepared the state was for severe weather, Texas was searching for ways to ensure it would be producing enough electricity in times of disaster.

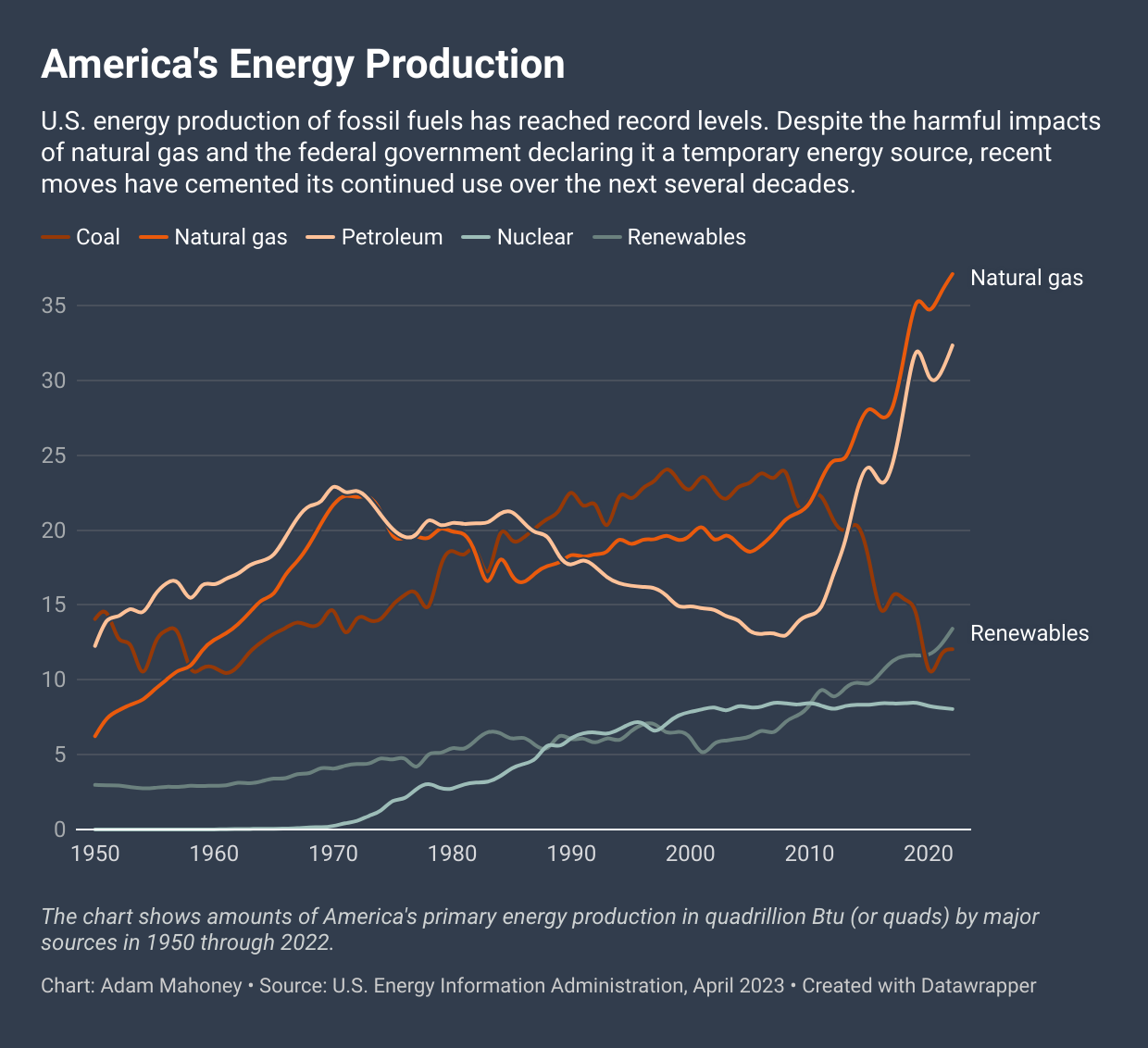

Their solution: new fossil fuel-powered power plants.

But while the state says these new power plants meet demand caused by severe weather and population growth, a new ERCOT Forecast says that as the state’s energy demand doubles over the next six years, most of the demand will come from water and energy consumer data centers for artificial intelligence supercomputers and cryptography processing.

Essentially, this means the state is building polluting power plants that have historically decimated black communities, in part for industries that experts say are increasing economic inequality and discrimination against black Americans.

Despite analysis showing that clean energy sources such as wind and solar are far more reliable and cheaper to produce than energy from fossil fuels, in the aftermath of last summer the state decided to subsidize New gas-fired power plants worth $10 billion.

Across the country, low-income black people are most exposed to pollution from power plants and have the higher risk of death of such pollution. In Texas, more than 75 percent of the state’s gas-fired power plants are in areas where the population has a higher-than-average share of people of color, according to a Capital B analysis of EPA data.

Early documents reviewed by Capital B show that the trend of placing these facilities in communities of color may continue. Of the companies that requested financing and stated that where they would build new factories, about half, or 45 percent, would be in communities with above-average black populations.

“They’re trying to use these ‘volatile’ weather events, the freezing and the heat, as justification for all these new gas plants,” Brittney Stredic told Capital B last year. She’s part of a coalition of community members who have been fighting for a new gas plant and pipeline in her Houston neighborhood for several years. “But we don’t need it.”

Read more: A gas storage plant and new pipeline disrupt life in this black community

Although Texas has recently established itself as the emerging country US renewable energy capitalThese measures signal a setback for the state — and for the climate.

Climate change and the intensified nature of winter and summer are largely caused by the burning of fossil fuels. And Texas’ response is to align itself with industries that have been shown to harm Black communities, experts say.

“There are so many downsides to cryptocurrencies, but unfortunately, the industry has a lot of money, and recently it has been using its money to get favorable policies in Washington, D.C., and places like Texas,” said Algernon Austin, director of Race and Economic Justice at the Center for Economic and Policy Research. Austin has spent years researching how the speculative get-rich-quick scheme targets the country’s most vulnerable.

“Cryptocurrencies are a shiny new way to lose money. The analysis that has been done suggests that, if anything, it has worked to increase inequality,” he added. “It is worrying that it is creating an environmental problem on top of all this.”

Artificial intelligence and cryptomining are immensely energy- and water-intensive due to the power required to process complex algorithms and transactions. As these supercomputers, which are typically three times the size of an average U.S. home, operate, they generate enormous amounts of heat that require continuous cooling — and demand for electricity.

Texas already consumes more energy than any other state, and the pollution from that consumption is palpable. Despite being home to 9 percent of the nation’s population, the state is responsible for 13 percent of all pollution from power plants and 15 percent of all pollution from natural gas plants.

The get-rich-quick mentality

It’s not Texas’ fault that the country’s new state passion for these energy intensive uses of the Internet is driving the need for energy. The energy required to run a single AI search, for example, is between 10 and 30 times the energy required to run a traditional Google search. However, its continued drive to attract business above almost all other considerations can be credited to the state.

Texas residents and experts say that in many ways, the state’s energy woes are driven by a get-rich-quick mentality that prioritizes attractive deals over the resulting strain on the power grid, water sources and rapid population growth.

But the state’s plight exemplifies the crossroads the country finds itself at as it tries to strengthen its power grids: one that can support the most vulnerable populations, like communities of color living near fossil fuel-fired power plants, or align itself with industries that further exacerbate the problems.

Entergy CEO and President Eliecer Viamontes cited that statewide desire as a reason behind his company’s decision to build new fossil fuel power plants in Texas. His company is one of two that have filed applications to open new gas-fired power plants in a predominantly Black and Latino suburb of Houston, where some neighborhoods already face cancer risks from air pollution 46 times higher than federal limits.

“We have to think about how this aligns with what the leadership of the state of Texas is pushing, which is that we have to be the number one state for business, the number one state for economic growth,” Viamontes he said. Without the new plants, he said, “There is a risk of losing economic growth in the region.”

But economic growth for whom, Austin wonders. The rise in cryptofinance in particular, a tool initially marketed as a way to reduce economic inequality, shows that mindset can work directly against improving lives in Black communities.

As state residents were hit by triple-digit heat in August, the grid operator gave millions of dollars for Bitcoin mining and data center companies to stop using so much energy. It’s a tactic Texas may have to use again for several summers to come. (To keep air conditioning running, that summer the state also obtained an emergency order from the U.S. Department of Energy allowing power plants to exceed pollution limits to produce more energy. That left communities of color facing the dual threat of suffocating heat and air pollution.)

“We’ve been incredibly misinformed because our local leaders haven’t made it a priority to talk to us about what’s going on,” said Kimberlee Walter, an activist in a Texas community that’s home to a crypto finance company that received $32 million last summer to use less energy. “These companies are wasting precious resources, driving up our energy bills and destabilizing an already very unstable grid.”

Meanwhile, in recent years, research has found that black people are more probable than white people to invest in cryptocurrencies and are more likely to incorrectly believe that the industry is regulated and safe. Black crypto investors are also more likely than white crypto investors to say they have borrowed money to make their investments.

Cryptocurrency has also increased costs for those who haven’t even invested in the coin. In Texas, it has already increased electricity costs for non-mining Texans by $1.8 billion a year, or 4.7%, according to conservative estimates from consulting firm Wood Mackenzie.

A large portion of these crypto mines have opened around the Dallas metro area, which is among the fastest-growing places for black people and is already home to 1.2 million black people. At least one of the new fossil fuel power plants proposed in a predominantly black community would be built exclusively to power a cryptomining supercomputer.

A natural gas plant lights up the sky near a 90 percent black neighborhood in Beaumont, Texas. (Adam Mahoney/Capital B)

A natural gas plant lights up the sky near a 90 percent black neighborhood in Beaumont, Texas. (Adam Mahoney/Capital B)

As natural gas production surges across the country, energy companies and government agencies are not “adequately addressing the history of the devastation that oil and gas have wrought in the Gulf South and communities of color,” said Robert Bullard, the father of environmental justice.

While clean energy is growing, Texas has a problem getting it to homes. The growth of renewable energy requires expensive transmission lines to move power to urban consumers from rural areas where wind and solar farms are located. But some residents believe the cost and infrastructure construction are worth it.

“The truth is that gas failed us when we needed it most,” the state’s Sierra Club chapter wrote after the subsidies for new plants were announced. “We need to reduce demand on the grid by making buildings more energy efficient, and we need to invest more in local and distributed energy systems like rooftop solar and battery storage. Our climate has changed, no matter how much fossil fuel-funded Texas politicians deny it.”

Bitcoin

Bitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

Risk assets fell on Thursday as China’s second rate cut in a week raised concerns of instability in the world’s second-largest economy.

Bitcoin (BTC)the leading cryptocurrency by market cap, is down nearly 2% since midnight UTC to around $64,000 and ether (ETH) fell more than 5%, dragging the broader altcoin market lower. The CoinDesk 20 Index (CD20), a measure of the broader cryptocurrency market, lost 4.6% in 24 hours.

In equity markets, Germany’s DAX, France’s CAC and the euro zone’s Euro Stoxx 50 all fell more than 1.5%, and futures linked to the tech-heavy Nasdaq 100 were down slightly after the index’s 3% drop on Wednesday, according to the data source. Investing.com.

On Thursday morning, the People’s Bank of China (PBoC) announced a surprise, cut outside the schedule in its one-year medium-term lending rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market. That is the biggest reduction since 2020.

The movement, together with similar reductions in other lending rates earlier this week shows the urgency among policymakers to sustain growth after their recent third plenary offered little hope of a boost. Data released earlier this month showed China’s economy expanded 4.7% in the second quarter at an annualized pace, much weaker than the 5.1% estimated and slower than the 5.3% in the first quarter.

“Equity futures are flat after yesterday’s bloody session that shook sentiment across asset classes,” Ilan Solot, senior global strategist at Marex Solutions, said in a note shared with CoinDesk. “The PBoC’s decision to cut rates in a surprise move has only added to the sense of panic.” Marex Solutions, a division of global financial platform Marex, specializes in creating and distributing custom derivatives products and issuing structured products tied to cryptocurrencies.

Solot noted the continued “steepening of the US Treasury yield curve” as a threat to risk assets including cryptocurrencies, echoing CoinDesk Reports since the beginning of this month.

The yield curve steepens when the difference between longer-duration and shorter-duration bond yields widens. This month, the spread between 10-year and two-year Treasury yields widened by 20 basis points to -0.12 basis points (bps), mainly due to stickier 10-year yields.

“For me, the biggest concern is the shape of the US yield curve, which continues to steepen. The 2- and 10-year curve is not only -12 bps inverted, compared to -50 bps last month. The recent moves have been led by the rise in back-end [10y] yields and lower-than-expected decline in yields,” Solot said.

That’s a sign that markets expect the Fed to cut rates but see tighter inflation and expansionary fiscal policy as growing risks, Solot said.

Bitcoin

How systematic approaches reduce investor risk

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

July 24, 2024, 5:30 p.m.

Updated July 24, 2024, 5:35 p.m.

(Benjamin Cheng/Unsplash)

Fuente

Bitcoin

India to Release Crypto Policy Position by September After Consultations with Stakeholders: Report

“The policy position is how one consults with relevant stakeholders, so it’s to go out in public and say here’s a discussion paper, these are the issues and then stakeholders will give their views,” said Seth, who is the Secretary for Economic Affairs. “A cross-ministerial group is currently looking at a broader policy on cryptocurrencies. We hope to release the discussion paper before September.”

Bitcoin

Bitcoin (BTC), Ether (ETH) slide as risk aversion spreads to crypto markets

Ether, the second-largest token, fueled a slide in digital assets after a stock rout spread unease across global markets.

Ether fell about 6%, the most in three weeks, and was trading at $3,188 as of 6:45 a.m. Thursday in London. Market leader Bitcoin fell about 3% to $64,260.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!