Bitcoin

Bitcoin celebrates Pizza Day with US$70,000: from US$41 pizza to US$700 million fortune

(Kitco News) – May 22nd has a special place in the hearts of crypto fans as it marks what has become known as “Bitcoin Pizza Day”, commemorating the historic event in 2010 when Laszlo Hanyecz, a Bitcoin (Bitcoin), paid 10,000 BTC for two Papa John’s pizzas.

Happy Bitcoin Pizza Day!

On this day in 2010, Laszlo Hanyecz made history by spending 10,000 Bitcoins on two Papa John’s pizzas.

That would be worth over $700 million today!

Legendary!

pic.twitter.com/bXIUF1nJNO

– Bitcoin Archive (@BTC_Archive) May 22, 2024

The event was recorded in the annals of Bitcointalk, where Hanyecz posted about his intentions several days before May 22, 2010, saying he would “pay 10,000 bitcoins for some pizzas… maybe two large ones, so I have some leftovers for the next day.” I like leftover pizza to eat later.”

Post by Laszlo Hanyecz offering to pay 10,000 BTC for two pizzas. Source: Bitcointalk.org

Hanyecz said someone could make it at home and deliver it to him, or buy it from a pizzeria and have it delivered to his house in exchange for 10,000 BTC. On May 22, 2010, he posted: “Just wanted to let you know that I successfully exchanged 10,000 bitcoins for pizza.”

Although the purchase went unnoticed at the time, it now marks an important date of celebration and reflection for the crypto community as it shows the significant increase in price that Bitcoin has experienced over the last fifteen years.

At the time of the transaction, Bitcoin was still just an emerging technology, primarily a subject of experimentation for a handful of enthusiasts and developers.

Since then, Bitcoin has proven to be the best-performing financial asset of all time. The value of 10,000 BTC totaled $41 in 2010, whereas at today’s prices it would be worth almost $700 million.

In retrospect, this represents almost $350 million per pizza and $43.75 million per slice – as a large Papa John’s pizza has eight slices – but who could have imagined at the time that Bitcoin would see the unprecedented price increase What happened?

In the following years, Bitcoin became a global phenomenon and is now accepted by millions of companies and service providers around the world. But it all started with that fateful pizza purchase in 2010, which is why May 22nd will forever be known as “Bitcoin Pizza Day” to the crypto faithful.

More than just an anecdote or trope, the day is a reminder of the potential of cryptocurrencies to transform the global financial system and upend the current status quo of fiat currencies and endless debt issuance.

And with the launch of spot Bitcoin exchange-traded funds (ETFs) in the US at the beginning of the year, the Bitcoin story is just beginning. Pension funds and large institutional investors are now getting in on the action, which could help push BTC towards $100,000, a once unthinkable price point that many now consider almost inevitable.

Despite any subsequent thesis, one fact remains true.

The ONLY solution we have (for any type of financial crisis) is printing money.

AND #Bitcoin it is the largest liquidity sponge in the world.

As the currency depreciates, $BTC higher prices.

$100,000 is not likely, it is inevitable.

– Miles Deutscher (@milesdeutscher) April 15, 2024

Today, Bitcoin Pizza Day is an occasion for the community to celebrate the past and recognize how far they have come, while also providing an opportunity to look optimistically to the future and the emerging Web3 world that will be built on blockchain technology. as its backbone. .

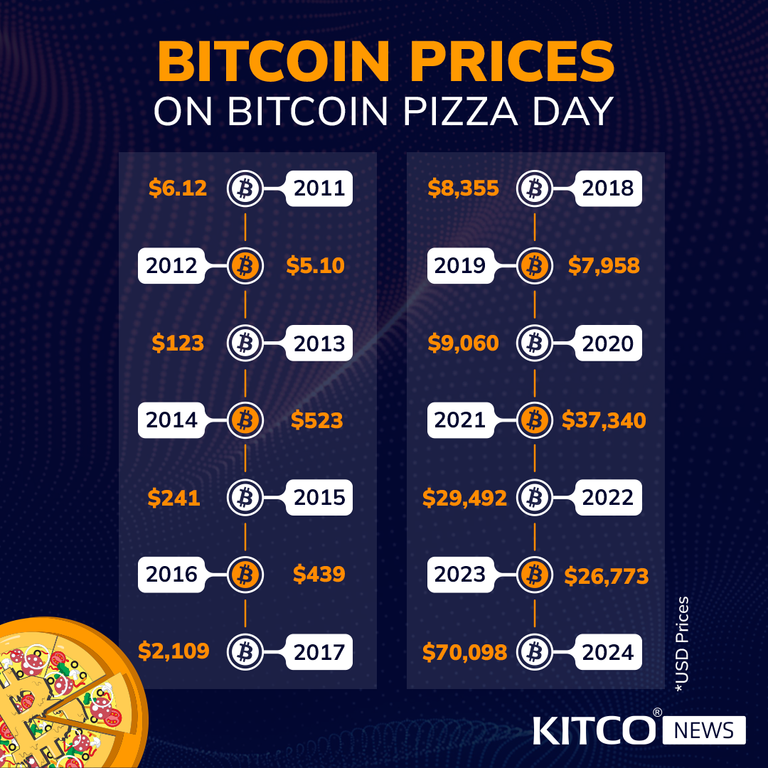

At the time of writing, Bitcoin is trading at $70,500, up 1.05% on the 24-hour chart and up 163.3% from Bitcoin Pizza Day 2023, when BTC it traded for $26,773.

BTC/USD Chart by TradingView

Disclaimer: The opinions expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure the accuracy of the information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes. This is not a request to carry out any exchange of goods, securities or other financial instruments. Kitco Metals Inc. and the author of this article accept no liability for loss and/or damage arising from the use of this publication.

Bitcoin

Bitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

Risk assets fell on Thursday as China’s second rate cut in a week raised concerns of instability in the world’s second-largest economy.

Bitcoin (BTC)the leading cryptocurrency by market cap, is down nearly 2% since midnight UTC to around $64,000 and ether (ETH) fell more than 5%, dragging the broader altcoin market lower. The CoinDesk 20 Index (CD20), a measure of the broader cryptocurrency market, lost 4.6% in 24 hours.

In equity markets, Germany’s DAX, France’s CAC and the euro zone’s Euro Stoxx 50 all fell more than 1.5%, and futures linked to the tech-heavy Nasdaq 100 were down slightly after the index’s 3% drop on Wednesday, according to the data source. Investing.com.

On Thursday morning, the People’s Bank of China (PBoC) announced a surprise, cut outside the schedule in its one-year medium-term lending rate to 2.3% from 2.5%, injecting 200 billion yuan ($27.5 billion) of liquidity into the market. That is the biggest reduction since 2020.

The movement, together with similar reductions in other lending rates earlier this week shows the urgency among policymakers to sustain growth after their recent third plenary offered little hope of a boost. Data released earlier this month showed China’s economy expanded 4.7% in the second quarter at an annualized pace, much weaker than the 5.1% estimated and slower than the 5.3% in the first quarter.

“Equity futures are flat after yesterday’s bloody session that shook sentiment across asset classes,” Ilan Solot, senior global strategist at Marex Solutions, said in a note shared with CoinDesk. “The PBoC’s decision to cut rates in a surprise move has only added to the sense of panic.” Marex Solutions, a division of global financial platform Marex, specializes in creating and distributing custom derivatives products and issuing structured products tied to cryptocurrencies.

Solot noted the continued “steepening of the US Treasury yield curve” as a threat to risk assets including cryptocurrencies, echoing CoinDesk Reports since the beginning of this month.

The yield curve steepens when the difference between longer-duration and shorter-duration bond yields widens. This month, the spread between 10-year and two-year Treasury yields widened by 20 basis points to -0.12 basis points (bps), mainly due to stickier 10-year yields.

“For me, the biggest concern is the shape of the US yield curve, which continues to steepen. The 2- and 10-year curve is not only -12 bps inverted, compared to -50 bps last month. The recent moves have been led by the rise in back-end [10y] yields and lower-than-expected decline in yields,” Solot said.

That’s a sign that markets expect the Fed to cut rates but see tighter inflation and expansionary fiscal policy as growing risks, Solot said.

Bitcoin

How systematic approaches reduce investor risk

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

Low liquidity, regulatory uncertainty and speculative behavior contribute to inefficiency in crypto markets. But systematic approaches, including momentum indices, can reduce risks for investors, says Gregory Mall, head of investment solutions at AMINA Bank.

July 24, 2024, 5:30 p.m.

Updated July 24, 2024, 5:35 p.m.

(Benjamin Cheng/Unsplash)

Fuente

Bitcoin

India to Release Crypto Policy Position by September After Consultations with Stakeholders: Report

“The policy position is how one consults with relevant stakeholders, so it’s to go out in public and say here’s a discussion paper, these are the issues and then stakeholders will give their views,” said Seth, who is the Secretary for Economic Affairs. “A cross-ministerial group is currently looking at a broader policy on cryptocurrencies. We hope to release the discussion paper before September.”

Bitcoin

Bitcoin (BTC), Ether (ETH) slide as risk aversion spreads to crypto markets

Ether, the second-largest token, fueled a slide in digital assets after a stock rout spread unease across global markets.

Ether fell about 6%, the most in three weeks, and was trading at $3,188 as of 6:45 a.m. Thursday in London. Market leader Bitcoin fell about 3% to $64,260.

-

News12 months ago

News12 months agoCryptocurrency exchanges Binance and KuCoin register with India’s financial intelligence unit as cryptocurrency credibility improves

-

News10 months ago

News10 months agoMiners’ ‘Capitulation’ Signals Bitcoin Price May Have Bottomed Out: CryptoQuant

-

Bitcoin9 months ago

Bitcoin9 months agoBitcoin (BTC), Stocks Bleed as China’s Surprise Rate Cut Signals Panic, Treasury Yield Curve Steepens

-

Altcoin9 months ago

Altcoin9 months agoOn-chain data confirms whales are preparing for altcoin surge with increased buy orders

-

Videos12 months ago

Videos12 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Videos12 months ago

Videos12 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Bitcoin12 months ago

Bitcoin12 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos12 months ago

Videos12 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos11 months ago

Videos11 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!

-

Videos12 months ago

Videos12 months agoCryptocurrency Crash Caused by THIS…

-

Videos12 months ago

Videos12 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin12 months ago

Altcoin12 months agoBinance Announces Investment: Altcoin Price Jumps!