Ethereum

Apple soars, Bitcoin and Ethereum fall: Tuesday’s market trends

Yahoo Finance Jared Blikre joins Asking for a Trend to break down Tuesday’s market trends.

Apple (AAPL) reached a new all-time high, up around 7% during the day. Blikre notes that the likelihood of this move being a false breakout is an unlikely, high-risk scenario.

Inventory volume across the market has fallen recently. Although volume is currently below average, Blikre believes it will normalize over the summer.

Finally, bitcoin (BTC-USD) and Ethereum (ETH-USD) are experiencing their worst day in five weeks, which they also hope to normalize over the coming months.

For more expert insights and the latest market action, click here to watch this full episode of Asking for a Trend.

This article was written by Mélanie Riehl

Video transcription

And the S and P 500 NASDAQ closes at a new high as Apple S hits record high here with more takeaways from the trading day.

Let’s jump straight to Yahoo.

Jared Blicker of Finance.

Jared.

Thanks, Josh.

Guess what?

I’m going to call it a comeback because Apple hasn’t been going anywhere for years.

You can see it’s up 7% today, the best day in several years.

This is what it looks like today.

I’ll show you the last two years and you’ll see what I mean by this breakout.

Uh we weren’t going anywhere uh for quite a long time here and only recently uh we can see it over the last five years, which includes the whole pandemic.

In fact, there was a lot of secondary action here.

So we’ve reached new nominal highs, but now we’re finally revealing what’s interesting about it.

And uh by the way, let me just show you our takeaway board, uh nicely prepared for us.

It’s Apple that reaches a new all-time high, but I did a study and so I took a signal day like today.

So if you have an apple that gains 3% and hits a new high.

I calculated that this has happened 15 times in the last 20 years and we only allow one signal per quarter.

What’s important is what happens afterward.

So, a day later, up 4/10 of a percent, only four times out of 10 is positive.

But you start looking at a week, a month, a quarter, a year later, up to 88%.

These are very good stats, even for a stock that is mostly up, because there are long periods of breakouts and it eventually goes up.

What is the risk here for this?

Because we’re looking at average gains of around 30% over the next year.

It’s the V that’s going to look at this in a second here.

But what I want to show you is this Apple graphic again.

So we’re looking at five years here.

The risk is that this is a false breakout and that we immediately go back down in the coming days and then go back down even further.

The story continues

But that’s the Iris scenario, but it’s a low probability.

That’s not what I think is going to happen.

And so for the market, Jared, what’s more important to remember when you know, a name like Apple is starting to work like that again.

Yeah.

So we’ve been talking about this NVIDIA story, which is the AI story, for a very long time.

Apple has sort of been left behind and you can see that in the year-to-date totals.

Even Apple pretty much breaks even to start the day for the entire year.

NVIDIA up 144%.

NVIDIA got all the action.

NVIDIA may be a little tired here.

So it would be entirely fitting if another major title could carry the AI banner for a while.

Um, Apple is still a leader in the stock market over the last 10 years.

So it’s probably comfortable for a lot of people to see him in the lead again.

Um, I see that as a big positive for the market.

All right, Jared Blu point number two.

Yes, we are facing market complacency.

So let me move on here.

Apple has reached an all-time high, but inventory volume has fallen recently.

Let me give you some statistics.

So I’m looking at uh spy volume spy, it’s uh, I’m tracking the S and P 500 spider ETF which is kind of an indicator of the market as a whole.

I recently saw the lowest amount of spying in years and sometimes what happens in the summer is good.

In May, June comes, you see a little volume flag, but it’s extreme.

I don’t mean extreme, but I mean more than average.

We are therefore seeing a volume below average.

What this reminds me of is, a few summers ago in 2022 we had this big bear market?

Everyone was a little scared.

Um, we’ve seen the stocks for a little while.

They managed to get up.

And so there was this feeling in the market that everything was going well.

But I think, you know, the old adage, “hedge in May or excuse me, sell in May and go,” should be replaced with “hedge in May and go.”

And I think that’s just what we’re seeing here.

Finally, I just found my card.

Here’s 2022, here’s that summer rally I was watching.

And I just think that market participants are just not very active this summer.

I think they got their positions on their hurdles and they kind of pulled away for a little 3rd, 3rd 1, Jerry.

We will come back to this very quickly.

This is due to Bitcoin, Bitcoin and Ether having their worst day in five weeks.

So I’m going to move on to the charts very quickly.

I showed the, uh Bitcoin Board, the Ether board at the close today and you can see once I load them up here, uh, just give me two seconds and here we go.

Um, you can see a lot of dark red on the screen.

This is Bitcoin.

What I have emphasized since the beginning of the year is that we are in a negotiating range.

So this could be the worst day we’ve had in a few weeks, maybe in a month or so.

But until we break out of that range, up or down, it doesn’t mean much.

And you take a look at Ether.

It’s a pretty similar chart.

So.

Just a little bit higher trading rate very quickly.

Does that tell me anything about the risk appetite as the feds approach, you know, a good question.

Um, Bitcoin has been correlated over the past few years.

You know, with risk, risk appetite before the meeting.

I don’t know, because in the case of copper, it’s kind of the appetite for risk that has reached a new high.

Then it fell to a new low.

You take it, you put that in conjunction, the commodities market with the crypto market, maybe risk is a little tired right now and you, you kind of put that, uh, with my thesis previous in the market, the market could be on the move. autopilot until the end of summer and that plays a role.

So I’m not expecting a huge shake-up tomorrow at the Fed meeting, but maybe things are a little more dicey than bubbly.

All right, we’ll wait and see, Jared.

Thank you my friend.

Appreciate.

Ethereum

Cryptocurrency liquidations surpass $200 million as Ethereum and Bitcoin plummet

Cryptocurrency market liquidations hit their highest level in a week on Wednesday as the price of Bitcoin fell below $60,000.

Over the past 24 hours, over 74,000 traders have been liquidated for $208 million, CoinGlass the data shows it.

The majority of those losses, about $184 million, went to investors holding long positions who had bet on a price rise.

The largest liquidations hit Ethereum investors, at $55.5 million, almost entirely on long positions, the data showed.

Current issues surrounding US monetary policy, geopolitical tensions, and the upcoming US presidential election in November are expected to impact the price of the leading cryptocurrency throughout 2024.

Bitcoin abandoned The stock price fell from $62,200 to $59,425 intraday. The asset has since recovered its losses above $60,200, but is still down 3% over the past 24 hours.

Solana, the world’s fifth-largest cryptocurrency by market capitalization, was the worst hit among the top 10 cryptocurrencies, down about 8% to $140. Solana had been riding high on New York investment management firm VanEck’s filing of its Solana Trust exchange-traded fund late last month.

Major cryptocurrencies have been falling over the past month. Ethereum has fallen more than 12% over 30 days despite growing interest in the launch of Ethereum spot ETFs.

Some analysts predict that new financial products could begin marketing in mid-Julywith at least one company predicting that the price of ETH will then take offBitcoin is down 12% over the same period.

Certainly, analysts always see further price increases this yearThe current market cooling represents a precursor to another major price surge in the coming months, Decrypt reported Monday.

On Wednesday, analytics firm CryptoQuant released a report examining Bitcoin Mining Metrics and highlighted the conditions for a return of prices to current levels.

Edited by Sebastian Sinclair.

Ethereum

Volume up 90%: good for ETH price?

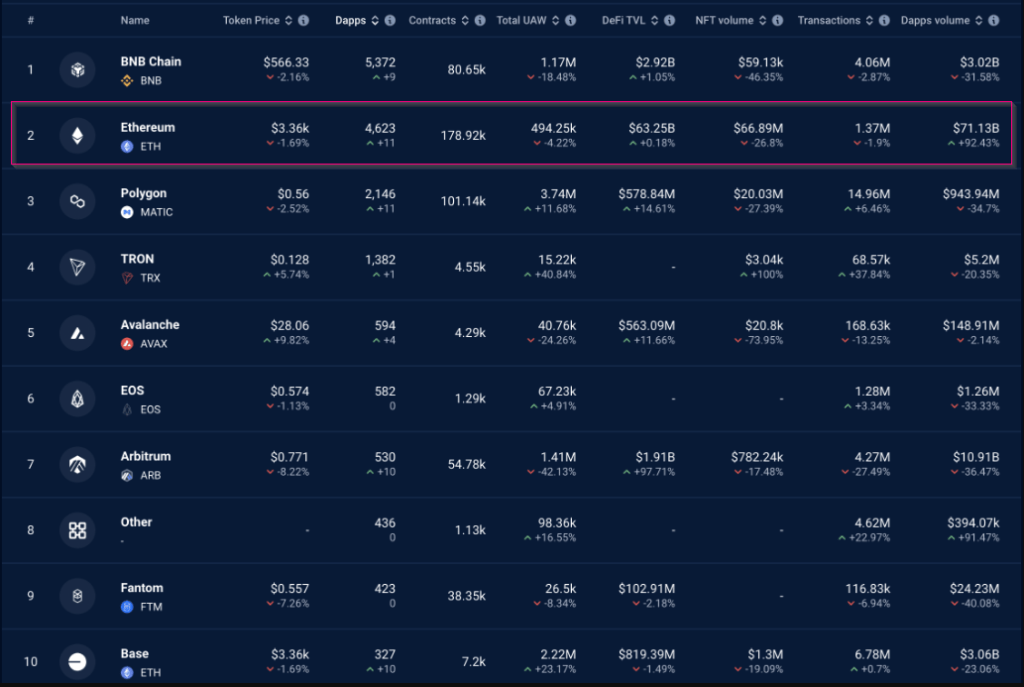

Ethereum (ETH) has emerged as a beacon in the sea of blockchains, with a staggering 92% increase in decentralized application (dApp) volume over the past week. But the news comes with a layer of complexity, revealing a landscape of both opportunity and potential setbacks for the leading blockchain.

Cheap gas fuels the fire

Analysts attribute the explosion in decentralized application volume to the Dencun upgrade in March, which significantly reduced gas costs – the cost associated with processing transactions on the Ethereum network.

Lower transaction fees have always attracted users, and this recent development seems to be no exception. The surge in activity suggests a revitalized Ethereum that is likely to attract new projects and foster a more vibrant dApp ecosystem.

NFT craze drives numbers up

While overall dApp volume (see chart below) paints a positive picture, a closer look reveals a more nuanced story. This surge appears to be driven primarily by an increase in NFT (non-fungible token) trading and staking activity.

Source: DappRadar

Source: DappRadar

Apps like Blur and Uniswap’s NFT aggregator have seen significant surges, highlighting the rise of the NFT market on Ethereum. This trend indicates a thriving niche in the Ethereum dApp landscape, but raises questions about the platform’s diversification beyond NFTs.

A look at user engagement

A curious problem emerges when looking at user engagement metrics. Despite the impressive increase in volume, the number of unique active wallets (UAWs) on the Ethereum network has actually decreased.

Ethereum is now trading at $3,316. Chart: TradingView

This disconnect suggests that current activity could be driven by a smaller, more active user base. While high volume is certainly a positive indicator, seeing broader user participation is essential to ensuring the sustainability of the dApp ecosystem.

A glimmer of hope ?

A positive long-term indicator for Ethereum is the trend of decreasing holdings on the exchange, as reported by Glass nodeThis suggests that ETH holders are moving their assets off exchanges, potentially reducing selling pressure and contributing to price stability.

If this trend continues, ETH could potentially target $4,000 this quarter or even surpass its all-time high. However, this price prediction remains speculative and depends on various market forces.

Ether price expected to rise in coming weeks. Source: CoinCodex

Ether price expected to rise in coming weeks. Source: CoinCodex

Ethereum at a Crossroads

Ethereum is at a crossroads. Dencun Upgrade has clearly revitalized dApp activity, particularly in the NFT space. However, uneven dApp performance and the decline of the UAW are raising concerns about the long-term sustainability of this growth. Network growth, measured by the number of new addresses joining the network, is also slowing, according to Santiment, which could potentially hamper wider adoption.

The short-term price outlook for ETH remains uncertain. While long-term indicators, such as declining exchange holdings, suggest potential for price appreciation, slowing network growth could lead to a price decline in the short term.

Look forward to

The coming months will be crucial for Ethereum. The platform must capitalize on the renewed interest in dApps by attracting a broader user base and fostering a more diverse dApp ecosystem beyond NFTs. Addressing scalability issues and ensuring user-friendly interfaces will also be essential to sustain growth.

If Ethereum can overcome these challenges, it has the potential to cement its position as the premier platform for decentralized applications. However, if it fails to adapt, other waiting blockchains could capitalize on its shortcomings.

Featured image from Pexels, chart from TradingView

Ethereum

Ethereum, Bitcoin, and XRP Behind $1.5 Billion Losses in Cryptocurrency Scams

The first half of 2024 has seen a surge in major hacks in the cryptocurrency sector. Ethereum (ETH)Bitcoin (BTC) and XRP have resulted in losses of over $1.5 billion due to cryptocurrency scams. This year, over 200 major incidents have resulted in losses of approximately $1.56 billion.

Cryptocurrency Scam Losses Reach $1.5 Billion

According to data from Peck Shield Alert, only $319 million in lost crypto funds have been recovered. Furthermore, this year’s losses represent a staggering 293% increase over the same period in 2023, when losses totaled $480 million.

Overview of Cryptocurrency Scams in 2024, Source: PeckShieldAlert | X

Additionally, DeFi protocols have been the top targets for hackers, accounting for 59% of the total value stolen. More than 20 public chains have suffered major hacks during this period. Additionally, Ethereum, Bitcoin, and XRP top the list for the amount lost via cryptocurrency hacks.

Additionally, Ethereum and BNB Chain were the most frequently targeted, each accounting for 31.3% of the total hacks. Meanwhile, Arbitrum followed with 12.5% of the attacks. One of the most significant incidents occurred on June 3, 2024.

Bitcoin DMMa major Japanese cryptocurrency exchange, reported a major breach. Attackers stole 4,502.9 BTC, worth over $300 million at the time. The incident highlighted the vulnerabilities of exchanges, especially those that handle large volumes of digital assets.

Read also : XRP News: Whale Moves 63 Million Coins as Ripple Strengthens Its Case

Major XRP, ETH and BTC hacks

A week after the DMM Bitcoin attack on June 10, UwU Loana decentralized finance (DeFi) lending protocol, was compromised. The breach resulted in a loss of approximately $19.3 million in digital assets. The hack underscores the ongoing risks associated with DeFi platforms, which often operate with less regulatory oversight. The platform later offered a $5 million reward to catch the hacker.

Earlier this year, on February 3, 2024, Ripple co-founder Chris Larsen confirmed a major security breach involving his personal wallets. Initially, rumors circulated that Ripple itself was targeted. However, Larsen clarified that the hack involved his digital wallets and not Ripple’s corporate assets.

The hackers managed to transfer 213 million XRP tokens, worth approximately $112.5 million. Additionally, on-chain detective ZachXBT first alerted the community about the suspicious transactions. In response to the theft, Larsen and various cryptocurrency exchanges took swift action to mitigate the impact.

Several exchanges, including MEXC, Gate, Binance, Kraken, OKX, HTX, and HitBTC, collaborated to freeze a significant portion of the stolen funds. Binance alone froze $4.2 million worth of XRP to aid in the investigation.

Additionally, on April 2, 2024, FixedFloat, a Bitcoin Lightning-based exchange, experienced a security breach. Unauthorized transactions resulted in financial losses exceeding $3 million. This incident highlighted ongoing security issues for FixedFloat, following a similar breach earlier in the year.

The company has also faced significant challenges securing its platform against repeated attacks. Additionally, in February, hackers stole $26 million worth of Ethereum and Bitcoin from FixedFloat. These digital assets were then transferred to exchanges for profit.

Read also : Ethereum Doubles Bitcoin’s Network Fee Revenue, Thanks to Layer-2

Ethereum

Ethereum’s Year-Over-Year Revenue Tops Charts, Hitting $2.7 Billion

Ethereum blockchain has been in first place for a year incomesurpassing all major blockchains.

According to data provided by Lookonchain, Ethereum generated $2.72 billion in annual revenue, surpassing the Bitcoin network by a margin of $1.42 billion. The data shows that Bitcoin accumulated $1.3 billion in revenue over the same period.

Defi Llama Data watch that Ethereum is still the leader in decentralized finance (challenge) with a total value locked (TVL) of $58.4 billion, or 60.9% of the entire market. The blockchain recorded a 30-day fee revenue of $131 million, according to the data aggregator.

Bitcoin’s TVL is currently set at $1 billion.

The network of the second largest cryptocurrency, ETH, witness a 155% year-over-year increase in its fee revenue in the first quarter of this year, as the cryptocurrency market saw a bullish trend.

Tron comes in third with annual revenue of $459 million. Solana and BSC also recorded nine-figure revenues of $241 million and $176 million, respectively.

Notably, Tron is the second largest chain in the challenge scene with a TVL of $7.7 billion. BSC and Solana take third and fourth place with TVLs of $4.8 billion and $4.5 billion, according to Defi Llama.

Avalanche, zkSync Era, Optimism and Polygon reached the top 10 with $68 million, $59 million, $40 million and $23 million in year-over-year revenue, respectively.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!