Altcoin

XRP Holders Lose Altcoin Holdings as Ripple Struggles to Counter Resistance at $0.55

- Ripple holders have dumped their XRP holdings and raked in $20 million in profits since May 18.

- XRP’s social dominance is almost at the same level, at 1.46%.

- XRP remained above $0.52 on Tuesday, but fell 1% on the day.

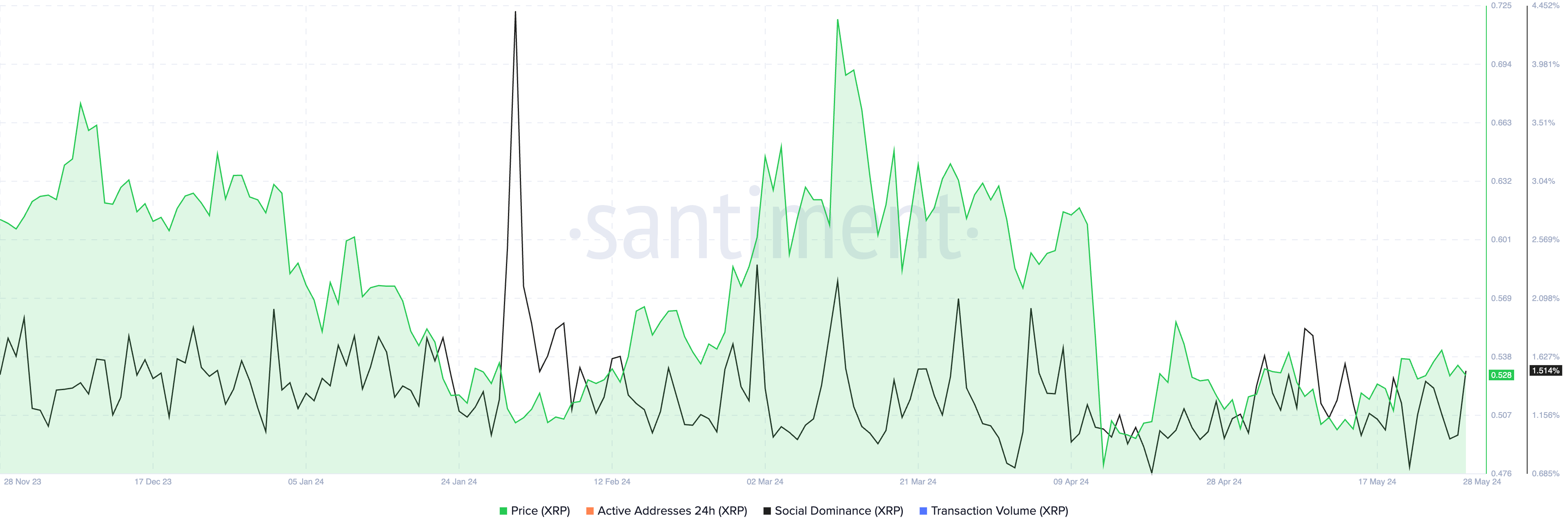

Ripple (XRP) holders consistently realized losses on their XRP holdings on several occasions between May 18 and May 28, as observed by crypto intelligence tracker Santiment. The altcoin’s social dominance remains largely unchanged, signaling XRP’s relevance among market participants.

XRP holders await further developments in the Securities and Exchange Commission (SEC) case against Ripple.

Daily Digest Market Movers: Ripple Holders Suffer Losses Amounting to $20 Million

- The on-chain Network Realized Profit/Loss metric, used to identify the net profit/loss realized by holders of an asset on a given day, shows that XRP holders have made losses of almost $20 million in the last ten days.

- Realization of losses on their XRP the holdings, amounting to $20 million, could amount to capitulation. This would mean that the altcoin price could recover and break the previous consolidation. XRP price may resume its rally as holders continue to suffer losses.

XRP price and profits/losses made by the network

- Social dominance, a metric used to identify XRP The share of cryptocurrency discussions has remained virtually unchanged over the past ten days. At the time of writing, the indicator is indicating 1.46% on May 19th and 1.51% on May 28th.

XRP price and social dominance

Ripple holders await a ruling in the SEC lawsuit against Ripple. The legal battle has dragged on since 2020, with the regulator dropping charges against executives Brad Garlinghouse and Chris Larsen, while seeking $2 billion in fines for selling unregistered securities.

Technical Analysis: XRP Expects Gain of Nearly 7%.

Ripple is in an uptrend that started on April 18th. Since altcoins it consistently formed higher highs and higher lows. XRP is attempting to flip the $0.5310 resistance level into support. This level is important since it marks 50% Fibonacci retracement of the decline from the April 9 high of $0.6431 to the April 13 low of $0.4188.

In its uptrend, XRP could extend gains by nearly 7% and reach $0.5703, the high of the May 6 and April 22 candlesticks on the XRP/USDT daily chart.

The Moving Average Convergence Divergence indicator with its green histogram bars above the neutral line, supports gains in XRP. This implies that there is underlying positive momentum.

The relative strength index (RSI) momentum indicator is reporting 50.23, above the neutral level, suggesting bullish momentum in the altcoin.

XRP/USDT daily chart

In the event of a correction, XRP could wipe out liquidity at the May 23 low of $0.5027 and find support at $0.4866, a level that has acted as support for over a month.

Frequently asked questions about the SEC lawsuit against Ripple

It depends on the transaction, according to a court ruling issued on July 14: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who purchased the token through programmatic sales on exchanges, on-demand liquidity services, and other platforms, XRP is not a security.

The US Securities & Exchange Commission (SEC) has accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales are not considered securities, sales of XRP tokens to institutional investors are in fact investment contracts. In this latest case, Ripple has violated US securities law and will have to continue to pursue the approximately $729 million it received under written contracts.

The ruling offers a partial victory for both Ripple and the SEC, depending on what you look at. Ripple benefits greatly from the fact that programmatic sales are not considered securities, and this could bode well for the cryptocurrency industry in general since most of the assets targeted by the SEC crackdown are managed by decentralized entities that have sold their tokens mainly to retail investors via exchange platforms, experts say. However, the ruling doesn’t do much to answer the key question of what makes a digital asset a security, so it’s not yet clear whether this lawsuit will set a precedent for other open cases involving dozens of digital assets. Topics such as what is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional sales and programmatic sales will likely persist.

The SEC has intensified its enforcement actions against the blockchain and digital assets sector, filing charges against platforms such as Coinbase or Binance for allegedly violating US securities law. The SEC states that most cryptocurrencies are securities and therefore subject to strict regulation. While defendants can use parts of the Ripple ruling in their favor, the SEC can also find reasons to maintain its current regulatory strategy through enforcement.

The court’s decision is a partial summary judgment. The sentence can be appealed once the final sentence has been issued or if the judge allows it before then. The case is in a preliminary stage, where both Ripple and the SEC still have a chance to reach a settlement.

Altcoin

Top 3 Ethereum-Based Altcoins 3 Times

Despite the increasing selling pressure in the cryptocurrency market, mid-cap and small-cap altcoins have seen an increase in buying sentiment. This indicates a shift in interest among users towards these cryptocurrency tokens.

Are you thinking of investing in ETH-based altcoins for the next AltSeason?

Scroll down because in this article we have covered the top three Ethereum-based altcoins that have the potential to see a huge uptrend in their respective portfolios in the near future.

Safe Price Analysis (SAFE):

Despite the growing bearish sentiment in the cryptocurrency market, SAFE price has seen bullish price action for the third consecutive day, highlighting the increased price action for the altcoin in the market. Furthermore, it is currently trading at a discount of 76.3% from its ATH of $4.01.

TradingView: SAFE/USDT

The technical indicator, MACD, shows a steady decline in the red histogram, highlighting an increase in bullish sentiment in the cryptocurrency market. In addition, the averages show a potential bullish convergence, suggesting a high possibility of a positive reversal.

If the bulls continue to gain momentum, SAFE coin price will prepare to test its resistance level of $1,450. On the contrary, a bearish action could send this altcoin crashing towards a new all-time low (ATL).

Aethir (ATH) Price Analysis:

Aethir price has seen a bullish price action adding over 10% to its portfolio with a trading volume of $40.126 million despite a bearish cloud over the cryptocurrency space. Notably, with a market cap of $292.916 million, this altcoin has secured the 216th position in the global cryptocurrency list.

TradingView: ATH/USDT

The MACD indicator has been showing a steady rise in the green histogram. However, its RSI has been showing a strong bearish curve in the 1D time frame. This suggests mixed sentiment for the ATH price in the cryptocurrency market.

If the market holds Aethir price above its important support level of $0.07050, the bulls will gain momentum and prepare to test its upper resistance level of $0.08415. On the contrary, if the bears overpower the bulls, this altcoin will prepare to test its low of $0.06435.

Neiro Ethereum (NIERO) Price Analysis:

Built on the Ethereum chain, Neiro Ethereum is a project that has a total supply of only 1 billion tokens. Positively, it has no buy/sell fees or team tokens for governance or community approach. It operates on its own and promotes itself as the next big opportunity in the cryptocurrency world.

With a trading price of $0.1852 and a total supply of 1 billion tokens, it has successfully secured the 234th position in the global cryptocurrency ranking, with a market capitalization of $185.446 million.

Notably, it is up 53.86% over the past day with a trading volume of $36.64 million, a decline of 7.68%. Furthermore, it is up about 1,200% since its inception, highlighting a strong bullish outlook for the altcoin in the near future.

Altcoin

Top 6 Altcoins Set for Explosive Rally Before 2025

The cryptocurrency market is on the verge of significant change as we approach 2025. The Altcoin Daily Analyst Austin predicts that any changes in monetary policy could trigger a strong rally in altcoins, especially with a possible turn in the Federal Reserve’s benchmark interest rate expected in September.

This pivot could drive explosive growth in the cryptocurrency market, benefiting Ethereum, Solana, and several promising new altcoins. Here are some altcoins ranging from under $1 to $2 that can give you the highest returns in the current market crash.

We are excited, are you? Let’s dive in!

Top 6 Cryptocurrencies to Watch

Aethir: The Decentralized GPU Marketplace

Aethir is positioning itself as a leader in decentralized cloud infrastructure for gaming and AI. With over $36 million in annual recurring revenue, Aethir is addressing the growing demand for GPU computing driven by major tech companies like Google and Microsoft. Its decentralized infrastructure leverages underutilized GPUs, making it a key player in the burgeoning tech industry. The current price is $0.07176.

Ondo: The Best Bet in the RWA Sector

Next up is Ondo, whose real-world asset protocols are changing the tokenization of financial assets. With an annual dividend of 5.3% USDY, ONDO is the governance token for the Ondo DAO and Flux Finance. This token has seen strong demand, demonstrated by consistent investor buy-ins. Recently, ONDO’s price has dropped 35% in two months, forming a triangle pattern that suggests a breakout. Rising OTC holdings and reduced selling pressure suggest a bullish outlook. The current price is $0.9251.

Lukso: Blockchain for Creators and Social Media

Lukso’s social and cultural blockchain unites creators, brands, and users. An Ethereum doppelganger, Lukso adds Universal Profiles and gas-free transactions to blockchain usage. Its creative strategy and strong leadership make it a blockchain mass adoption project to watch. Current price is $1.71.

AIT Protocol: Decentralized AI Data Annotation

The AIT Protocol addresses the need for decentralized work in AI data annotation. Uniquely, the AIT Protocol connects human trainers with AI model owners to improve AI models through a decentralized marketplace. However, its adoption in Asia and strategic investments suggest that it could disrupt AI. The current price is $0.1169.

Foxy (Line): Meme coin with level 2 potential

Foxy, a meme coin for Linea Layer 2 Ethereum scaling, has an endorsement from ConsenSys. Foxy stands out in Ethereum Layer 2 due to Linea’s MetaMask integration and fast transactions. Additionally, Linea adoption and reduced transaction costs are influencing its growth. The current price is $0.01116.

Off the Grid: Emerging Altcoin for Gaming

Lastly, on the list is Off The Grid, developed by Godzilla. This highly anticipated AAA game promises to make waves in the crypto gaming industry. Although it hasn’t launched yet, positive feedback from industry experts supports its potential success.

Infrastructure projects like Immutable and specific games like Xers and Star Heroes are also worth considering for those interested in crypto gaming.

Altcoin

Top Analyst Admits He Ignored XRP For Years, But Now Finds XRP Chart Very Interesting

Scott Melker, host of The Wolf of All Streets podcast, said he hadn’t paid attention to XRP charts for a while, but now finds them intriguing.

Melker revealed this in a recent send after analyzing XRP’s pattern on the weekly timeframe. He shared a chart that suggests XRP is on track to break out of a significant resistance channel.

While acknowledging that a rejection is likely, Melker noted that a subsequent breakout is on the horizon. Furthermore, the analyst emphasized that regardless of an individual’s perception of XRP and its performance, this upcoming price action is worth keeping an eye on.

Notably, Melker’s latest analysis on XRP comes as the asset has outperformed the broader bear market, which staged a solitary comeback while others fell. XRP surged more than 10% on Wednesday, briefly emerging as the day’s best-performing cryptocurrency among the top 100.

This development has triggered renewed interest in XRPeven among market observers like Melker and Ali Martinez, who rarely comment on XRP’s price action.

XRP Resistance Levels to Watch

In his latest commentary, Melker identified immediate resistance levels that XRP must overcome on its climb to higher prices. These levels include $0.75 and $0.93, which XRP must overcome to reach $1, with additional barriers at $1.3 and $1.9.

Scott Melker’s XRP Chart

Scott Melker’s XRP Chart

Interestingly, for the immediate barrier of $0.75, Melker is not the only analyst to emphasize its importance before aiming higher. Analyst “Crypto Adict” also commented on this level yesterday, urging caution versus ambitious goals like $100 when there are more immediate challenges.

The impact of this resistance level was evident in March when XRP rose to $0.744 in one day but he was unable to continue his ascent.

In his analysis, Ali Martinez echoed Melker’s sentiment by highlighting the $0.93 price level as a significant hurdle. Martinez stressed out that once XRP breaks above this level, it will effectively end its nearly seven-year downtrend, opening the door to higher highs.

At press time, XRP is back just above $0.60 after hitting $0.6556 yesterday, reflecting an 8% decline in the past 24 hours. Notably, XRP’s uptrend has been interrupted by Bitcoin’s volatility, as the leading asset fell back to the $63K range yesterday.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the personal views of the author and do not reflect the views of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Announcement-

Altcoin

Dogecoin (DOGE), ETFSwap (ETFS), and Shiba Inu (SHIB) are poised to lead the altcoin rally in a big way

Dogecoin (DOGE): Altcoin Rises From Meme Origins to Market Rally’s Top Spotlight

Dogecoin (DOGE), initially launched in 2013 as a “joke currency” based on a popular Shiba Inu meme, is now positioned to lead a major altcoin rally. Despite its humorous origins, Dogecoin is gaining popularity among investors due to its platform utilities, including transaction speed and payment methods. Currently, Dogecoin (DOGE) is trade at around $9,139, a recovery followed by a weekly low of $0.11.

-

Videos9 months ago

Videos9 months agoBitcoin Price AFTER Halving REVEALED! What’s next?

-

Bitcoin8 months ago

Bitcoin8 months agoBitcoin Could Test Record Highs Next Week in ETF Flows, Says Analyst; Coinbase appears in the update

-

Videos9 months ago

Videos9 months agoAre cryptocurrencies in trouble? Bitcoin Insider Reveals “What’s Next?”

-

Videos9 months ago

Videos9 months agoCryptocurrency Crash Caused by THIS…

-

Videos8 months ago

Videos8 months agoThe REAL reason why cryptocurrency is going up!

-

Altcoin8 months ago

Altcoin8 months agoThe best Altcoins to buy before they rise

-

Videos9 months ago

Videos9 months agoBlackRock Will Send Bitcoin to $116,000 in the Next 51 Days (XRP News)

-

Videos9 months ago

Videos9 months agoDonald Trump: I like Bitcoin now! Joe Biden HATES cryptocurrencies.

-

Videos8 months ago

Videos8 months agoSolana Cryptocurrencies: the future WILL SHOCK you | What comes next?

-

News9 months ago

News9 months agoTON, AKT, AR expect increases of 15%+ as the market stabilizes

-

Videos8 months ago

Videos8 months agoBitcoin Whale REVEALS: The 5 Best Coins to Make You a Millionaire!

-

Videos8 months ago

Videos8 months agoBREAKING NEWS: The 19 best cryptocurrencies ready to skyrocket!